r r t

PRINT FORM

CLEAR FIELDS

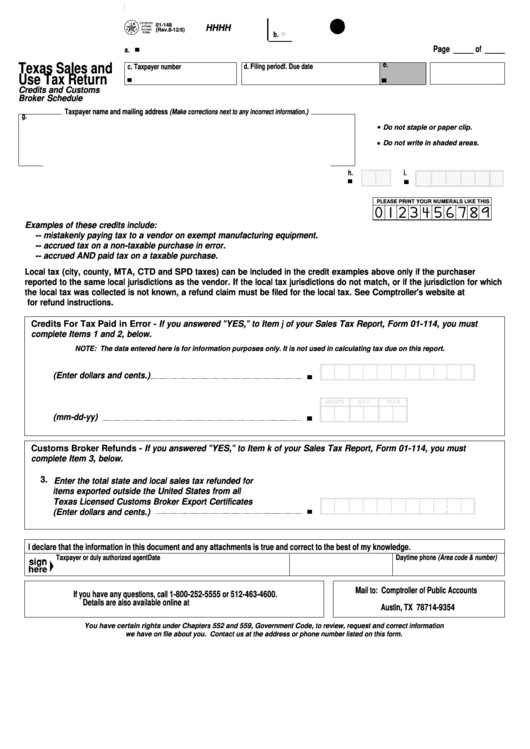

01-148

HHHH

(Rev.8-12/5)

b.

Page _____ of _____

a.

Texas Sales and

e.

d. Filing period

f. Due date

c. Taxpayer number

Use Tax Return

Credits and Customs

Broker Schedule

Taxpayer name and mailing address (Make corrections next to any incorrect information.)

g.

Do not staple or paper clip.

Do not write in shaded areas.

h.

i.

PLEASE PRINT YOUR NUMERALS LIKE THIS

Examples of these credits include:

-- mistakenly paying tax to a vendor on exempt manufacturing equipment.

-- accrued tax on a non-taxable purchase in error.

-- accrued AND paid tax on a taxable purchase.

Local tax (city, county, MTA, CTD and SPD taxes) can be included in the credit examples above only if the purchaser

reported to the same local jurisdictions as the vendor. If the local tax jurisdictions do not match, or if the jurisdiction for which

the local tax was collected is not known, a refund claim must be filed for the local tax. See Comptroller's website at

for refund instructions.

Credits For Tax Paid in Error - If you answered "YES," to Item j of your Sales Tax Report, Form 01-114, you must

complete Items 1 and 2, below.

NOTE: The data entered here is for information purposes only. It is not used in calculating tax due on this report.

1. Amount of tax credit being taken on this return

(Enter dollars and cents.)

2. Earliest date of the tax paid in error for this credit

(mm-dd-yy)

Customs Broker Refunds - If you answered "YES," to Item k of your Sales Tax Report, Form 01-114, you must

complete Item 3, below.

3. Enter the total state and local sales tax refunded for

items exported outside the United States from all

Texas Licensed Customs Broker Export Certificates

(Enter dollars and cents.)

I declare that the information in this document and any attachments is true and correct to the best of my knowledge.

Taxpayer or duly authorized agent

Date

Daytime phone (Area code & number)

Mail to: Comptroller of Public Accounts

If you have any questions, call 1-800-252-5555 or 512-463-4600.

P.O. Box 149354

Details are also available online at

Austin, TX 78714-9354

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information

we have on file about you. Contact us at the address or phone number listed on this form.

1

1