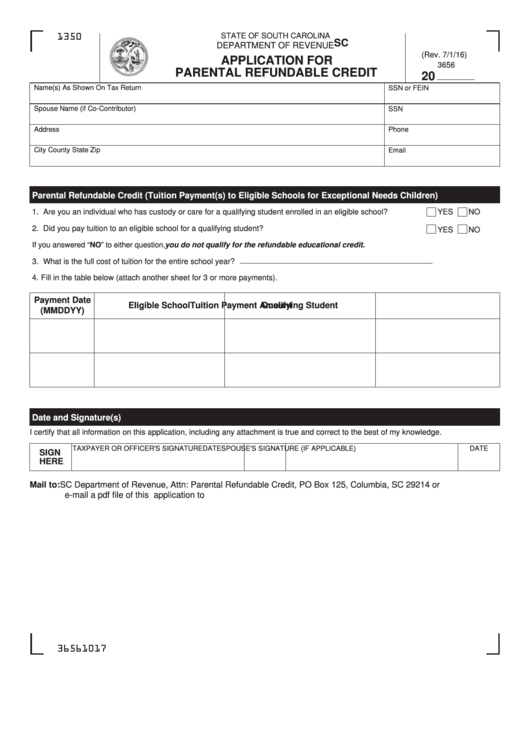

Form Sc Sch.tc-57a - Application For Parental Refundable Credit - South Carolina Department Of Revenue

ADVERTISEMENT

1350

STATE OF SOUTH CAROLINA

SC SCH.TC-57A

DEPARTMENT OF REVENUE

(Rev. 7/1/16)

APPLICATION FOR

3656

PARENTAL REFUNDABLE CREDIT

20

Name(s) As Shown On Tax Return

SSN or FEIN

Spouse Name (if Co-Contributor)

SSN

Address

Phone

City County State Zip

Email

Parental Refundable Credit (Tuition Payment(s) to Eligible Schools for Exceptional Needs Children)

YES

NO

1. Are you an individual who has custody or care for a qualifying student enrolled in an eligible school?

2. Did you pay tuition to an eligible school for a qualifying student?

YES

NO

If you answered “NO” to either question, you do not qualify for the refundable educational credit.

3. What is the full cost of tuition for the entire school year?

4. Fill in the table below (attach another sheet for 3 or more payments).

Payment Date

Eligible School

Qualifying Student

Tuition Payment Amount

(MMDDYY)

Date and Signature(s)

I certify that all information on this application, including any attachment is true and correct to the best of my knowledge.

TAXPAYER OR OFFICER'S SIGNATURE

DATE

SPOUSE'S SIGNATURE (IF APPLICABLE)

DATE

SIGN

HERE

Mail to: SC Department of Revenue,

Attn: Parental Refundable

Credit, PO Box 125, Columbia, SC 29214 or

e-mail a pdf file of this application to taxtech@dor.sc.gov.

36561017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1