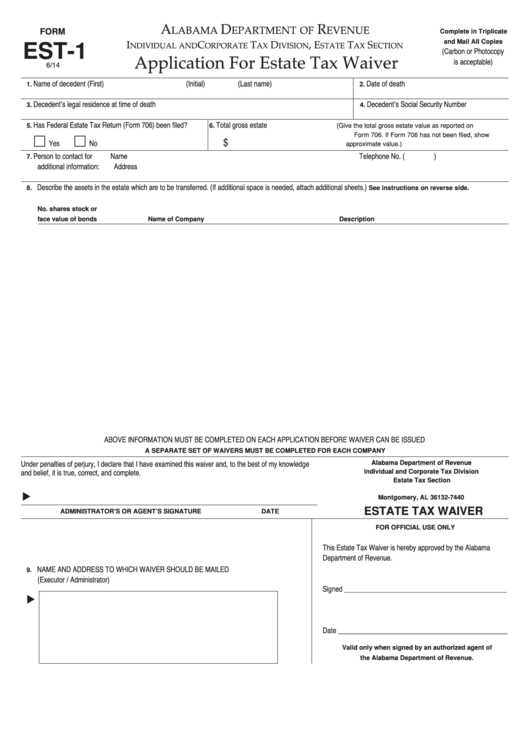

Form Est-1 - Application For Estate Tax Waiver

ADVERTISEMENT

A

D

r

lAbAmA

epArtment of

evenue

Complete in Triplicate

ORM

and Mail All Copies

(Carbon or Photocopy

EST-1

I

C

t

D

, e

t

s

nDIvIDuAl AnD

orporAte

Ax

IvIsIon

stAte

Ax

eCtIon

is acceptable)

6/14

Application for estate tax Waiver

1. Name of decedent (First)

(Initial)

(Last name)

2. Date of death

3. Decedent’s legal residence at time of death

4. Decedent’s Social Security Number

5. Has Federal Estate Tax Return (Form 706) been filed?

6. Total gross estate

(Give the total gross estate value as reported on

$

Yes

No

Form 706. If Form 706 has not been filed, show

approximate value.)

7. Person to contact for

Name

Telephone No. (

)

additional information:

Address

8. Describe the assets in the estate which are to be transferred. (If additional space is needed, attach additional sheets.) See instructions on reverse side.

No. shares stock or

face value of bonds

Name of Company

Description

ABOVE INFORMATION MUST BE COMPLETED ON EACH APPLICATION BEFORE WAIVER CAN BE ISSUED

A SEPARATE SET OF WAIVERS MUST BE COMPLETED FOR EACH COMPANY

Under penalties of perjury, I declare that I have examined this waiver and, to the best of my knowledge

Alabama Department of Revenue

and belief, it is true, correct, and complete.

Individual and Corporate Tax Division

Estate Tax Section

P.O. Box 327440

Montgomery, AL 36132-7440

ESTATE TAX WAIVER

ADMINISTRATOR’S OR AGENT’S SIGNATURE

DATE

FOR OFFICIAL USE ONLY

This Estate Tax Waiver is hereby approved by the Alabama

Department of Revenue.

9. NAME AND ADDRESS TO WHICH WAIVER SHOULD BE MAILED

(Executor / Administrator)

Signed ______________________________________________

Date ________________________________________________

Valid only when signed by an authorized agent of

the Alabama Department of Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2