Instructions For Schedule A-1 Lines 1-21

ADVERTISEMENT

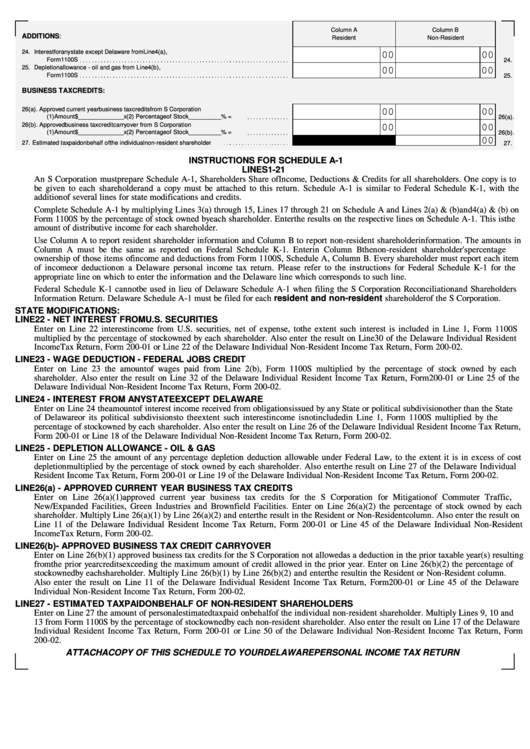

Column A

Column B

ADDITIONS:

Resident

Non-Resident

24. Interest for any state except Delaware from Line 4(a),

00

00

Form 1100S

24.

25. Depletion allowance - oil and gas from Line 4(b),

00

00

Form 1100S

25.

BUSINESS TAX CREDITS:

26(a). Approved current year business tax credits from S Corporation

00

00

(1) Amount $ ______________ x (2) Percentage of Stock __________% =

26(a).

26(b). Approved business tax credit carryover from S Corporation

00

00

(1) Amount $ ______________ x (2) Percentage of Stock __________% =

26(b).

00

27. Estimated tax paid on behalf of the individual non-resident shareholder

27.

INSTRUCTIONS FOR SCHEDULE A-1

LINES 1-21

An S Corporation must prepare Schedule A-1, Shareholders Share of Income, Deductions & Credits for all shareholders. One copy is to

be given to each shareholder and a copy must be attached to this return. Schedule A-1 is similar to Federal Schedule K-1, with the

addition of several lines for state modifications and credits.

Complete Schedule A-1 by multiplying Lines 3(a) through 15, Lines 17 through 21 on Schedule A and Lines 2(a) & (b) and 4(a) & (b) on

Form 1100S by the percentage of stock owned by each shareholder. Enter the results on the respective lines on Schedule A-1. This is the

amount of distributive income for each shareholder.

Use Column A to report resident shareholder information and Column B to report non-resident shareholder information. The amounts in

Column A must be the same as reported on Federal Schedule K-1. Enter in Column B the non-resident shareholder's percentage

ownership of those items of income and deductions from Form 1100S, Schedule A, Column B. Every shareholder must report each item

of income or deduction on a Delaware personal income tax return. Please refer to the instructions for Federal Schedule K-1 for the

appropriate line on which to enter the information and the Delaware line which corresponds to such line.

Federal Schedule K-1 cannot be used in lieu of Delaware Schedule A-1 when filing the S Corporation Reconciliation and Shareholders

Information Return. Delaware Schedule A-1 must be filed for each resident and non-resident shareholder of the S Corporation.

STATE MODIFICATIONS:

LINE 22 - NET INTEREST FROM U.S. SECURITIES

Enter on Line 22 interest income from U.S. securities, net of expense, to the extent such interest is included in Line 1, Form 1100S

multiplied by the percentage of stock owned by each shareholder. Also enter the result on Line 30 of the Delaware Individual Resident

Income Tax Return, Form 200-01 or Line 22 of the Delaware Individual Non-Resident Income Tax Return, Form 200-02.

LINE 23 - WAGE DEDUCTION - FEDERAL JOBS CREDIT

Enter on Line 23 the amount of wages paid from Line 2(b), Form 1100S multiplied by the percentage of stock owned by each

shareholder. Also enter the result on Line 32 of the Delaware Individual Resident Income Tax Return, Form 200-01 or Line 25 of the

Delaware Individual Non-Resident Income Tax Return, Form 200-02.

LINE 24 - INTEREST FROM ANY STATE EXCEPT DELAWARE

Enter on Line 24 the amount of interest income received from obligations issued by any State or political subdivision other than the State

of Delaware or its political subdivisions to the extent such interest income is not included in Line 1, Form 1100S multiplied by the

percentage of stock owned by each shareholder. Also enter the result on Line 26 of the Delaware Individual Resident Income Tax Return,

Form 200-01 or Line 18 of the Delaware Individual Non-Resident Income Tax Return, Form 200-02.

LINE 25 - DEPLETION ALLOWANCE - OIL & GAS

Enter on Line 25 the amount of any percentage depletion deduction allowable under Federal Law, to the extent it is in excess of cost

depletion multiplied by the percentage of stock owned by each shareholder. Also enter the result on Line 27 of the Delaware Individual

Resident Income Tax Return, Form 200-01 or Line 19 of the Delaware Individual Non-Resident Income Tax Return, Form 200-02.

LINE 26(a) - APPROVED CURRENT YEAR BUSINESS TAX CREDITS

Enter on Line 26(a)(1) approved current year business tax credits for the S Corporation for Mitigation of Commuter Traffic,

New/Expanded Facilities, Green Industries and Brownfield Facilities. Enter on Line 26(a)(2) the percentage of stock owned by each

shareholder. Multiply Line 26(a)(1) by Line 26(a)(2) and enter the result in the Resident or Non-Resident column. Also enter the result on

Line 11 of the Delaware Individual Resident Income Tax Return, Form 200-01 or Line 45 of the Delaware Individual Non-Resident

Income Tax Return, Form 200-02.

LINE 26(b) - APPROVED BUSINESS TAX CREDIT CARRYOVER

Enter on Line 26(b)(1) approved business tax credits for the S Corporation not allowed as a deduction in the prior taxable year(s) resulting

from the prior year credits exceeding the maximum amount of credit allowed in the prior year. Enter on Line 26(b)(2) the percentage of

stock owned by each shareholder. Multiply Line 26(b)(1) by Line 26(b)(2) and enter the result in the Resident or Non-Resident column.

Also enter the result on Line 11 of the Delaware Individual Resident Income Tax Return, Form 200-01 or Line 45 of the Delaware

Individual Non-Resident Income Tax Return, Form 200-02.

LINE 27 - ESTIMATED TAX PAID ON BEHALF OF NON-RESIDENT SHAREHOLDERS

Enter on Line 27 the amount of personal estimated tax paid on behalf of the individual non-resident shareholder. Multiply Lines 9, 10 and

13 from Form 1100S by the percentage of stock owned by each non-resident shareholder. Also enter the result on Line 17 of the Delaware

Individual Resident Income Tax Return, Form 200-01 or Line 50 of the Delaware Individual Non-Resident Income Tax Return, Form

200-02.

ATTACH A COPY OF THIS SCHEDULE TO YOUR DELAWARE PERSONAL INCOME TAX RETURN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1