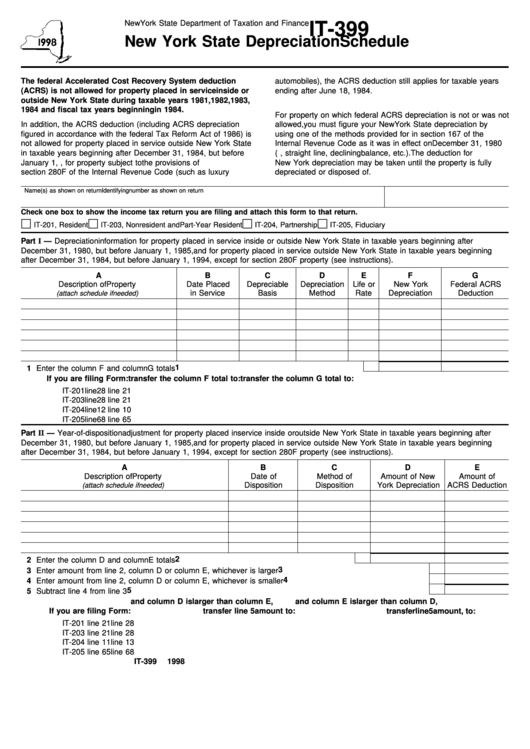

New York State Department of Taxation and Finance

IT-399

New York State Depreciation Schedule

The federal Accelerated Cost Recovery System deduction

automobiles), the ACRS deduction still applies for taxable years

(ACRS) is not allowed for property placed in service inside or

ending after June 18, 1984.

outside New York State during taxable years 1981, 1982, 1983,

1984 and fiscal tax years beginning in 1984.

For property on which federal ACRS depreciation is not or was not

In addition, the ACRS deduction (including ACRS depreciation

allowed, you must figure your New York State depreciation by

figured in accordance with the federal Tax Reform Act of 1986) is

using one of the methods provided for in section 167 of the

not allowed for property placed in service outside New York State

Internal Revenue Code as it was in effect on December 31, 1980

in taxable years beginning after December 31, 1984, but before

(e.g., straight line, declining balance, etc.). The deduction for

January 1, 1994. However, for property subject to the provisions of

New York depreciation may be taken until the property is fully

section 280F of the Internal Revenue Code (such as luxury

depreciated or disposed of.

Name(s) as shown on return

Identifying number as shown on return

Check one box to show the income tax return you are filing and attach this form to that return.

□

□

□

□

IT-201, Resident

IT-203, Nonresident and Part-Year Resident

IT-204, Partnership

IT-205, Fiduciary

Part I — Depreciation information for property placed in service inside or outside New York State in taxable years beginning after

December 31, 1980, but before January 1, 1985, and for property placed in service outside New York State in taxable years beginning

after December 31, 1984, but before January 1, 1994, except for section 280F property (see instructions).

A

B

C

D

E

F

G

Description of Property

Date Placed

Depreciable

Depreciation

Life or

New York

Federal ACRS

in Service

Basis

Method

Rate

Depreciation

Deduction

(attach schedule if needed)

1 Enter the column F and column G totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

If you are filing Form:

transfer the column F total to:

transfer the column G total to:

IT-201. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 21

IT-203. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 21

IT-204. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 10

IT-205. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 68 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 65

Part II — Year-of-disposition adjustment for property placed in service inside or outside New York State in taxable years beginning after

December 31, 1980, but before January 1, 1985, and for property placed in service outside New York State in taxable years beginning

after December 31, 1984, but before January 1, 1994, except for section 280F property (see instructions).

A

B

C

D

E

Description of Property

Date of

Method of

Amount of New

Amount of

Disposition

Disposition

York Depreciation

ACRS Deduction

(attach schedule if needed)

2 Enter the column D and column E totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Enter amount from line 2, column D or column E, whichever is larger . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Enter amount from line 2, column D or column E, whichever is smaller . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

and column D is larger than column E,

and column E is larger than column D,

If you are filing Form:

transfer line 5 amount to:

transfer line 5 amount, to:

IT-201 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 21. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 28

IT-203 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 21. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 28

IT-204 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 13

IT-205 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 65. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . line 68

IT-399

1998

1

1