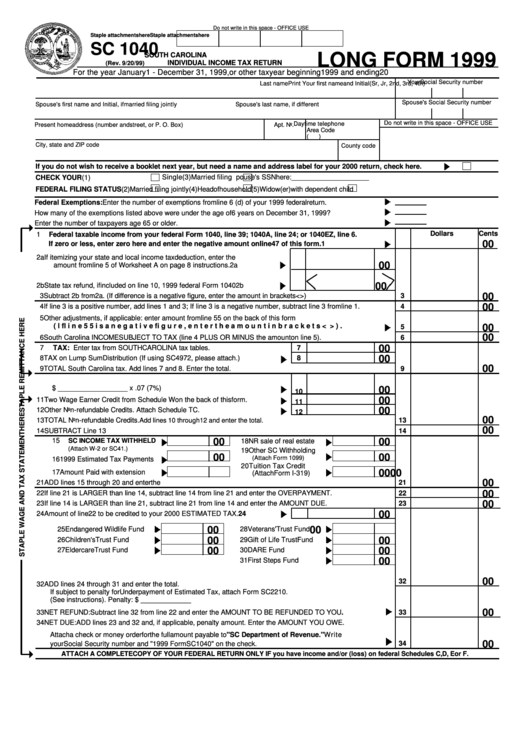

Form Sc 1040 - Individual Income Tax Return (1999) - South Carolina

ADVERTISEMENT

Do not write in this space - OFFICE USE

Staple attachments here

Staple attachments here

SC 1040

LONG FORM 1999

SOUTH CAROLINA

INDIVIDUAL INCOME TAX RETURN

(Rev. 9/20/99)

For the year January 1 - December 31, 1999, or other tax year beginning

1999 and ending

20

Your Social Security number

Print Your first name and Initial

(Sr, Jr, 2nd, 3rd, 4th)

Last name

Spouse's Social Security number

Spouse's first name and Initial, if married filing jointly

Spouse's last name, if different

Do not write in this space - OFFICE USE

Daytime telephone

Present home address (number and street, or P. O. Box)

Apt. No.

Area Code

(

)

City, state and ZIP code

County code

If you do not wish to receive a booklet next year, but need a name and address label for your 2000 return, check here.

Single

(3)

Married filing separately. Enter spouse's SSN here: ____________________

CHECK YOUR

(1)

FEDERAL FILING STATUS (2)

Married filing jointly

(4)

Head of household

(5)

Widow(er) with dependent child

Federal Exemptions: Enter the number of exemptions from line 6 (d) of your 1999 federal return.

How many of the exemptions listed above were under the age of 6 years on December 31, 1999?

Enter the number of taxpayers age 65 or older.

Dollars

Cents

1

Federal taxable income from your federal Form 1040, line 39; 1040A, line 24; or 1040EZ, line 6.

00

If zero or less, enter zero here and enter the negative amount on line 47 of this form.

1

2a

If itemizing your state and local income tax deduction, enter the

00

amount from line 5 of Worksheet A on page 8 instructions.

2a

00

2b

State tax refund, if included on line 10, 1999 federal Form 1040

2b

00

3

Subtract 2b from 2a. (If difference is a negative figure, enter the amount in brackets < > )

3

00

4

If line 3 is a positive number, add lines 1 and 3; If line 3 is a negative number, subtract line 3 from line 1.

4

5

Other adjustments, if applicable: enter amount from line 55 on the back of this form

(If line 55 is a negative figure, enter the amount in brackets < > ).

00

5

00

6

South Carolina INCOME SUBJECT TO TAX (line 4 PLUS OR MINUS the amount on line 5).

6

00

7

TAX: Enter tax from SOUTH CAROLINA tax tables.

7

8

TAX on Lump Sum Distribution (If using SC4972, please attach.)

8

00

00

9

TOTAL South Carolina tax. Add lines 7 and 8. Enter the total.

9

10

Child and Dependent Care. Federal EXPENSE from Form 2441

$ __________________ x .07 (7%)

00

10

00

11

Two Wage Earner Credit from Schedule W on the back of this form.

11

00

12

Other Non-refundable Credits. Attach Schedule TC.

12

00

13

TOTAL Non-refundable Credits.

13

Add lines 10 through 12 and enter the total.

00

14

SUBTRACT Line 13 from line 9. Enter the difference BUT NOT LESS THAN ZERO.

14

15

00

00

SC INCOME TAX WITHHELD

18 NR sale of real estate

(Attach W-2 or SC41.)

19 Other SC Withholding

00

00

(Attach Form 1099)

16 1999 Estimated Tax Payments

20 Tuition Tax Credit

17 Amount Paid with extension

00

00

(Attach Form I-319)

00

21

ADD lines 15 through 20 and enter the total. These are your Total Payments/Credits.

21

00

22

If line 21 is LARGER than line 14, subtract line 14 from line 21 and enter the OVERPAYMENT.

22

00

23

If line 14 is LARGER than line 21, subtract line 21 from line 14 and enter the AMOUNT DUE.

23

00

24 Amount of line 22 to be credited to your 2000 ESTIMATED TAX.

24

25 Endangered Wildlife Fund

00

28 Veterans' Trust Fund

00

00

00

26 Children's Trust Fund

29 Gift of Life Trust Fund

00

00

27 Eldercare Trust Fund

30 DARE Fund

00

31 First Steps Fund

00

32

32 ADD lines 24 through 31 and enter the total.

If subject to penalty for Underpayment of Estimated Tax, attach Form SC2210.

(See instructions). Penalty: $ _____________

00

33 NET REFUND: Subtract line 32 from line 22 and enter the AMOUNT TO BE REFUNDED TO YOU.

33

34 NET DUE: ADD lines 23 and 32 and, if applicable, penalty amount. Enter the AMOUNT YOU OWE.

Attach a check or money order for the full amount payable to "SC Department of Revenue." Write

34

00

your Social Security number and "1999 Form SC1040" on the check.

ATTACH A COMPLETE COPY OF YOUR FEDERAL RETURN ONLY IF you have income and/or (loss) on federal Schedules C, D, E or F.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2