South Dakota Franchise Tax On Financial Institutions

ADVERTISEMENT

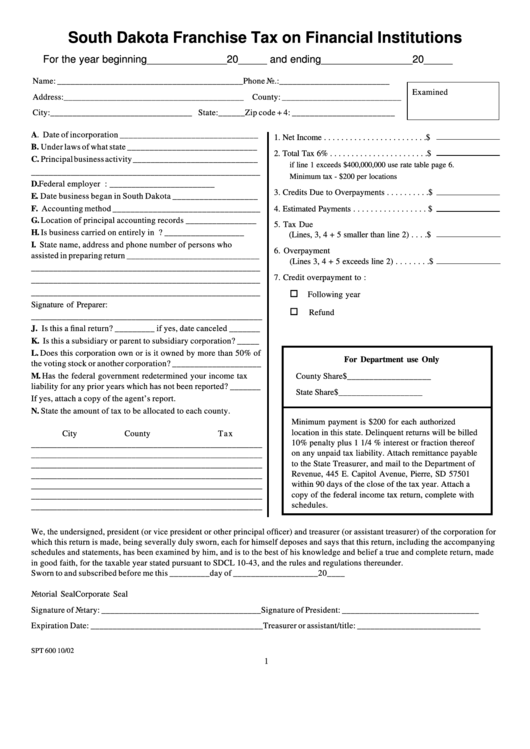

South Dakota Franchise Tax on Financial Institutions

For the year beginning______________20_____ and ending________________20_____

Name: __________________________________________

Phone No.:_________________________

Examined

Address:_________________________________________ County: ___________________________

City:________________________________ State:______ Zip code + 4: _______________________

A. Date of incorporation _______________________________

1. Net Income . . . . . . . . . . . . . . . . . . . . . . . . $

B. Under laws of what state _____________________________

2. Total Tax 6% . . . . . . . . . . . . . . . . . . . . . . .$

C. Principal business activity ____________________________

if line 1 exceeds $400,000,000 use rate table page 6.

____________________________________________________

Minimum tax - $200 per locations

D. Federal employer I.D. Number: ________________________

3. Credits Due to Overpayments . . . . . . . . . .$

E. Date business began in South Dakota ___________________

F. Accounting method _________________________________

4. Estimated Payments . . . . . . . . . . . . . . . . . $

G. Location of principal accounting records ________________

5. Tax Due

H. Is business carried on entirely in S.D.? __________________

(Lines, 3, 4 + 5 smaller than line 2) . . . .$

I. State name, address and phone number of persons who

6. Overpayment

assisted in preparing return ______________________________

(Lines 3, 4 + 5 exceeds line 2) . . . . . . . .$

____________________________________________________

7. Credit overpayment to :

____________________________________________________

o

____________________________________________________

Following year

Signature of Preparer:

o

Refund

_____________________________________________________

J. Is this a final return? _________ if yes, date canceled _______

K. Is this a subsidiary or parent to subsidiary corporation? _____

L. Does this corporation own or is it owned by more than 50% of

For Department use Only

the voting stock or another corporation? ____________________

M. Has the federal government redetermined your income tax

County Share

$___________________

liability for any prior years which has not been reported? _______

State Share

$___________________

If yes, attach a copy of the agent’s report.

N. State the amount of tax to be allocated to each county.

Minimum payment is $200 for each authorized

location in this state. Delinquent returns will be billed

City

County

Tax

10% penalty plus 1 1/4 % interest or fraction thereof

_____________________________________________________

on any unpaid tax liability. Attach remittance payable

_____________________________________________________

to the State Treasurer, and mail to the Department of

_____________________________________________________

Revenue, 445 E. Capitol Avenue, Pierre, SD 57501

_____________________________________________________

within 90 days of the close of the tax year. Attach a

______________________________________________________

copy of the federal income tax return, complete with

_____________________________________________________

schedules.

_____________________________________________________

We, the undersigned, president (or vice president or other principal officer) and treasurer (or assistant treasurer) of the corporation for

which this return is made, being severally duly sworn, each for himself deposes and says that this return, including the accompanying

schedules and statements, has been examined by him, and is to the best of his knowledge and belief a true and complete return, made

in good faith, for the taxable year stated pursuant to SDCL 10-43, and the rules and regulations thereunder.

Sworn to and subscribed before me this _________day of ___________________20____

Notorial Seal

Corporate Seal

Signature of Notary: ____________________________________

Signature of President: _______________________________

Expiration Date: _______________________________________

Treasurer or assistant/title: ____________________________

SPT 600 10/02

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3