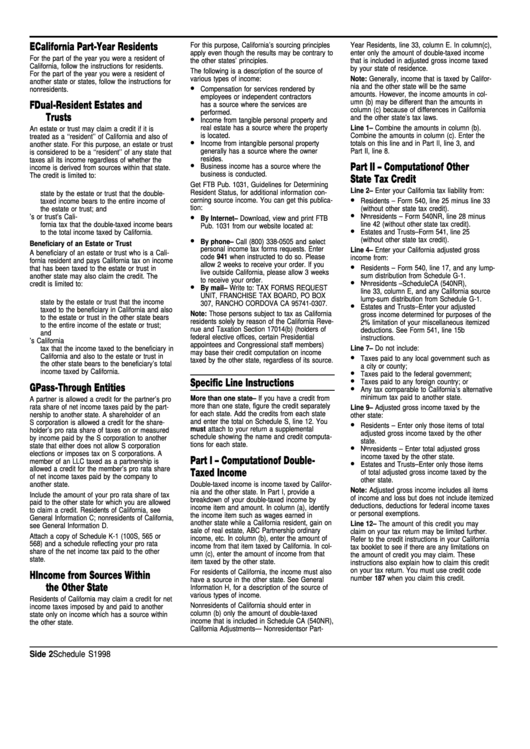

Schedule S - Other State Tax Credit - 1998

ADVERTISEMENT

E California Part-Year Residents

For this purpose, California’s sourcing principles

Year Residents, line 33, column E. In column (c),

apply even though the results may be contrary to

enter only the amount of double-taxed income

For the part of the year you were a resident of

the other states’ principles.

that is included in adjusted gross income taxed

California, follow the instructions for residents.

by your state of residence.

The following is a description of the source of

For the part of the year you were a resident of

various types of income:

Note: Generally, income that is taxed by Califor-

another state or states, follow the instructions for

•

nia and the other state will be the same

nonresidents.

Compensation for services rendered by

amounts. However, the income amounts in col-

employees or independent contractors

umn (b) may be different than the amounts in

F Dual-Resident Estates and

has a source where the services are

column (c) because of differences in California

performed.

Trusts

•

and the other state’s tax laws.

Income from tangible personal property and

real estate has a source where the property

Line 1 – Combine the amounts in column (b).

An estate or trust may claim a credit if it is

is located.

Combine the amounts in column (c). Enter the

treated as a ‘‘resident’’ of California and also of

•

Income from intangible personal property

totals on this line and in Part II, line 3, and

another state. For this purpose, an estate or trust

generally has a source where the owner

Part II, line 8.

is considered to be a ‘‘resident’’ of any state that

resides.

taxes all its income regardless of whether the

•

Part II – Computation of Other

Business income has a source where the

income is derived from sources within that state.

business is conducted.

The credit is limited to:

State Tax Credit

Get FTB Pub. 1031, Guidelines for Determining

1. The proportion of the tax paid to the other

Line 2 – Enter your California tax liability from:

Resident Status, for additional information con-

state by the estate or trust that the double-

•

cerning source income. You can get this publica-

Residents – Form 540, line 25 minus line 33

taxed income bears to the entire income of

tion:

(without other state tax credit).

the estate or trust; and

•

•

Nonresidents – Form 540NR, line 28 minus

2. The proportion of the estate’s or trust’s Cali-

By Internet – Download, view and print FTB

fornia tax that the double-taxed income bears

line 42 (without other state tax credit).

Pub. 1031 from our website located at:

•

to the total income taxed by California.

Estates and Trusts – Form 541, line 25

•

(without other state tax credit).

By phone – Call (800) 338-0505 and select

Beneficiary of an Estate or Trust

personal income tax forms requests. Enter

Line 4 – Enter your California adjusted gross

A beneficiary of an estate or trust who is a Cali-

code 941 when instructed to do so. Please

income from:

fornia resident and pays California tax on income

•

allow 2 weeks to receive your order. If you

Residents – Form 540, line 17, and any lump-

that has been taxed to the estate or trust in

live outside California, please allow 3 weeks

sum distribution from Schedule G-1.

another state may also claim the credit. The

•

to receive your order.

credit is limited to:

•

Nonresidents – Schedule CA (540NR),

By mail – Write to: TAX FORMS REQUEST

line 33, column E, and any California source

1. The proportion of the tax paid to the other

UNIT, FRANCHISE TAX BOARD, PO BOX

lump-sum distribution from Schedule G-1.

state by the estate or trust that the income

•

307, RANCHO CORDOVA CA 95741-0307.

