Instructions Application For International Fuel Tax Agreement (Ifta) License And Special Fuel User Permit

ADVERTISEMENT

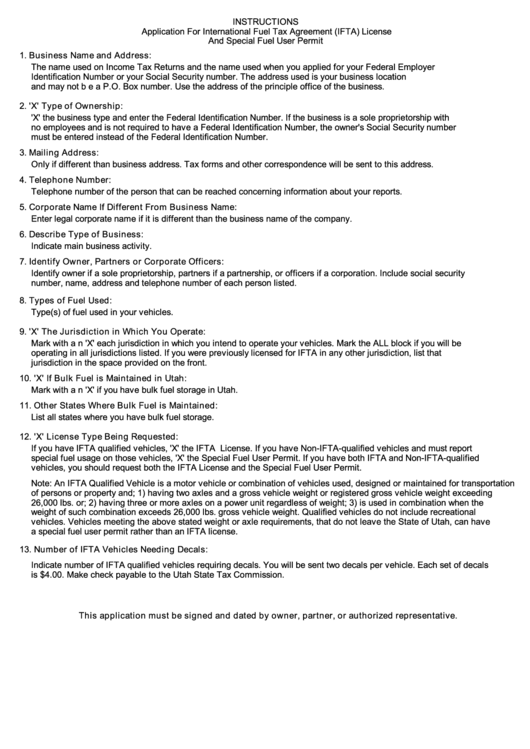

INSTRUCTIONS

Application For International Fuel Tax Agreement (IFTA) License

And Special Fuel User Permit

1. Business Name and Address:

The name used on Income Tax Returns and the name used when you applied for your Federal Employer

Identification Number or your Social Security number. The address used is your business location

and may not be a P.O. Box number. Use the address of the principle office of the business.

2. 'X' Type of Ownership:

'X' the business type and enter the Federal Identification Number. If the business is a sole proprietorship with

no employees and is not required to have a Federal Identification Number, the owner's Social Security number

must be entered instead of the Federal Identification Number.

3. Mailing Address:

Only if different than business address. Tax forms and other correspondence will be sent to this address.

4. Telephone Number:

Telephone number of the person that can be reached concerning information about your reports.

5. Corporate Name If Different From Business Name:

Enter legal corporate name if it is different than the business name of the company.

6. Describe Type of Business:

Indicate main business activity.

7. Identify Owner, Partners or Corporate Officers:

Identify owner if a sole proprietorship, partners if a partnership, or officers if a corporation. Include social security

number, name, address and telephone number of each person listed.

8. Types of Fuel Used:

Type(s) of fuel used in your vehicles.

9. 'X' The Jurisdiction in Which You Operate:

Mark with an 'X' each jurisdiction in which you intend to operate your vehicles. Mark the ALL block if you will be

operating in all jurisdictions listed. If you were previously licensed for IFTA in any other jurisdiction, list that

jurisdiction in the space provided on the front.

10. 'X' If Bulk Fuel is Maintained in Utah:

Mark with an 'X' if you have bulk fuel storage in Utah.

11. Other States Where Bulk Fuel is Maintained:

List all states where you have bulk fuel storage.

12. 'X' License Type Being Requested:

If you have IFTA qualified vehicles, 'X' the IFTA License. If you have Non-IFTA-qualified vehicles and must report

special fuel usage on those vehicles, 'X' the Special Fuel User Permit. If you have both IFTA and Non-IFTA-qualified

vehicles, you should request both the IFTA License and the Special Fuel User Permit.

Note: An IFTA Qualified Vehicle is a motor vehicle or combination of vehicles used, designed or maintained for transportation

of persons or property and; 1) having two axles and a gross vehicle weight or registered gross vehicle weight exceeding

26,000 lbs. or; 2) having three or more axles on a power unit regardless of weight; 3) is used in combination when the

weight of such combination exceeds 26,000 lbs. gross vehicle weight. Qualified vehicles do not include recreational

vehicles. Vehicles meeting the above stated weight or axle requirements, that do not leave the State of Utah, can have

a special fuel user permit rather than an IFTA license.

13. Number of IFTA Vehicles Needing Decals:

Indicate number of IFTA qualified vehicles requiring decals. You will be sent two decals per vehicle. Each set of decals

is $4.00. Make check payable to the Utah State Tax Commission.

This application must be signed and dated by owner, partner, or authorized representative.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1