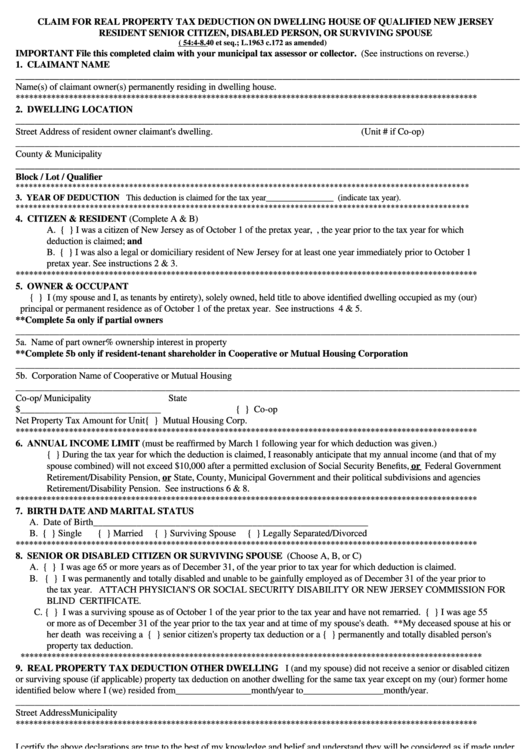

CLAIM FOR REAL PROPERTY TAX DEDUCTION ON DWELLING HOUSE OF QUALIFIED NEW JERSEY

RESIDENT SENIOR CITIZEN, DISABLED PERSON, OR SURVIVING SPOUSE

(N.J.S.A. 54:4-8.40 et seq.; L.1963 c.172 as amended)

IMPORTANT File this completed claim with your municipal tax assessor or collector. (See instructions on reverse.)

1. CLAIMANT NAME

________________________________________________________________________________________________________

Name(s) of claimant owner(s) permanently residing in dwelling house.

********************************************************************************************************

2. DWELLING LOCATION

________________________________________________________________________________________________________

Street Address of resident owner claimant's dwelling.

(Unit # if Co-op)

________________________________________________________________________________________________________

County & Municipality

________________________________________________________________________________________________________

Block / Lot / Qualifier

********************************************************************************************************

3. YEAR OF DEDUCTION This deduction is claimed for the tax year________________ (indicate tax year).

********************************************************************************************************

4. CITIZEN & RESIDENT (Complete A & B)

A. { } I was a citizen of New Jersey as of October 1 of the pretax year, i.e., the year prior to the tax year for which

deduction is claimed; and

B. { } I was also a legal or domiciliary resident of New Jersey for at least one year immediately prior to October 1

pretax year. See instructions 2 & 3.

********************************************************************************************************

5. OWNER & OCCUPANT

{ } I (my spouse and I, as tenants by entirety), solely owned, held title to above identified dwelling occupied as my (our)

principal or permanent residence as of October 1 of the pretax year. See instructions 4 & 5.

**Complete 5a only if partial owners

________________________________________________________________________________________________________

5a. Name of part owner

% ownership interest in property

**Complete 5b only if resident-tenant shareholder in Cooperative or Mutual Housing Corporation

________________________________________________________________________________________________________

5b. Corporation Name of Cooperative or Mutual Housing

________________________________________________________________________________________________________

Co-op/M.H. Corp. Street Address

Municipality

State

$_____________________________

{ } Co-op

Net Property Tax Amount for Unit

{ } Mutual Housing Corp.

********************************************************************************************************

6. ANNUAL INCOME LIMIT (must be reaffirmed by March 1 following year for which deduction was given.)

{ } During the tax year for which the deduction is claimed, I reasonably anticipate that my annual income (and that of my

spouse combined) will not exceed $10,000 after a permitted exclusion of Social Security Benefits, or Federal Government

Retirement/Disability Pension, or State, County, Municipal Government and their political subdivisions and agencies

Retirement/Disability Pension. See instructions 6 & 8.

********************************************************************************************************

7. BIRTH DATE AND MARITAL STATUS

A. Date of Birth_________________________________________________________

B. { } Single

{ } Married

{ } Surviving Spouse

{ } Legally Separated/Divorced

********************************************************************************************************

8. SENIOR OR DISABLED CITIZEN OR SURVIVING SPOUSE (Choose A, B, or C)

A. { } I was age 65 or more years as of December 31, of the year prior to tax year for which deduction is claimed.

B. { } I was permanently and totally disabled and unable to be gainfully employed as of December 31 of the year prior to

the tax year. ATTACH PHYSICIAN'S OR SOCIAL SECURITY DISABILITY OR NEW JERSEY COMMISSION FOR

BLIND CERTIFICATE.

C. { } I was a surviving spouse as of October 1 of the year prior to the tax year and have not remarried. { } I was age 55

or more as of December 31 of the year prior to the tax year and at time of my spouse's death. **My deceased spouse at his or

her death was receiving a { } senior citizen's property tax deduction or a { } permanently and totally disabled person's

property tax deduction.

********************************************************************************************************

9. REAL PROPERTY TAX DEDUCTION OTHER DWELLING I (and my spouse) did not receive a senior or disabled citizen

or surviving spouse (if applicable) property tax deduction on another dwelling for the same tax year except on my (our) former home

identified below where I (we) resided from________________month/year to_________________month/year.

________________________________________________________________________________________________________

Street Address

Municipality

********************************************************************************************************

I certify the above declarations are true to the best of my knowledge and belief and understand they will be considered as if made under

oath and subject to penalties for perjury if falsified.

________________________________________________________________________________________________________

Signature of Claimant

Date

********************************************************************************************************

OFFICIAL USE ONLY - Block____________________Lot__________________Approved in amount of $________________

{ } Age

{ } Disability

{ } Surviving Spouse of { }senior citizen or { }disabled person

Assessor_______________________________________________________________Date______________________________

Form PTD rev. May 1996

1

1