Estates and Trusts – Enter your adjusted

taxed to the beneficiary in California and also

Note: Those persons subject to tax as California

gross income determined for purposes of the

to the estate or trust in the other state bears

residents solely by reason of the California Reve-

2% limitation of your miscellaneous itemized

to the entire income of the estate or trust;

nue and Taxation Section 17014(b) (holders of

deductions. See Form 541, line 15b

and

federal elective offices, certain Presidential

instructions.

2. The proportion of the beneficiary’s California

appointees and Congressional staff members)

tax that the income taxed to the beneficiary in

Line 7 – Do not include:

may base their credit computation on income

•

California and also to the estate or trust in

Taxes paid to any local government such as

taxed by the other state, regardless of its source.

the other state bears to the beneficiary’s total

a city or county;

•

income taxed by California.

Taxes paid to the federal government;

•

Specific Line Instructions

Taxes paid to any foreign country; or

•

G Pass-Through Entities

Any tax comparable to California’s alternative

minimum tax paid to another state.

More than one state – If you have a credit from

A partner is allowed a credit for the partner’s pro

more than one state, figure the credit separately

rata share of net income taxes paid by the part-

Line 9 – Adjusted gross income taxed by the

for each state. Add the credits from each state

nership to another state. A shareholder of an

other state:

and enter the total on Schedule S, line 12. You

•

S corporation is allowed a credit for the share-

Residents – Enter only those items of total

must attach to your return a supplemental

holder’s pro rata share of taxes on or measured

adjusted gross income taxed by the other

schedule showing the name and credit computa-

by income paid by the S corporation to another

state.

tions for each state.

•

state that either does not allow S corporation

Nonresidents – Enter total adjusted gross

elections or imposes tax on S corporations. A

income taxed by the other state.

Part I – Computation of Double-

•

member of an LLC taxed as a partnership is

Estates and Trusts – Enter only those items

allowed a credit for the member’s pro rata share

Taxed Income

of total adjusted gross income taxed by the

of net income taxes paid by the company to

other state.

Double-taxed income is income taxed by Califor-

another state.

Note: Adjusted gross income includes all items

nia and the other state. In Part I, provide a

Include the amount of your pro rata share of tax

of income and loss but does not include itemized

breakdown of your double-taxed income by

paid to the other state for which you are allowed

deductions, deductions for federal income taxes

income item and amount. In column (a), identify

to claim a credit. Residents of California, see

or personal exemptions.

the income item such as wages earned in

General Information C; nonresidents of California,

another state while a California resident, gain on

Line 12 – The amount of this credit you may

see General Information D.

sale of real estate, ABC Partnership ordinary

claim on your tax return may be limited further.

Attach a copy of Schedule K-1 (100S, 565 or

income, etc. In column (b), enter the amount of

Refer to the credit instructions in your California

568) and a schedule reflecting your pro rata

income from that item taxed by California. In col-

tax booklet to see if there are any limitations on

share of the net income tax paid to the other

umn (c), enter the amount of income from that

the amount of credit you may claim. These

state.

item taxed by the other state.

instructions also explain how to claim this credit

on your tax return. You must use credit code

For residents of California, the income must also

H Income from Sources Within

number 187 when you claim this credit.

have a source in the other state. See General

the Other State

Information H, for a description of the source of

various types of income.

Residents of California may claim a credit for net

Nonresidents of California should enter in

income taxes imposed by and paid to another

column (b) only the amount of double-taxed

state only on income which has a source within

income that is included in Schedule CA (540NR),

the other state.

California Adjustments — Nonresidents or Part-

Side 2 Schedule S 1998

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1