Form 720 - Schedule Llet(K)-C Draft - Limited Liability Entity Tax - Continuation Sheet

ADVERTISEMENT

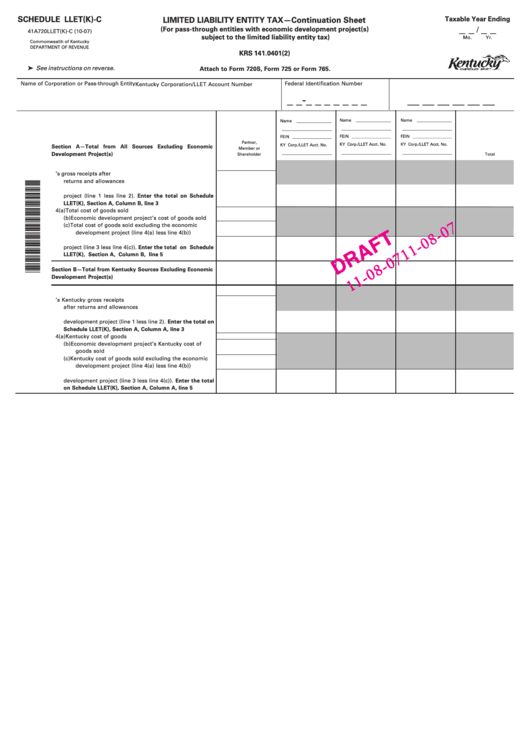

SCHEDULE LLET(K)-C

Taxable Year Ending

LIMITED LIABILITY ENTITY TAX—Continuation Sheet

_ _

_ _

(For pass-through entities with economic development project(s)

/

41A720LLET(K)-C (10-07)

subject to the limited liability entity tax)

Mo.

Yr.

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

KRS 141.0401(2)

➤ See instructions on reverse.

Attach to Form 720S, Form 725 or Form 765.

Name of Corporation or Pass-through Entity

Federal Identification Number

Kentucky Corporation/LLET Account Number

_ _ - _ _ _ _ _ _ _

__ __ __ __ __ __

Name

_________________

Name

_________________

Name

_________________

________________________

________________________

________________________

FEIN ___________________

FEIN ___________________

FEIN ___________________

Partner,

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

Section A—Total from All Sources Excluding Economic

Member or

________________________

________________________

________________________

Development Project(s)

Total

Shareholder

1. Total gross receipts after returns and allowances .............

2. Total economic development project’s gross receipts after

returns and allowances ..........................................................

3. Total gross receipts excluding the economic development

project (line 1 less line 2). Enter the total on Schedule

LLET(K), Section A, Column B, line 3 ...................................

4 (a) Total cost of goods sold ................................................

(b) Economic development project’s cost of goods sold

(c) Total cost of goods sold excluding the economic

development project (line 4(a) less line 4(b)) .............

5. Total gross profits excluding the economic development

project (line 3 less line 4(c)). Enter the total on Schedule

LLET(K), Section A, Column B, line 5 ...............................

Section B—Total from Kentucky Sources Excluding Economic

Development Project(s)

1. Kentucky gross receipts after returns and allowances .....

2. Economic development project’s Kentucky gross receipts

after returns and allowances .................................................

3. Kentucky

gross

receipts

excluding

the

economic

development project (line 1 less line 2). Enter the total on

Schedule LLET(K), Section A, Column A, line 3 .................

4 (a) Kentucky cost of goods sold .........................................

(b) Economic development project’s Kentucky cost of

goods sold .......................................................................

(c)

Kentucky cost of goods sold excluding the economic

development project (line 4(a) less line 4(b)) .............

5. Kentucky

gross

profits

excluding

the

economic

development project (line 3 less line 4(c)). Enter the total

on Schedule LLET(K), Section A, Column A, line 5 ...........

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2