Instructions For Completing Form Mo-941 - Employer'S Withholding Tax

ADVERTISEMENT

— PLEASE TRIM ON THE DOTTED LINE PRIOR TO FILING —

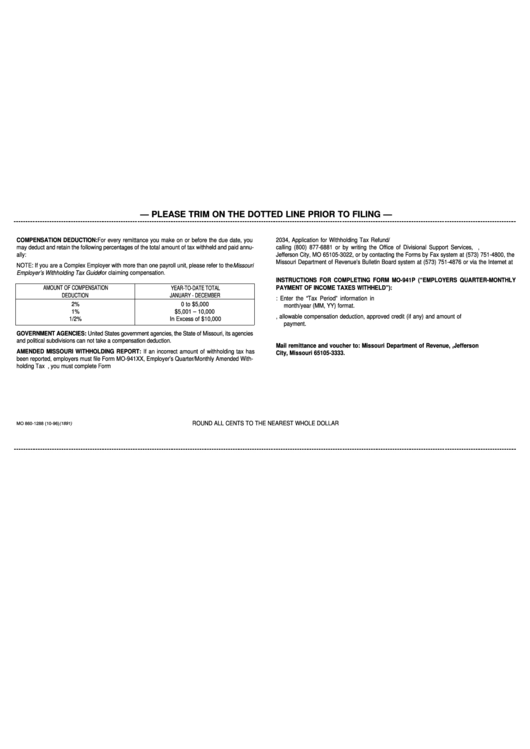

COMPENSATION DEDUCTION: For every remittance you make on or before the due date, you

2034, Application for Withholding Tax Refund/Credit. These forms are available upon request by

may deduct and retain the following percentages of the total amount of tax withheld and paid annu-

calling (800) 877-6881 or by writing the Office of Divisional Support Services, P.O. Box 3022,

ally:

Jefferson City, MO 65105-3022, or by contacting the Forms by Fax system at (573) 751-4800, the

Missouri Department of Revenue’s Bulletin Board system at (573) 751-4876 or via the Internet at

NOTE: If you are a Complex Employer with more than one payroll unit, please refer to the Missouri

Employer’s Withholding Tax Guide for claiming compensation.

INSTRUCTIONS FOR COMPLETING FORM MO-941P (“EMPLOYERS QUARTER-MONTHLY

PAYMENT OF INCOME TAXES WITHHELD”):

AMOUNT OF COMPENSATION

YEAR-TO-DATE TOTAL

DEDUCTION

JANUARY - DECEMBER

1. Complete Identification and addressing block. NOTE: Enter the “Tax Period” information in

2%

0 to $5,000

month/year (MM, YY) format.

1%

$5,001 – 10,000

2. Enter tax withheld, allowable compensation deduction, approved credit (if any) and amount of

1/2%

In Excess of $10,000

payment.

GOVERNMENT AGENCIES: United States government agencies, the State of Missouri, its agencies

3. Sign and date the voucher.

and political subdivisions can not take a compensation deduction.

Mail remittance and voucher to: Missouri Department of Revenue, P.O. Box 3333, Jefferson

AMENDED MISSOURI WITHHOLDING REPORT: If an incorrect amount of withholding tax has

City, Missouri 65105-3333.

been reported, employers must file Form MO-941XX, Employer’s Quarter/Monthly Amended With-

holding Tax Return. If the amended amount will result in an overpayment, you must complete Form

ROUND ALL CENTS TO THE NEAREST WHOLE DOLLAR

MO 860-1288 (10-96) (1891)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1