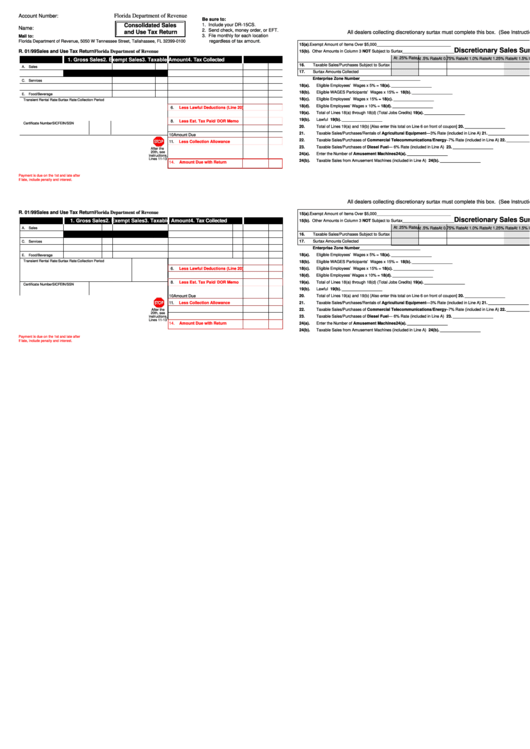

Form Dr-7 - Consolidated Sales And Use Tax Return

ADVERTISEMENT

DR-7

Account Number:

Florida Department of Revenue

R. 01/99

Be sure to:

1. Include your DR-15CS.

Consolidated Sales

Name:

2. Send check, money order, or EFT.

and Use Tax Return

All dealers collecting discretionary surtax must complete this box. (See Instructions)

3. File monthly for each location

Mail to:

Florida Department of Revenue, 5050 W Tennessee Street, Tallahassee, FL 32399-0100

regardless of tax amount.

15(a). Exempt Amount of Items Over $5,000 _________________________________

Discretionary Sales Surtax

R. 01/99

Sales and Use Tax Return

Florida Department of Revenue

15(b). Other Amounts in Column 3 NOT Subject to Surtax _______________________

At .25% Rate

At .5% Rate

At 0.75% Rate At 1.0% Rate

At 1.25% Rate At 1.5% Rate

1. Gross Sales

2. Exempt Sales

3. Taxable Amount

4. Tax Collected

16.

Taxable Sales/Purchases Subject to Surtax

A.

Sales

17.

Surtax Amounts Collected

B.

Taxable Purchases

Enterprise Zone Number ___________________________

C. Services

18(a).

Eligible Employees’ Wages x 5% = .................................................................................................................. 18(a). __________________

D. Transient Rentals

18(b).

Eligible WAGES Participants’ Wages x 15% = ................................................................................................. 18(b). __________________

E.

Food/Beverage

18(c).

Eligible Employees’ Wages x 15% = ................................................................................................................ 18(c). __________________

Transient Rental Rate:

Surtax Rate:

Collection Period

5.

Total Amount of Tax Collected

18(d).

Eligible Employees’ Wages x 10% = ................................................................................................................. 18(d). __________________

6.

Less Lawful Deductions (Line 20)

19(a).

Total of Lines 18(a) through 18(d) (Total Jobs Credits) ..................................................................................... 19(a). __________________

7.

Total Tax Due

19(b).

Lawful Deductions ............................................................................................................................................. 19(b). __________________

8.

Less Est. Tax Paid/ DOR Memo

Certificate Number

SIC

FEIN/SSN

20.

Total of Lines 19(a) and 19(b) [Also enter this total on Line 6 on front of coupon] ................................................ 20. __________________

9.

Plus Est. Tax Due Current Month

21.

Taxable Sales/Purchases/Rentals of Agricultural Equipment—3% Rate (included in Line A) ........................... 21. __________________

10

Amount Due

22.

Taxable Sales/Purchases of Commercial Telecommunications/Energy–7% Rate (included in Line A) ........... 22. __________________

11.

Less Collection Allowance

23.

Taxable Sales/Purchases of Diesel Fuel — 6% Rate (included in Line A) ........................................................... 23. __________________

After the

12.

Plus Penalty

20th, see

24(a).

Enter the Number of Amusement Machines .................................................................................................. 24(a). __________________

instructions,

13.

Plus Interest

Lines 11-13

24(b).

Taxable Sales from Amusement Machines (included in Line A) ........................................................................ 24(b). __________________

14.

Amount Due with Return

Payment is due on the 1st and late after

If late, include penalty and interest.

1. Gross Sales

2. Exempt Sales

3. Taxable Amount

4. Tax Collected

All dealers collecting discretionary surtax must complete this box. (See Instructions)

R. 01/99

Sales and Use Tax Return

Florida Department of Revenue

15(a). Exempt Amount of Items Over $5,000 _________________________________

Discretionary Sales Surtax

1. Gross Sales

2. Exempt Sales

3. Taxable Amount

4. Tax Collected

15(b). Other Amounts in Column 3 NOT Subject to Surtax _______________________

At .25% Rate

A.

Sales

At .5% Rate

At 0.75% Rate At 1.0% Rate

At 1.25% Rate At 1.5% Rate

16.

Taxable Sales/Purchases Subject to Surtax

B.

Taxable Purchases

17.

Surtax Amounts Collected

C. Services

Enterprise Zone Number ___________________________

D. Transient Rentals

18(a).

Eligible Employees’ Wages x 5% = .................................................................................................................. 18(a). __________________

E.

Food/Beverage

Transient Rental Rate:

Surtax Rate:

Collection Period

5.

Total Amount of Tax Collected

18(b).

Eligible WAGES Participants’ Wages x 15% = ................................................................................................. 18(b). __________________

6.

Less Lawful Deductions (Line 20)

18(c).

Eligible Employees’ Wages x 15% = ................................................................................................................ 18(c). __________________

18(d).

Eligible Employees’ Wages x 10% = ................................................................................................................. 18(d). __________________

7.

Total Tax Due

8.

Less Est. Tax Paid/ DOR Memo

19(a).

Total of Lines 18(a) through 18(d) (Total Jobs Credits) ..................................................................................... 19(a). __________________

Certificate Number

SIC

FEIN/SSN

9.

Plus Est. Tax Due Current Month

19(b).

Lawful Deductions ............................................................................................................................................. 19(b). __________________

20.

Total of Lines 19(a) and 19(b) [Also enter this total on Line 6 on front of coupon] ................................................ 20. __________________

10

Amount Due

11.

Less Collection Allowance

21.

Taxable Sales/Purchases/Rentals of Agricultural Equipment—3% Rate (included in Line A) ........................... 21. __________________

12.

Plus Penalty

22.

Taxable Sales/Purchases of Commercial Telecommunications/Energy–7% Rate (included in Line A) ........... 22. __________________

After the

20th, see

13.

Plus Interest

23.

Taxable Sales/Purchases of Diesel Fuel — 6% Rate (included in Line A) ........................................................... 23. __________________

instructions,

Lines 11-13

14.

Amount Due with Return

24(a).

Enter the Number of Amusement Machines .................................................................................................. 24(a). __________________

24(b).

Taxable Sales from Amusement Machines (included in Line A) ........................................................................ 24(b). __________________

Payment is due on the 1st and late after

If late, include penalty and interest.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1