Form F-1120es - Change Of Address Or Business Name

ADVERTISEMENT

F-1120A

R. 01/00

Page 5

Taxable Year and Accounting Methods

General Information Continued

The taxable year and method of accounting must be the same for Florida

income tax purposes as that used for federal income tax purposes. If the

Form F-1120. Installment one of Form F-1120ES is provided in this package.

taxpayer’s taxable year or method of accounting is changed for federal income

If you require additional installment coupons and/or Form F-1120, see

tax purposes, its taxable year or method of accounting must be changed for

Information, Forms and Payments on page 6.

Florida purposes.

To Amend a Return

Rounding Off to Whole-Dollar Amounts

To amend an income tax return, file Form F-1120X. To obtain Form F-1120X

The corporation may enter the dollar amounts on the return as whole-dollar

see Information, Forms, and Payments on page 6.

amounts. To do so, drop any amount less than 50 cents to the next lowest

If a federal amended return is filed or other re-determination of federal income

dollar and increase any amount from 50 cents to 99 cents to the next highest

is made (for example, through an audit adjustment), and the adjustment(s)

dollar. If this method is used on the federal return, it must be used on the

would affect net income subject to the Florida Corporate Income/Franchise

Florida return; otherwise, the treatment is optional.

Tax or the Emergency Excise Tax, the taxpayer must file an amended Florida

Return. A copy of the amended federal return or other adjustments, such as

Federal Employer Identification Number (FEIN)

a Revenue Agent’s Report (RAR) must be attached to the amended return.

Enter the FEIN assigned by the IRS in each area requesting an FEIN. If you

have not received your FEIN, enter “Applied For” in the space provided.

When the number is received from the IRS, send it to the Department.

------------------------------------------------------------------------------------------------------------------------------------------------------ Detach Here ----------------------------------------------------------------------------------------------------------------------------------------

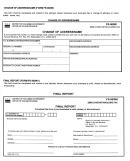

Change of Address or Business Name

_ _ - _ _ _ _ _ _ _

FEIN of Entity

Complete this form, sign it, and mail it to the Department if:

CHANGE

•

the address below is not correct

IN

•

the business location changes

New

Business

Location____________________________________________________

•

the corporation name changes

Location

Address

City_______________________________State_______ZIP__________________

Mail to:

Business Telephone (_______)

___________________County________________

FLORIDA DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

In Care

of__________________________________________________________

TALLAHASSEE FL 32399-0100

New

Mailing

Address_____________________________________________________

Mailing

Address

City_______________________________State_______ZIP__________________

Owner’s Telephone (_______)

___________________County_________________

New

Business

Name

DBA______________________________________________________________

New

Corporation

________________________________________________________________

Name

9000 0 99999999 0002999999 9 3009999999 0000 8

_______________________________________________

Signature of Officer (Required)

Date

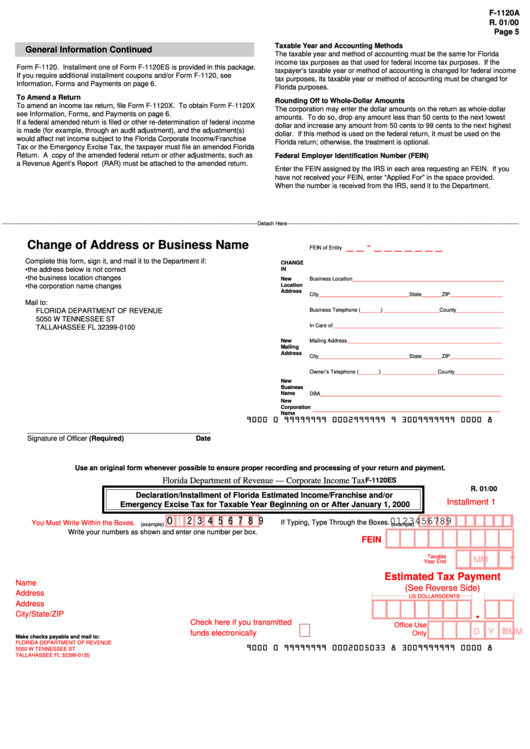

Use an original form whenever possible to ensure proper recording and processing of your return and payment.

Florida Department of Revenue — Corporate Income Tax

F-1120ES

R. 01/00

Declaration/Installment of Florida Estimated Income/Franchise and/or

Installment 1

Emergency Excise Tax for Taxable Year Beginning on or After January 1, 2000

0 1 2 3 4 5 6 7 8 9

0123456789

If Typing, Type Through the Boxes.

You Must Write Within the Boxes.

(example)

(example)

Write your numbers as shown and enter one number per box.

FEIN

Taxable

M

M

Y Y

Year End

Estimated Tax Payment

Name

(See Reverse Side)

Address

US DOLLARS

CENTS

Address

City/State/ZIP

Check here if you transmitted

Office Use

M

M

D

D Y

Y

funds electronically

Only

Make checks payable and mail to:

FLORIDA DEPARTMENT OF REVENUE

9000 0 99999999 0002005033 8 3009999999 0000 8

5050 W TENNESSEE ST

TALLAHASSEE FL 32399-0135

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3