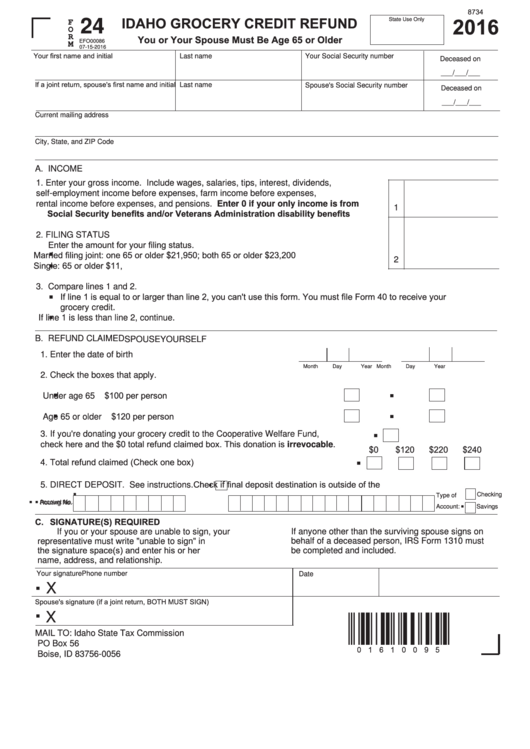

8734

2016

State Use Only

IDAHO GROCERY CREDIT REFUND

24

F

O

You or Your Spouse Must Be Age 65 or Older

R

EFO00086

M

07-15-2016

Your first name and initial

Last name

Your Social Security number

Deceased on

___/___/___

If a joint return, spouse's first name and initial

Last name

Spouse's Social Security number

Deceased on

___/___/___

Current mailing address

City, State, and ZIP Code

A. INCOME

1. Enter your gross income. Include wages, salaries, tips, interest, dividends,

self-employment income before expenses, farm income before expenses,

rental income before expenses, and pensions. Enter 0 if your only income is from

1

Social Security benefits and/or Veterans Administration disability benefits ......

2. FILING STATUS

Enter the amount for your filing status.

.

Married filing joint: one 65 or older $21,950; both 65 or older $23,200 ...................

.

2

Single: 65 or older $11,900.......................................................................................

3. Compare lines 1 and 2.

.

If line 1 is equal to or larger than line 2, you can't use this form. You must file Form 40 to receive your

.

grocery credit.

If line 1 is less than line 2, continue.

B. REFUND CLAIMED

YOURSELF

SPOUSE

1. Enter the date of birth ..............................................................

Month

Day

Year

Month

Day

Year

2. Check the boxes that apply.

.

.

Under age 65 .......................................................... $100 per person

.

.

Age 65 or older ....................................................... $120 per person

.

3. If you're donating your grocery credit to the Cooperative Welfare Fund,

check here and the $0 total refund claimed box. This donation is irrevocable.

$0

$120

$220

$240

.

4. Total refund claimed (Check one box) .............................................................

.

Check if final deposit destination is outside of the U.S.

.

5. DIRECT DEPOSIT. See instructions.

.

.

Checking

.

Type of

Account No.

Routing No.

Account:

Savings

C. SIGNATURE(S) REQUIRED

If you or your spouse are unable to sign, your

If anyone other than the surviving spouse signs on

behalf of a deceased person, IRS Form 1310 must

representative must write "unable to sign" in

the signature space(s) and enter his or her

be completed and included.

name, address, and relationship.

Your signature

Phone number

Date

.

X

Spouse's signature (if a joint return, BOTH MUST SIGN)

.

X

{"^!¦}

MAIL TO:

Idaho State Tax Commission

PO Box 56

Boise, ID 83756-0056

1

1