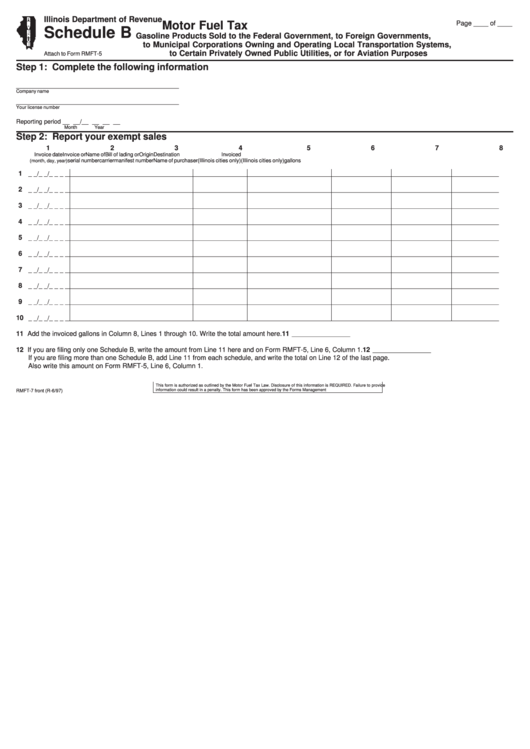

Illinois Department of Revenue

Motor Fuel Tax

Page ____ of ____

Schedule B

Gasoline Products Sold to the Federal Government, to Foreign Governments,

to Municipal Corporations Owning and Operating Local Transportation Systems,

to Certain Privately Owned Public Utilities, or for Aviation Purposes

Attach to Form RMFT-5

Step 1: Complete the following information

_______________________________________________

Company name

_______________________________________________

Your license number

Reporting period __ __/__ __ __ __

Month

Year

Step 2: Report your exempt sales

1

2

3

4

5

6

7

8

Invoice date

Invoice or

Name of

Bill of lading or

Origin

Destination

Invoiced

serial number

carrier

manifest number

Name of purchaser

(Illinois cities only)

(Illinois cities only)

gallons

(month, day, year)

1

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

2

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

3

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

4

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

5

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

6

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

7

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

8

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

9

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

10

_ _/_ _/_ _ _ _ ______________ _____________________ _______________ ________________________ _________________ _________________ __________________

11 Add the invoiced gallons in Column 8, Lines 1 through 10. Write the total amount here.

11

____________________

12 If you are filing only one Schedule B, write the amount from Line 11 here and on Form RMFT-5, Line 6, Column 1.

12

____________________

If you are filing more than one Schedule B, add Line 11 from each schedule, and write the total on Line 12 of the last page.

Also write this amount on Form RMFT-5, Line 6, Column 1.

This form is authorized as outlined by the Motor Fuel Tax Law. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0084

RMFT-7 front (R-6/97)

1

1