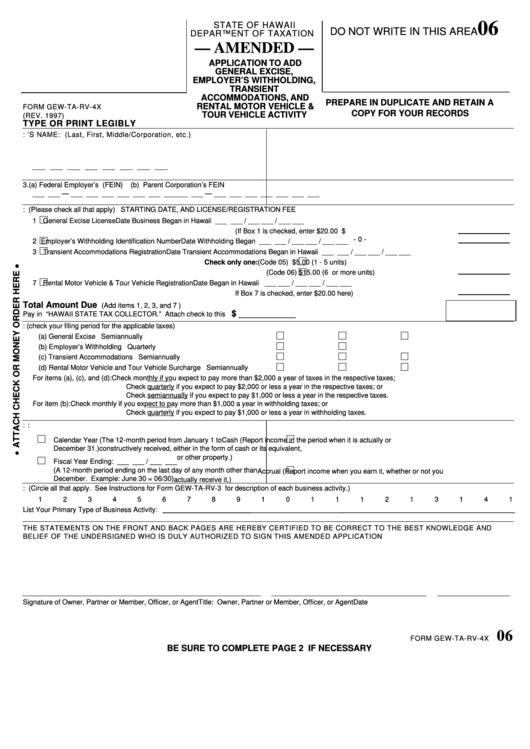

06

STATE OF HAWAII

DO NOT WRITE IN THIS AREA

DEPARTMENT OF TAXATION

— AMENDED —

APPLICATION TO ADD

GENERAL EXCISE,

EMPLOYER’S WITHHOLDING,

TRANSIENT

ACCOMMODATIONS, AND

PREPARE IN DUPLICATE AND RETAIN A

RENTAL MOTOR VEHICLE &

FORM GEW-TA-RV-4X

COPY FOR YOUR RECORDS

TOUR VEHICLE ACTIVITY

(REV. 1997)

TYPE OR PRINT LEGIBLY

1. HAWAII IDENTIFICATION NUMBER:

2. TAXPAYER’S NAME: (Last, First, Middle/Corporation, etc.)

___ ___ ___ ___ ___ ___ ___ ___

3. (a) Federal Employer’s I.D. Number (FEIN)

(b) Parent Corporation’s FEIN

___ ___ — ___ ___ ___ ___ ___ ___ ___

___ ___ — ___ ___ ___ ___ ___ ___ ___

4. APPLICATION IS HEREBY MADE TO ADD: (Please check all that apply) STARTING DATE, AND LICENSE/REGISTRATION FEE

1

General Excise License

Date Business Began in Hawaii ___ ___ / ___ ___ / ___ ___

(If Box 1 is checked, enter $20.00 here ................................................1 $

- 0 -

2

Employer’s Withholding Identification Number

Date Withholding Began ___ ___ / ___ ___ / ___ ___ .......................................2

3

Transient Accommodations Registration

Date Transient Accommodations Began in Hawaii ___ ___ / ___ ___ / ___ ___

Check only one:

(Code 05)

$5.00 (1 - 5 units)

(Code 06)

$15.00 (6 or more units).................................3

7

Rental Motor Vehicle & Tour Vehicle Registration Date Began in Hawaii ___ ___ / ___ ___ / ___ ___

If Box 7 is checked, enter $20.00 here) ................................................7

Total Amount Due

(Add items 1, 2, 3, and 7 )

$ ____________

Pay in U.S. dollars on U.S. Bank to “HAWAII STATE TAX COLLECTOR.” Attach check to this form...........................................................

5. FILING PERIOD FOR: (check your filing period for the applicable taxes)

(a) General Excise Tax....................................................................................

Monthly ...........

Quarterly..........

Semiannually

(b) Employer’s Withholding Tax.......................................................................

Monthly ...........

Quarterly

(c) Transient Accommodations Tax.................................................................

Monthly ...........

Quarterly..........

Semiannually

(d) Rental Motor Vehicle and Tour Vehicle Surcharge Tax .............................

Monthly ...........

Quarterly..........

Semiannually

For items (a), (c), and (d):

Check monthly if you expect to pay more than $2,000 a year of taxes in the respective taxes;

Check quarterly if you expect to pay $2,000 or less a year in the respective taxes; or

Check semiannually if you expect to pay $1,000 or less a year in the respective taxes.

For item (b):

Check monthly if you expect to pay more than $1,000 a year in withholding taxes; or

Check quarterly if you expect to pay $1,000 or less a year in withholding taxes.

6. ACCOUNTING PERIOD:

7. ACCOUNTING METHODS:

Calendar Year (The 12-month period from January 1 to

Cash (Report income in the period when it is actually or

December 31.)

constructively received, either in the form of cash or its equivalent,

or other property.)

Fiscal Year Ending: ___ ___ / ___ ___

(A 12-month period ending on the last day of any month other than

Accrual (Report income when you earn it, whether or not you

December. Example: June 30 = 06/30)

actually receive it.)

8. TYPE OF BUSINESS ACTIVITIES: (Circle all that apply. See Instructions for Form GEW-TA-RV-3 for description of each business activity.)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

List Your Primary Type of Business Activity:

THE STATEMENTS ON THE FRONT AND BACK PAGES ARE HEREBY CERTIFIED TO BE CORRECT TO THE BEST KNOWLEDGE AND

BELIEF OF THE UNDERSIGNED WHO IS DULY AUTHORIZED TO SIGN THIS AMENDED APPLICATION

Signature of Owner, Partner or Member, Officer, or Agent

Title: Owner, Partner or Member, Officer, or Agent

Date

06

FORM GEW-TA-RV-4X

BE SURE TO COMPLETE PAGE 2 IF NECESSARY

1

1 2

2