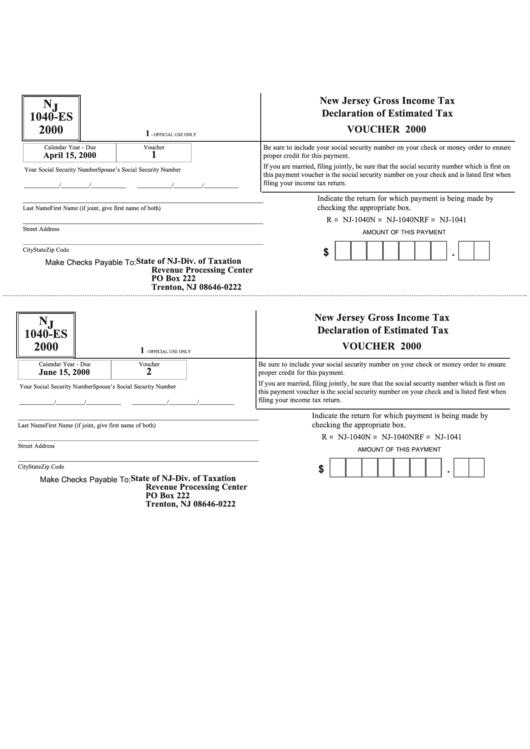

Form Nj 1040-Es - New Jersey Gross Income Tax Declaration Of Estimated Tax Voucher - 2000

ADVERTISEMENT

New Jersey Gross Income Tax

N J

Declaration of Estimated Tax

1040-ES

2000

VOUCHER 2000

1

- OFFICIAL USE ONLY

Calendar Year - Due

Voucher

Be sure to include your social security number on your check or money order to ensure

1

April 15, 2000

proper credit for this payment.

If you are married, filing jointly, be sure that the social security number which is first on

Your Social Security Number

Spouse’s Social Security Number

this payment voucher is the social security number on your check and is listed first when

filing your income tax return.

___________/_________/___________

___________/_________/___________

Indicate the return for which payment is being made by

____________________________________________________________________________

checking the appropriate box.

Last Name

First Name (if joint, give first name of both)

R ¤ NJ-1040

N ¤ NJ-1040NR

F ¤ NJ-1041

____________________________________________________________________________

Street Address

AMOUNT OF THIS PAYMENT

____________________________________________________________________________

City

State

Zip Code

$

.

State of NJ-Div. of Taxation

Make Checks Payable To:

Revenue Processing Center

PO Box 222

Trenton, NJ 08646-0222

New Jersey Gross Income Tax

N J

Declaration of Estimated Tax

1040-ES

2000

VOUCHER 2000

1

- OFFICIAL USE ONLY

Be sure to include your social security number on your check or money order to ensure

Calendar Year - Due

Voucher

2

June 15, 2000

proper credit for this payment.

If you are married, filing jointly, be sure that the social security number which is first on

Your Social Security Number

Spouse’s Social Security Number

this payment voucher is the social security number on your check and is listed first when

filing your income tax return.

___________/_________/___________

___________/_________/___________

Indicate the return for which payment is being made by

____________________________________________________________________________

checking the appropriate box.

Last Name

First Name (if joint, give first name of both)

R ¤ NJ-1040

N ¤ NJ-1040NR

F ¤ NJ-1041

____________________________________________________________________________

Street Address

AMOUNT OF THIS PAYMENT

____________________________________________________________________________

City

State

Zip Code

$

.

State of NJ-Div. of Taxation

Make Checks Payable To:

Revenue Processing Center

PO Box 222

Trenton, NJ 08646-0222

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2