Form F-7004a, F-1120a - Florida Corporate Short Form Tentative Income Tax Return And Application For Extension Of Time To File Return - 2000

ADVERTISEMENT

F-1120A

R. 01/00

Page 3

Florida Form F-1120 or F-1120A annually and are subject to Florida

Who Must File a Florida Corporate Income/Franchise

corporate income tax. The Florida Form F-1120A can only be filed if all of

Tax return (continued from page 1)

the criteria for that form are met.

Homeowners and condominium associations that file federal Form

•

EXTENSION OF TIME FOR FILING - A taxpayer may apply for an extension

1120H must file Florida Form F-1120 or F-1120A for the first year in

of time to file Florida Form F-1120A. Extensions are valid for six months. Only

Florida. If they do not have federal taxable income, only the information

one extension is permitted per tax year. To apply for an extension, detach

questions need to be answered. Returns for subsequent years are not

and complete Florida Form F-7004A. It must be filed with the Department

required of the homeowner or condominium association when no federal

together with payment of all the tax due on or before the original due date of

tax is due, and federal Form 1120H continues to be filed. When federal

Florida Form F-1120A.

Form 1120 is filed, a Florida Form F-1120 or F-1120A is required

regardless of whether any tax may be due. The Florida Form F-1120 or

Line by Line Instructions for F-1120A

F-1120A is also required for the first year federal Form 1120H is filed

subsequent to the filing of federal Form 1120 (If there is no federal taxable

Line 1 Federal Taxable Income - Generally, the corporations should enter

income, only the information questions need to be answered). The

the amount shown on line 30, page 1 of the federal form 1120 or the

Florida Form F-1120A can only be filed if all of the criteria for that form are

corresponding line (taxable income) of the federal income tax return filed.

met.

S corporations should enter only the amount of income (net passive income

Political organizations that file federal Form 1120-POL.

•

or capital gains) subject to federal income tax at the corporate level.

S corporations answering no to question D, on page 2, enter “0” on line 6.

•

S Corporations must file Form F-1120 or F-1120A for the first year they

qualify as S corporations for federal tax purposes or the first year foreign

(out-of-state) S corporations do business in Florida. If they do not have

Line 2 Net Operating Loss Deduction (NOLD) and State Income Taxes

Deducted in Computing Federal Taxable Income - Enter the sum of:

federal taxable income, only the information questions need to be

answered. There is no filing requirement for subsequent years as long as

(A) Any Net Operating Loss Deduction shown on Line 29(a) of the

the federal subchapter S election continues, except for tax years that an S

federal Form 1120 or on the corresponding line of other federal income

corporation is subject to federal tax. S corporations that have federal

tax forms.

taxable income must file Florida Form F-1120 or F-1120A and are

(B) Any tax upon, or measured by, income paid or accrued as a liability

subject to Florida corporate income tax. The Florida Form F-1120A

to any U.S. state or the District of Columbia that is deducted from

can only be filed if all of the criteria for that form are met.

gross income in the computation of federal income for the taxable year.

Taxes based upon gross receipts or revenues are excluded.

Effective January 1, 1997, qualified subchapter S subsidiaries (QSSS)

•

are not treated as separate entities from their parent corporations for

If state income taxes are included in Line 2, complete question G on the

purposes of Florida corporate income tax. The qualified subchapter S

reverse side of the Form F-1120A.

subsidiary is required to file an informational return (Form F-1120) that

Use the following to compute your line 2 entry:

should identify the subsidiary, the S corporation parent, and the effective

a NOLD___________________________________________________

date of the election year.

b State Income Taxes deducted in computing Federal Taxable

Income__________________________________________________

•

Tax-exempt organizations that are fully exempt from the federal

c. Total - Add a and b then enter this amount on Line 2.

income tax and have a “determination letter” from the Internal Revenue

Service to that effect, must attach a copy of the determination letter to

Line 3 Florida Net Operating Loss Deduction (NOLD)

Florida Form F-1120 for the first year they qualify as an exempt

Enter the amount (if any) of the Florida Net Operating Loss Deduction on Line

organization or the first year subject to the Florida Income Tax Code.

3. For Florida corporate income tax, a net operating loss can never be

(See Information, Forms and Payments on page 6 for information on how

carried back as a deduction to a prior taxable year. A net operating loss can

to obtain a Form F-1120.) Additional returns will not be required as long

as they continue to qualify for exemption from federal income tax.

Organizations that have “unrelated trade or business income” must file

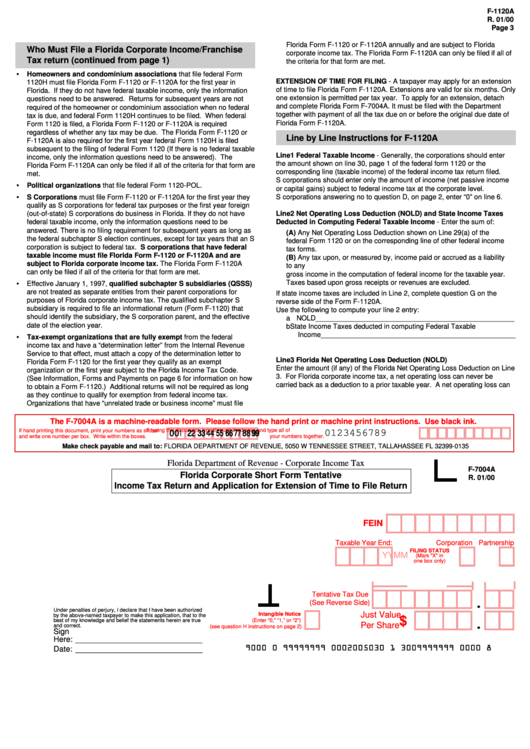

The F-7004A is a machine-readable form. Please follow the hand print or machine print instructions. Use black ink.

If hand printing this document, print your numbers as shown

If typing this document, type through the boxes and type all of

0123456789

0 0 0 0 0 1 1 1 1 1 2 2 2 2 2 3 3 3 3 3 4 4 4 4 4 5 5 5 5 5 6 6 6 6 6 7 7 7 7 7 8 8 8 8 8 9 9 9 9 9

and write one number per box. Write within the boxes.

your numbers together.

Make check payable and mail to: FLORIDA DEPARTMENT OF REVENUE, 5050 W TENNESSEE STREET, TALLAHASSEE FL 32399-0135

Florida Department of Revenue - Corporate Income Tax

F-7004A

Florida Corporate Short Form Tentative

R. 01/00

Income Tax Return and Application for Extension of Time to File Return

FEIN

Taxable Year End:

Corporation Partnership

FILING STATUS

M

M

Y

Y

(Mark "X" in

one box only)

U.S. DOLLARS

CENTS

Tentative Tax Due

(See Reverse Side)

Under penalties of perjury, I declare that I have been authorized

Just Value

Intangible Notice

by the above-named taxpayer to make this application, that to the

$

(Enter “0,” “1,” or “2”)

best of my knowledge and belief the statements herein are true

Per Share

and correct.

(see question H instructions on page 2)

Sign

Here: _____________________________

9000 0 99999999 0002005030 1 3009999999 0000 8

Date: _____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2