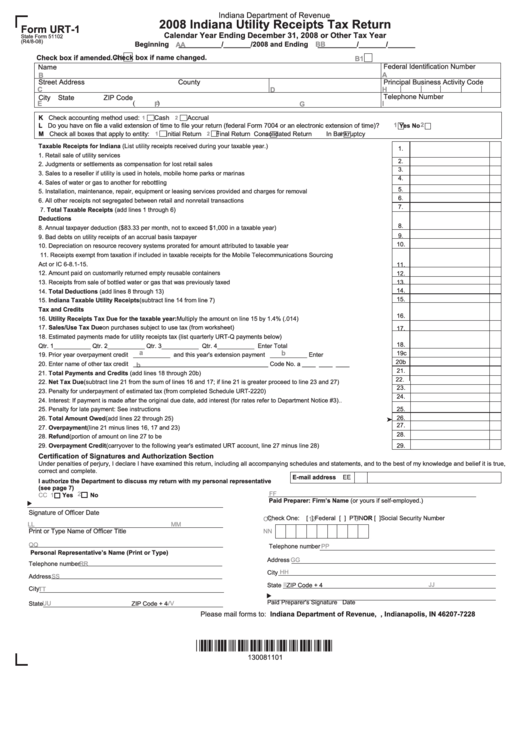

Form Urt-1 - 2008 Indiana Utility Receipts Tax Return

ADVERTISEMENT

Indiana Department of Revenue

2008 Indiana Utility Receipts Tax Return

Form URT-1

Calendar Year Ending December 31, 2008 or Other Tax Year

State Form 51102

(R4/8-08)

Beginning

___________/_______/2008 and Ending

BB

__________/_______/_______

AA

Check box if amended.

Check box if name changed.

A1

B1

Federal Identification Number

Name

A

B

Street Address

County

Principal Business Activity Code

C

D

H

Telephone Number

City

State

ZIP Code

(

)

E

I

F

G

K Check accounting method used:

Cash

Accrual

1

2

L Do you have on file a valid extension of time to file your return (federal Form 7004 or an electronic extension of time)?

2

1

Yes

No

M Check all boxes that apply to entity:

Initial Return

Final Return

Consolidated Return

In Bankruptcy

4

1

2

3

Taxable Receipts for Indiana (List utility receipts received during your taxable year.)

1.

1. Retail sale of utility services ...........................................................................................................................................................

2.

2. Judgments or settlements as compensation for lost retail sales ...................................................................................................

3.

3. Sales to a reseller if utility is used in hotels, mobile home parks or marinas ................................................................................

4.

4. Sales of water or gas to another for rebottling ...............................................................................................................................

5.

5. Installation, maintenance, repair, equipment or leasing services provided and charges for removal ..........................................

6.

6. All other receipts not segregated between retail and nonretail transactions ................................................................................

7.

7.

Total Taxable Receipts (add lines 1 through 6)............................................................................................................................

Deductions

8.

8. Annual taxpayer deduction ($83.33 per month, not to exceed $1,000 in a taxable year) .............................................................

9.

9. Bad debts on utility receipts of an accrual basis taxpayer .............................................................................................................

10.

10. Depreciation on resource recovery systems prorated for amount attributed to taxable year .......................................................

11. Receipts exempt from taxation if included in taxable receipts for the Mobile Telecommunications Sourcing

Act or IC 6-8.1-15. ...........................................................................................................................................................................

11.

12.

Amount paid on customarily returned empty reusable containers ................................................................................................

12.

13.

Receipts from sale of bottled water or gas that was previously taxed ...........................................................................................

13.

14.

14.

Total Deductions (add lines 8 through 13)....................................................................................................................................

15.

15.

Indiana Taxable Utility Receipts (subtract line 14 from line 7) ...................................................................................................

Tax and Credits

16.

16.

Utility Receipts Tax Due for the taxable year: Multiply the amount on line 15 by 1.4% (.014) .................................................

17.

Sales/Use Tax Due on purchases subject to use tax (from worksheet) .......................................................................................

17.

18.

Estimated payments made for utility receipts tax (list quarterly URT-Q payments below)

18.

Qtr. 1___________

Qtr. 2___________

Qtr. 3___________

Qtr. 4___________ Enter Total .......

a

b

19c

19.

Prior year overpayment credit ___________ and this year's extension payment ___________ Enter Total... .................

20b

20.

Enter name of other tax credit ________________________________________ Code No. a ____ ____ ____

b

21.

21.

Total Payments and Credits (add lines 18 through 20b) ................................................................................... ..........................

22.

22.

Net Tax Due (subtract line 21 from the sum of lines 16 and 17; if line 21 is greater proceed to line 23 and 27)..........................

23.

23.

Penalty for underpayment of estimated tax (from completed Schedule URT-2220) .....................................................................

24.

24.

Interest: If payment is made after the original due date, add interest (for rates refer to Department Notice #3).. .......................

25.

25.

Penalty for late payment: See instructions .....................................................................................................................................

26.

26.

Total Amount Owed (add lines 22 through 25).............................................................................................................................

27.

27.

Overpayment (line 21 minus lines 16, 17 and 23) ........................................................ ..................................................................

28.

28.

Refund (portion of amount on line 27 to be refunded......................................................................................................................

29.

29.

Overpayment Credit (carryover to the following year's estimated URT account, line 27 minus line 28) ...................................

Certification of Signatures and Authorization Section

Under penalties of perjury, I declare I have examined this return, including all accompanying schedules and statements, and to the best of my knowledge and belief it is true,

correct and complete.

E-mail address

EE

I authorize the Department to discuss my return with my personal representative

(see page 7)

2

FF

CC 1

Yes

No

Paid Preparer: Firm’s Name (or yours if self-employed.)

Signature of Officer

Date

Check One:

[ ] Federal I.D. Number

[ ] PTIN OR

[ ]Social Security Number

OO

1

2

3

LL

MM

Print or Type Name of Officer

Title

NN

QQ

Telephone number

PP

Personal Representative’s Name (Print or Type)

GG

Address

Telephone number

RR

HH

City

Address

SS

II

JJ

State

ZIP Code + 4

City

TT

Paid Preparer's Signature

Date

State

UU

ZIP Code + 4

VV

Please mail forms to: Indiana Department of Revenue, P.O.Box 7228, Indianapolis, IN 46207-7228

*130081101*

130081101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2