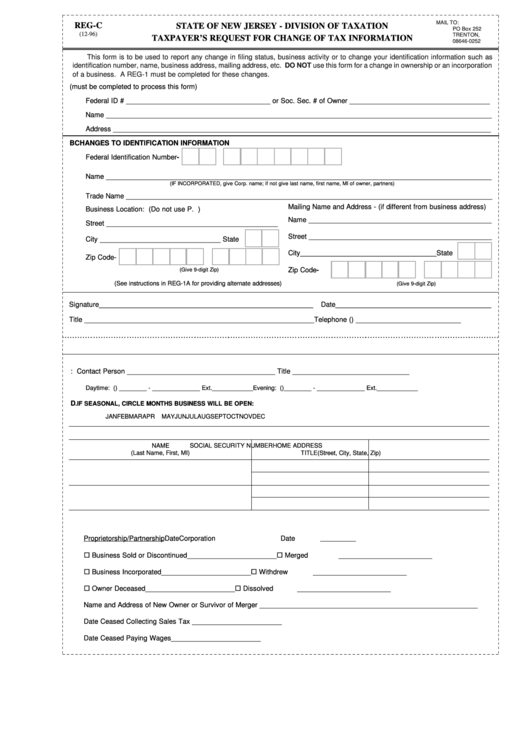

MAIL TO:

REG-C

STATE OF NEW JERSEY - DIVISION OF TAXATION

PO Box 252

(12-96)

TRENTON, N.J.

TAXPAYER’S REQUEST FOR CHANGE OF TAX INFORMATION

08646-0252

This form is to be used to report any change in filing status, business activity or to change your identification information such as

identification number, name, business address, mailing address, etc. DO NOT use this form for a change in ownership or an incorporation

of a business. A REG-1 must be completed for these changes.

A.

CURRENT INFORMATION (must be completed to process this form)

Federal ID # _____________________________________ or Soc. Sec. # of Owner ____________________________________

Name ___________________________________________________________________________________________________

Address _________________________________________________________________________________________________

B

CHANGES TO IDENTIFICATION INFORMATION

Federal Identification Number

-

Name ___________________________________________________________________________________________________

(IF INCORPORATED, give Corp. name; if not give last name, first name, MI of owner, partners)

Trade Name ______________________________________________________________________________________________

Mailing Name and Address - (if different from business address)

Business Location: (Do not use P. O. Box for location address)

Name _______________________________________________

Street ____________________________________________

Street _______________________________________________

City _______________________________ State

City___________________________________State

Zip Code

-

Zip Code

-

(Give 9-digit Zip)

(See instructions in REG-1A for providing alternate addresses)

(Give 9-digit Zip)

Signature_______________________________________________________

Date________________________________________

Title ___________________________________________________________

Telephone (

) ___________________________

C.

Telephone Numbers: Contact Person ______________________________________ Title ______________________________

Daytime: (

) ________ - ______________ Ext.____________

Evening: (

)________ - ______________ Ext.____________

D

.

IF SEASONAL, CIRCLE MONTHS BUSINESS WILL BE OPEN:

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEPT

OCT

NOV

DEC

E.

CHANGES IN OWNERSHIP OR CORPORATE OFFICERS

NAME

SOCIAL SECURITY NUMBER

HOME ADDRESS

(Last Name, First, MI)

TITLE

(Street, City, State, Zip)

F.

CHANGES IN FILING STATUS AND BUSINESS ACTIVITY

Proprietorship/Partnership

Date

Corporation

Date

¨ Business Sold or Discontinued

¨ Merged

_______________________

________________________

¨ Business Incorporated

¨ Withdrew

_______________________

________________________

¨ Owner Deceased

¨ Dissolved

_______________________

________________________

Name and Address of New Owner or Survivor of Merger ________________________________________________________

Date Ceased Collecting Sales Tax

_______________________

Date Ceased Paying Wages

_______________________

1

1