Instructions For Fuel Tax Return For International Fuel Tax Agreement (Ifta) And Special Fuel User Tax

ADVERTISEMENT

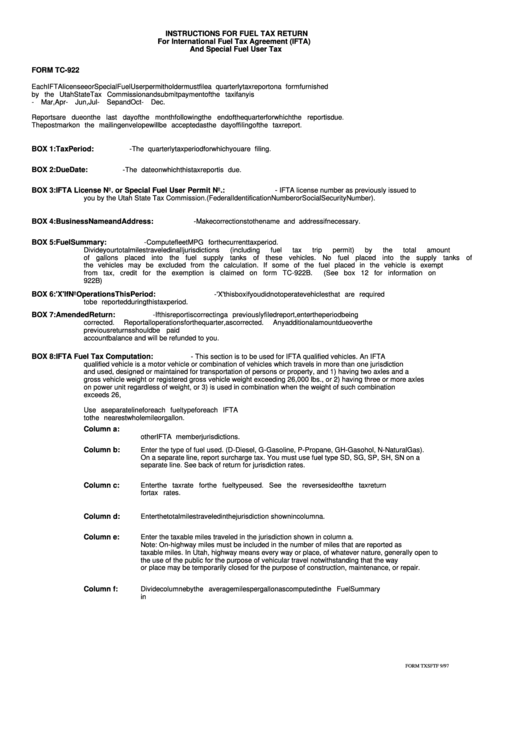

INSTRUCTIONS FOR FUEL TAX RETURN

For International Fuel Tax Agreement (IFTA)

And Special Fuel User Tax

FORM TC-922

Each IFTA licensee

or Special Fuel User permit holder must file a quarterly tax report

on a form

furnished

by the Utah State Tax Commission

and submit payment of the tax if any is due. Quarterly filing periods

are Jan

- Mar, Apr - Jun, Jul - Sep and Oct - Dec.

Reports

are due on the last day of the month following

the end of the quarter for

which the report

is due.

The postmark on the mailing envelope will be accepted as the day of filing of the tax report.

BOX 1:

Tax Period:

- The quarterly tax period for which you are filing.

BOX 2:

Due Date:

- The date on which this tax report is due.

BOX 3:

IFTA License No. or Special Fuel User Permit No.:

- IFTA license number as previously issued to

you by the Utah State Tax Commission.(FederalIdentificationNumberorSocialSecurityNumber).

BOX 4:

Business Name and Address:

- Make corrections

to the name and address if necessary.

BOX 5:

Fuel Summary:

-

Compute

fleet

MPG for

the current

tax period.

Divide your total miles traveled in all jurisdictions

(including fuel tax trip permit) by the total amount

of gallons placed into the fuel supply tanks of these vehicles. No fuel placed into the supply tanks of

the vehicles may be excluded

from the calculation. If some of the fuel placed in the vehicle is exempt

from

tax, credit

for

the exemption

is claimed on form

TC-922B.

(See box 12 for

information

on

922B)

BOX 6:

'X' If No Operations This Period:

-

'X' this box if you did not operate vehicles that are required

to be reported

during this tax period.

BOX 7:

Amended Return:

-

If this report

is correcting

a previously

filed

report,

enter the period

being

corrected.

Report all operations

for

the quarter, as corrected.

Any additional amount due over the

previous

returns

should

be paid with

this return.

Any credits

will

reflect

on your

account balance and will be refunded to you.

BOX 8:

IFTA Fuel Tax Computation:

- This section is to be used for IFTA qualified vehicles. An IFTA

qualified vehicle is a motor vehicle or combination of vehicles which travels in more than one jurisdiction

and used, designed or maintained for transportation of persons or property, and 1) having two axles and a

gross vehicle weight or registered gross vehicle weight exceeding 26,000 lbs., or 2) having three or more axles

on power unit regardless of weight, or 3) is used in combination when the weight of such combination

exceeds 26,000lbs.grossvehicleweight.Qualifiedvehiclesdonotincluderecreationalvehicles.

Use a separate line for

each fuel type for

each IFTA member jurisdiction.

Round all mileage and gallons

to the nearest whole mile or gallon.

Column a:

Enter state abbreviation.

See reverse

side of

the tax return

for

abbreviations

of

other IFTA member jurisdictions.

Column b:

Enter the type of fuel used. (D-Diesel, G-Gasoline, P-Propane, GH-Gasohol, N-NaturalGas).

On a separate line, report surcharge tax. You must use fuel type SD, SG, SP, SH, SN on a

separate line. See back of return for jurisdiction rates.

Column c:

Enter the tax rate for

the fuel type used. See the reverse side of the tax return

for tax rates.

Column d:

Enter the total miles traveled in the jurisdiction shown

in column a.

Column e:

Enter the taxable miles traveled in the jurisdiction shown in column a.

Note: On-highway miles must be included in the number of miles that are reported as

taxable miles. In Utah, highway means every way or place, of whatever nature, generally open to

the use of the public for the purpose of vehicular travel notwithstanding that the way

or place may be temporarily closed for the purpose of construction, maintenance, or repair.

Column f:

Divide column e by the average miles per gallon as computed

in the Fuel Summary

in Box 5. Round to the nearest whole gallon.

FORM TXSFTF 9/97

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2