Reset This Form

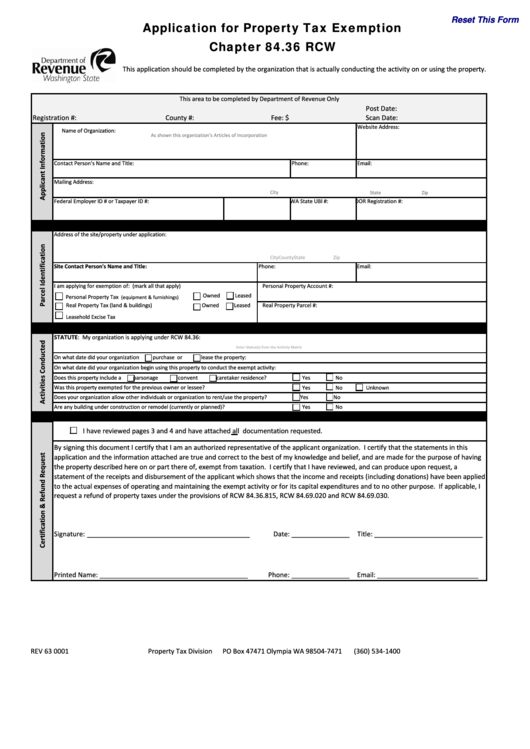

Application for Property Tax Exemption

Chapter 84.36 RCW

This application should be completed by the organization that is actually conducting the activity on or using the property.

This area to be completed by Department of Revenue Only

Post Date:

Registration #:

County #:

Fee: $

Scan Date:

Website Address:

Name of Organization:

As shown this organization's Articles of Incorporation

Contact Person's Name and Title:

Phone:

Email:

Mailing Address:

City

State

Zip

Federal Employer ID # or Taxpayer ID #:

WA State UBI #:

DOR Registration #:

Address of the site/property under application:

City

County

State

Zip

Site Contact Person's Name and Title:

Phone:

Email:

I am applying for exemption of: (mark all that apply)

Personal Property Account #:

Owned Leased

Personal Property Tax

(equipment & furnishings)

Real Property Tax (land & buildings)

Owned Leased

Real Property Parcel #:

Leasehold Excise Tax

STATUTE: My organization is applying under RCW 84.36:

Enter Statue(s) from the Activity Matrix

On what date did your organization purchase or lease the property:

On what date did your organization begin using this property to conduct the exempt activity:

Does this property include a parsonage convent caretaker residence?

Yes

No

Was this property exempted for the previous owner or lessee?

Yes

No

Unknown

Does your organization allow other individuals or organization to rent/use the property?

Yes

No

Are any building under construction or remodel (currently or planned)?

Yes

No

I have reviewed pages 3 and 4 and have attached all documentation requested.

By signing this document I certify that I am an authorized representative of the applicant organization. I certify that the statements in this

application and the information attached are true and correct to the best of my knowledge and belief, and are made for the purpose of having

the property described here on or part there of, exempt from taxation. I certify that I have reviewed, and can produce upon request, a

statement of the receipts and disbursement of the applicant which shows that the income and receipts (including donations) have been applied

to the actual expenses of operating and maintaining the exempt activity or for its capital expenditures and to no other purpose. If applicable, I

request a refund of property taxes under the provisions of RCW 84.36.815, RCW 84.69.020 and RCW 84.69.030.

Signature:

_____________________________________________

Date:

________________

Title: ______________________________

Printed Name: _________________________________________

Phone:

________________

Email: ____________________________

REV 63 0001

Property Tax Division PO Box 47471 Olympia WA 98504‐7471 (360) 534‐1400

1

1 2

2