Form Ct-247 - Application For Exemption From Corporation Franchise Taxes By A Not-For-Profit Organization

ADVERTISEMENT

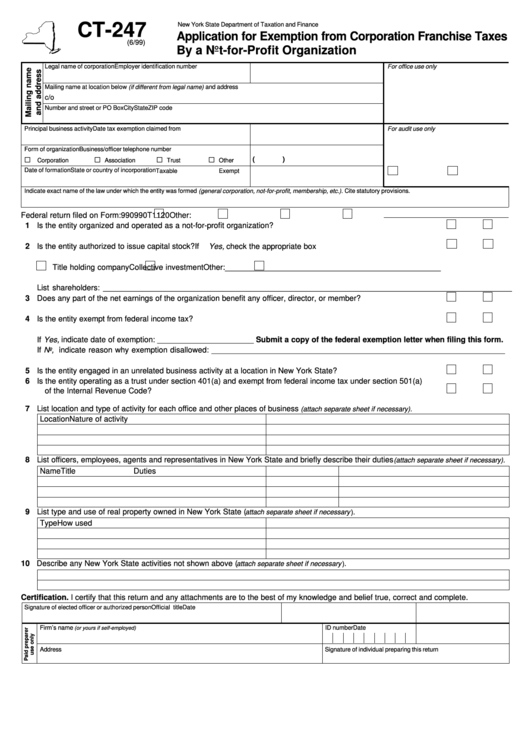

CT-247

New York State Department of Taxation and Finance

Application for Exemption from Corporation Franchise Taxes

(6/99)

By a Not-for-Profit Organization

Legal name of corporation

Employer identification number

For office use only

Mailing name at location below (if different from legal name) and address

c/o

Number and street or PO Box

City

State

ZIP code

Principal business activity

Date tax exemption claimed from

For audit use only

Form of organization

Business/officer telephone number

G

G

G

G

(

)

Corporation

Association

Trust

Other

Date of formation

State or country of incorporation

Taxable

Exempt

Indicate exact name of the law under which the entity was formed ( general corporation, not-for-profit, membership, etc.). Cite statutory provisions.

Federal return filed on Form:

990

990T

1120

Other:

1 Is the entity organized and operated as a not-for-profit organization? ..............................................................................

Yes

No

2 Is the entity authorized to issue capital stock? If Yes, check the appropriate box below ................................................

Yes

No

Title holding company

Collective investment

Other:_________________________________________________

List shareholders: _____________________________________________________________________________________________

3 Does any part of the net earnings of the organization benefit any officer, director, or member? ......................................

Yes

No

4 Is the entity exempt from federal income tax? ...................................................................................................................

Yes

No

If Yes, indicate date of exemption: ______________________ Submit a copy of the federal exemption letter when filing this form.

If No, indicate reason why exemption disallowed:

___________________________________________________________________

5 Is the entity engaged in an unrelated business activity at a location in New York State? .................................................

Yes

No

6 Is the entity operating as a trust under section 401(a) and exempt from federal income tax under section 501(a)

of the Internal Revenue Code? ......................................................................................................................................

Yes

No

7 List location and type of activity for each office and other places of business

(attach separate sheet if necessary).

Location

Nature of activity

8 List officers, employees, agents and representatives in New York State and briefly describe their duties

(attach separate sheet if necessary).

Name

Title

Duties

9 List type and use of real property owned in New York State (

attach separate sheet if necessary ).

Type

How used

10 Describe any New York State activities not shown above (

attach separate sheet if necessary ).

Certification. I certify that this return and any attachments are to the best of my knowledge and belief true, correct and complete.

Signature of elected officer or authorized person

Official title

Date

Firm’s name

ID number

Date

(or yours if self-employed)

Address

Signature of individual preparing this return

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1