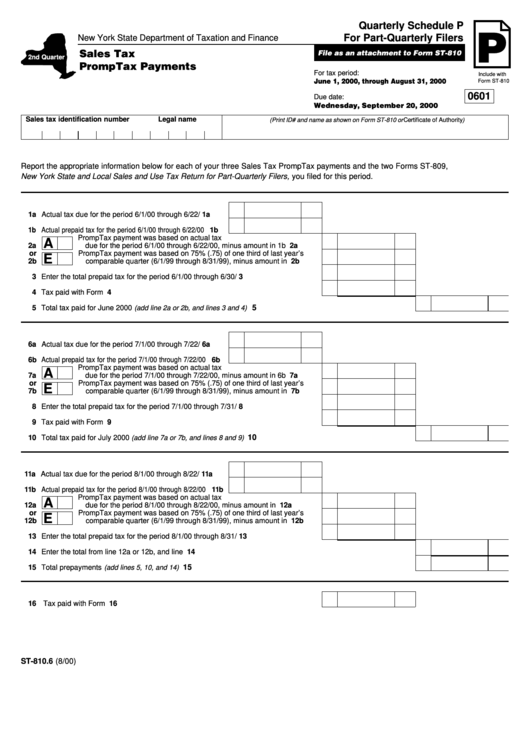

Form St-810.6 - Quarterly Schedule P For Part-Quarterly Filers - New York State Department Of Taxation And Finance

ADVERTISEMENT

Quarterly Schedule P

P

New York State Department of Taxation and Finance

For Part-Quarterly Filers

Sales Tax

File as an attachment to Form ST-810

2nd Quarter

PrompTax Payments

For tax period:

Include with

June 1, 2000, through August 31, 2000

Form ST-810

0601

Due date:

Wednesday, September 20, 2000

Sales tax identification number

Legal name

(Print ID# and name as shown on Form ST-810 or Certificate of Authority )

Report the appropriate information below for each of your three Sales Tax PrompTax payments and the two Forms ST-809,

New York State and Local Sales and Use Tax Return for Part-Quarterly Filers, you filed for this period.

1a Actual tax due for the period 6/1/00 through 6/22/00 ......

1a

1b Actual prepaid tax for the period 6/1/00 through 6/22/00 .......

1b

PrompTax payment was based on actual tax

A

2a

due for the period 6/1/00 through 6/22/00, minus amount in 1b ..............

2a

or

PrompTax payment was based on 75% (.75) of one third of last year’s

E

2b

comparable quarter (6/1/99 through 8/31/99), minus amount in 1b .........

2b

3 Enter the total prepaid tax for the period 6/1/00 through 6/30/00 ..................................

3

4 Tax paid with Form ST-809 ............................................................................................

4

5 Total tax paid for June 2000 (add line 2a or 2b, and lines 3 and 4)

.........................................................................

5

6a Actual tax due for the period 7/1/00 through 7/22/00 ......

6a

6b Actual prepaid tax for the period 7/1/00 through 7/22/00 ......

6b

PrompTax payment was based on actual tax

A

7a

due for the period 7/1/00 through 7/22/00, minus amount in 6b ..............

7a

or

PrompTax payment was based on 75% (.75) of one third of last year’s

E

7b

comparable quarter (6/1/99 through 8/31/99), minus amount in 1b .........

7b

8 Enter the total prepaid tax for the period 7/1/00 through 7/31/00 ..................................

8

9 Tax paid with Form ST-809 ............................................................................................

9

...........................................................................

10

10 Total tax paid for July 2000 (add line 7a or 7b, and lines 8 and 9)

11a Actual tax due for the period 8/1/00 through 8/22/00 ...... 11a

11b Actual prepaid tax for the period 8/1/00 through 8/22/00 ...... 11b

PrompTax payment was based on actual tax

A

12a

due for the period 8/1/00 through 8/22/00, minus amount in 11b ............ 12a

or

PrompTax payment was based on 75% (.75) of one third of last year’s

E

12b

comparable quarter (6/1/99 through 8/31/99), minus amount in 1b ......... 12b

13 Enter the total prepaid tax for the period 8/1/00 through 8/31/00 ..................................

13

14 Enter the total from line 12a or 12b, and line 13 .........................................................................................................

14

.........................................................................................................

15

15 Total prepayments (add lines 5, 10, and 14)

16 Tax paid with Form ST-810 ...........................................................................................

16

ST-810.6 (8/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1