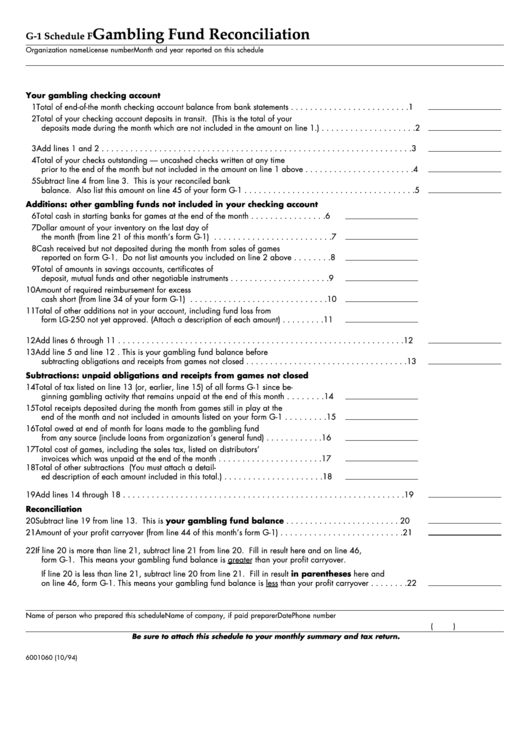

Gambling Fund Reconciliation

G-1 Schedule F

Organization name

License number

Month and year reported on this schedule

Your gambling checking account

1 Total of end-of-the month checking account balance from bank statements . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total of your checking account deposits in transit. (This is the total of your

deposits made during the month which are not included in the amount on line 1.) . . . . . . . . . . . . . . . . . . . . 2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total of your checks outstanding — uncashed checks written at any time

prior to the end of the month but not included in the amount on line 1 above . . . . . . . . . . . . . . . . . . . . . . . 4

5 Subtract line 4 from line 3. This is your reconciled bank

balance. Also list this amount on line 45 of your form G-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Additions: other gambling funds not included in your checking account

6 Total cash in starting banks for games at the end of the month . . . . . . . . . . . . . . . . 6

7 Dollar amount of your inventory on the last day of

the month (from line 21 of this month’s form G-1) . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Cash received but not deposited during the month from sales of games

reported on form G-1. Do not list amounts you included on line 2 above . . . . . . . . 8

9 Total of amounts in savings accounts, certificates of

deposit, mutual funds and other negotiable instruments . . . . . . . . . . . . . . . . . . . . . 9

10 Amount of required reimbursement for excess

cash short (from line 34 of your form G-1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Total of other additions not in your account, including fund loss from

form LG-250 not yet approved. (Attach a description of each amount) . . . . . . . . . 11

12 Add lines 6 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Add line 5 and line 12 . This is your gambling fund balance before

subtracting obligations and receipts from games not closed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Subtractions: unpaid obligations and receipts from games not closed

14 Total of tax listed on line 13 (or, earlier, line 15) of all forms G-1 since be-

ginning gambling activity that remains unpaid at the end of this month . . . . . . . . 14

15 Total receipts deposited during the month from games still in play at the

end of the month and not included in amounts listed on your form G-1 . . . . . . . . . 15

16 Total owed at end of month for loans made to the gambling fund

from any source (include loans from organization’s general fund) . . . . . . . . . . . . 16

1 7 Total cost of games, including the sales tax, listed on distributors’

invoices which was unpaid at the end of the month . . . . . . . . . . . . . . . . . . . . . . 17

1 8 Total of other subtractions (You must attach a detail-

ed description of each amount included in this total.) . . . . . . . . . . . . . . . . . . . . . 18

1 9 Add lines 14 through 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Reconciliation

2 0 Subtract line 19 from line 13. This is your gambling fund balance . . . . . . . . . . . . . . . . . . . . . . . . 20

2 1 Amount of your profit carryover (from line 44 of this month’s form G-1) . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 If line 20 is more than line 21, subtract line 21 from line 20. Fill in result here and on line 46,

form G-1. This means your gambling fund balance is greater than your profit carryover.

If line 20 is less than line 21, subtract line 20 from line 21. Fill in result in parentheses here and

on line 46, form G-1. This means your gambling fund balance is less than your profit carryover . . . . . . . . 22

Name of person who prepared this schedule

Name of company, if paid preparer

Date

Phone number

(

)

Be sure to attach this schedule to your monthly summary and tax return.

6001060 (10/94)

1

1