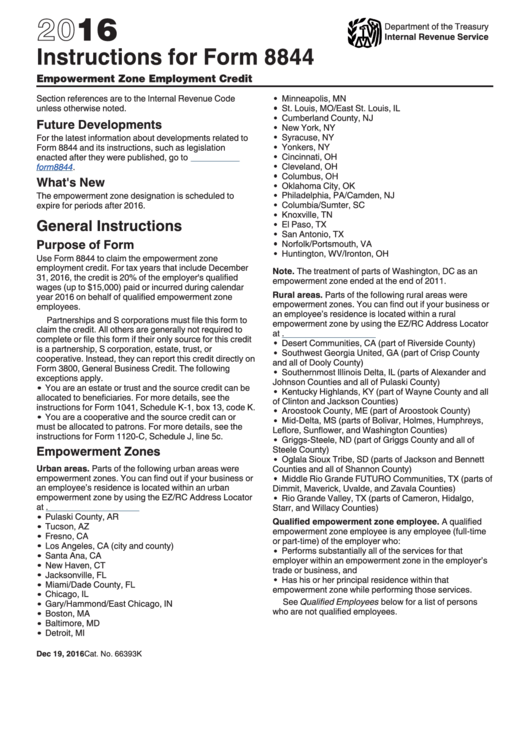

Instructions For Form 8844 - Empowerment Zone Employment Credit - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 8844

Empowerment Zone Employment Credit

Section references are to the Internal Revenue Code

Minneapolis, MN

unless otherwise noted.

St. Louis, MO/East St. Louis, IL

Cumberland County, NJ

Future Developments

New York, NY

Syracuse, NY

For the latest information about developments related to

Yonkers, NY

Form 8844 and its instructions, such as legislation

Cincinnati, OH

enacted after they were published, go to

Cleveland, OH

form8844.

Columbus, OH

What's New

Oklahoma City, OK

The empowerment zone designation is scheduled to

Philadelphia, PA/Camden, NJ

expire for periods after 2016.

Columbia/Sumter, SC

Knoxville, TN

General Instructions

El Paso, TX

San Antonio, TX

Purpose of Form

Norfolk/Portsmouth, VA

Huntington, WV/Ironton, OH

Use Form 8844 to claim the empowerment zone

employment credit. For tax years that include December

Note. The treatment of parts of Washington, DC as an

31, 2016, the credit is 20% of the employer's qualified

empowerment zone ended at the end of 2011.

wages (up to $15,000) paid or incurred during calendar

Rural areas. Parts of the following rural areas were

year 2016 on behalf of qualified empowerment zone

empowerment zones. You can find out if your business or

employees.

an employee’s residence is located within a rural

Partnerships and S corporations must file this form to

empowerment zone by using the EZ/RC Address Locator

claim the credit. All others are generally not required to

at egis.hud.gov/ezrclocator.

complete or file this form if their only source for this credit

Desert Communities, CA (part of Riverside County)

is a partnership, S corporation, estate, trust, or

Southwest Georgia United, GA (part of Crisp County

cooperative. Instead, they can report this credit directly on

and all of Dooly County)

Form 3800, General Business Credit. The following

Southernmost Illinois Delta, IL (parts of Alexander and

exceptions apply.

Johnson Counties and all of Pulaski County)

You are an estate or trust and the source credit can be

Kentucky Highlands, KY (part of Wayne County and all

allocated to beneficiaries. For more details, see the

of Clinton and Jackson Counties)

instructions for Form 1041, Schedule K-1, box 13, code K.

Aroostook County, ME (part of Aroostook County)

You are a cooperative and the source credit can or

Mid-Delta, MS (parts of Bolivar, Holmes, Humphreys,

must be allocated to patrons. For more details, see the

Leflore, Sunflower, and Washington Counties)

instructions for Form 1120-C, Schedule J, line 5c.

Griggs-Steele, ND (part of Griggs County and all of

Empowerment Zones

Steele County)

Oglala Sioux Tribe, SD (parts of Jackson and Bennett

Urban areas. Parts of the following urban areas were

Counties and all of Shannon County)

empowerment zones. You can find out if your business or

Middle Rio Grande FUTURO Communities, TX (parts of

an employee’s residence is located within an urban

Dimmit, Maverick, Uvalde, and Zavala Counties)

empowerment zone by using the EZ/RC Address Locator

Rio Grande Valley, TX (parts of Cameron, Hidalgo,

at egis.hud.gov/ezrclocator.

Starr, and Willacy Counties)

Pulaski County, AR

Qualified empowerment zone employee. A qualified

Tucson, AZ

empowerment zone employee is any employee (full-time

Fresno, CA

or part-time) of the employer who:

Los Angeles, CA (city and county)

Performs substantially all of the services for that

Santa Ana, CA

employer within an empowerment zone in the employer’s

New Haven, CT

trade or business, and

Jacksonville, FL

Has his or her principal residence within that

Miami/Dade County, FL

empowerment zone while performing those services.

Chicago, IL

See Qualified Employees below for a list of persons

Gary/Hammond/East Chicago, IN

who are not qualified employees.

Boston, MA

Baltimore, MD

Detroit, MI

Dec 19, 2016

Cat. No. 66393K

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3