Form Tc 707 - Obtain Review Of A Final Determination Of The Tax Commission

ADVERTISEMENT

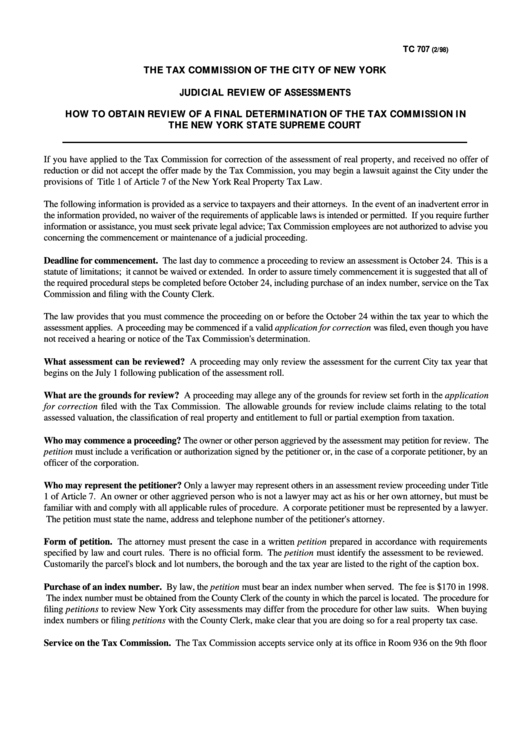

TC 707

(2/98)

THE TAX COMMISSION OF THE CITY OF NEW YORK

JUDICIAL REVIEW OF ASSESSMENTS

HOW TO OBTAIN REVIEW OF A FINAL DETERMINATION OF THE TAX COMMISSION IN

THE NEW YORK STATE SUPREME COURT

If you have applied to the Tax Commission for correction of the assessment of real property, and received no offer of

reduction or did not accept the offer made by the Tax Commission, you may begin a lawsuit against the City under the

provisions of Title 1 of Article 7 of the New York Real Property Tax Law.

The following information is provided as a service to taxpayers and their attorneys. In the event of an inadvertent error in

the information provided, no waiver of the requirements of applicable laws is intended or permitted. If you require further

information or assistance, you must seek private legal advice; Tax Commission employees are not authorized to advise you

concerning the commencement or maintenance of a judicial proceeding.

Deadline for commencement. The last day to commence a proceeding to review an assessment is October 24. This is a

statute of limitations; it cannot be waived or extended. In order to assure timely commencement it is suggested that all of

the required procedural steps be completed before October 24, including purchase of an index number, service on the Tax

Commission and filing with the County Clerk.

The law provides that you must commence the proceeding on or before the October 24 within the tax year to which the

assessment applies. A proceeding may be commenced if a valid application for correction was filed, even though you have

not received a hearing or notice of the Tax Commission's determination.

What assessment can be reviewed? A proceeding may only review the assessment for the current City tax year that

begins on the July 1 following publication of the assessment roll.

What are the grounds for review? A proceeding may allege any of the grounds for review set forth in the application

for correction filed with the Tax Commission. The allowable grounds for review include claims relating to the total

assessed valuation, the classification of real property and entitlement to full or partial exemption from taxation.

Who may commence a proceeding? The owner or other person aggrieved by the assessment may petition for review. The

petition must include a verification or authorization signed by the petitioner or, in the case of a corporate petitioner, by an

officer of the corporation.

Who may represent the petitioner? Only a lawyer may represent others in an assessment review proceeding under Title

1 of Article 7. An owner or other aggrieved person who is not a lawyer may act as his or her own attorney, but must be

familiar with and comply with all applicable rules of procedure. A corporate petitioner must be represented by a lawyer.

The petition must state the name, address and telephone number of the petitioner's attorney.

Form of petition. The attorney must present the case in a written petition prepared in accordance with requirements

specified by law and court rules. There is no official form. The petition must identify the assessment to be reviewed.

Customarily the parcel's block and lot numbers, the borough and the tax year are listed to the right of the caption box.

Purchase of an index number. By law, the petition must bear an index number when served. The fee is $170 in 1998.

The index number must be obtained from the County Clerk of the county in which the parcel is located. The procedure for

filing petitions to review New York City assessments may differ from the procedure for other law suits. When buying

index numbers or filing petitions with the County Clerk, make clear that you are doing so for a real property tax case.

Service on the Tax Commission. The Tax Commission accepts service only at its office in Room 936 on the 9th floor

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2