Form Bpc - Biomass Producer And Collector Credit

ADVERTISEMENT

Fill in tax year

Form

(or fiscal year end date)

BPC

Biomass Producer and

Collector Credit

Name

Social Security number (SSN)/Oregon business identification number (BIN)

Address (city, state, and ZIP code)

Telephone number

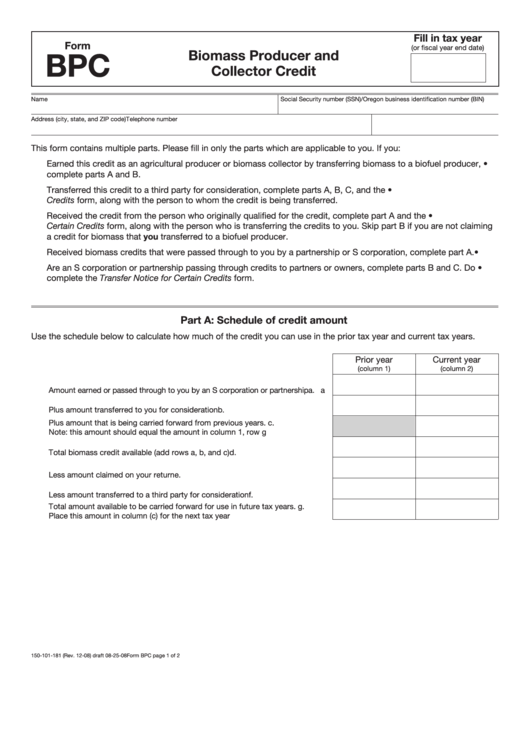

This form contains multiple parts. Please fill in only the parts which are applicable to you. If you:

•

Earned this credit as an agricultural producer or biomass collector by transferring biomass to a biofuel producer,

complete parts A and B.

•

Transferred this credit to a third party for consideration, complete parts A, B, C, and the

Transfer Notice for Certain

Credits form, along with the person to whom the credit is being transferred.

Transfer Notice for

•

Received the credit from the person who originally qualified for the credit, complete part A and the

Certain Credits form, along with the person who is transferring the credits to you. Skip part B if you are not claiming

a credit for biomass that you transferred to a biofuel producer.

•

Received biomass credits that were passed through to you by a partnership or S corporation, complete part A.

not

•

Are an S corporation or partnership passing through credits to partners or owners, complete parts B and C. Do

complete the Transfer Notice for Certain Credits form.

Part A: Schedule of credit amount

Use the schedule below to calculate how much of the credit you can use in the prior tax year and current tax years.

Prior year

Current year

(column 1)

(column 2)

a.

Amount earned or passed through to you by an S corporation or partnership

..... a

b.

Plus amount transferred to you for consideration

................................................ b

c.

Plus amount that is being carried forward from previous years.

Note: this amount should equal the amount in column 1, row g ......................... c

d.

Total biomass credit available (add rows a, b, and c)

.......................................... d

e.

Less amount claimed on your return

.................................................................... e

f.

Less amount transferred to a third party for consideration

.................................. f

g.

Total amount available to be carried forward for use in future tax years.

Place this amount in column (c) for the next tax year .......................................... g

150-101-181 (Rev. 12-08) draft 08-25-08

Form BPC page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2