Colorado Form 106-Ep Draft - Colorado Composite Nonresident Return Estimated Tax Payment Voucher - 2008

ADVERTISEMENT

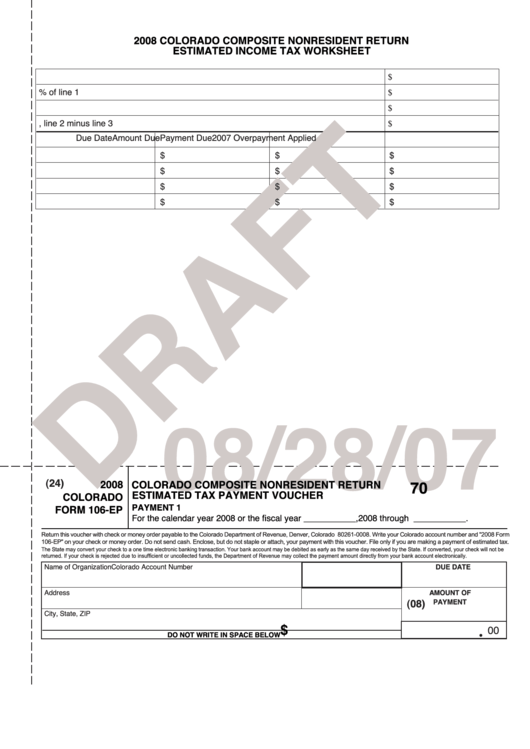

2008 COLORADO COMPOSITE NONRESIDENT RETURN

ESTIMATED INCOME TAX WORKSHEET

1.

Estimated 2008 Colorado taxable income

$

2.

Estimated 2008 Colorado income tax - 4.63% of line 1

$

3.

Estimated 2008 Form 106CR credits

$

4.

Net estimated tax, line 2 minus line 3

$

Due Date

Amount Due

2007 Overpayment Applied

Payment Due

$

$

$

$

$

$

$

$

$

$

$

$

08/28/07

(24)

2008

COLORADO COMPOSITE NONRESIDENT RETURN

70

ESTIMATED TAX PAYMENT VOUCHER

COLORADO

PAYMENT 1

FORM 106-EP

For the calendar year 2008 or the fiscal year ___________,2008 through ___________.

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008. Write your Colorado account number and "2008 Form

106-EP" on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment with this voucher. File only if you are making a payment of estimated tax.

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will not be

returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

Name of Organization

Colorado Account Number

DUE DATE

Address

F.E.I.N.

AMOUNT OF

PAYMENT

(08)

City, State, ZIP

$

00

DO NOT WRITE IN SPACE BELOW

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2