Instructions For Form 6118 - Claim For Refund Of Tax Return Preparer And Promoter Penalties

ADVERTISEMENT

2

Form 6118 (Rev. 4-2017)

Page

General Instructions

If you are self-employed or employed by another preparer or

promoter, enter your social security number. If you are the employer

of other preparers or promoters, enter your employer identification

Section references are to the Internal Revenue Code unless

number.

otherwise noted.

Type of Penalty

Future Developments

For item M (other penalties), enter the name of the penalty and the

For the latest information about developments related to Form 6118

corresponding Internal Revenue Code section.

and its instructions, such as legislation enacted after they were

published, go to

Additional Information

What's New. For tax years beginning after 2015, the penalty under

You may want to attach a copy of the penalty statements to your

section 6695(g) (type J) has been expanded to include failure to

claim. In addition to completing the form, you must give your

exercise due diligence in determining eligibility for, and/or amount

reasons for claiming a refund for each penalty listed. Identify each

of, the child tax credit, additional child tax credit, and /or American

penalty by its line number and write your explanation in the space

Opportunity tax credit.

below.

Purpose of Form

For additional information about refunds of preparer penalties,

see Regulations section 1.6696-1.

Use Form 6118 if you are a tax return preparer or a promoter and

want to claim a refund of preparer or promoter penalties you paid

Privacy Act and Paperwork Reduction Act Notice. We ask for the

but that you believe were incorrectly charged.

information on this form to carry out the Internal Revenue laws of

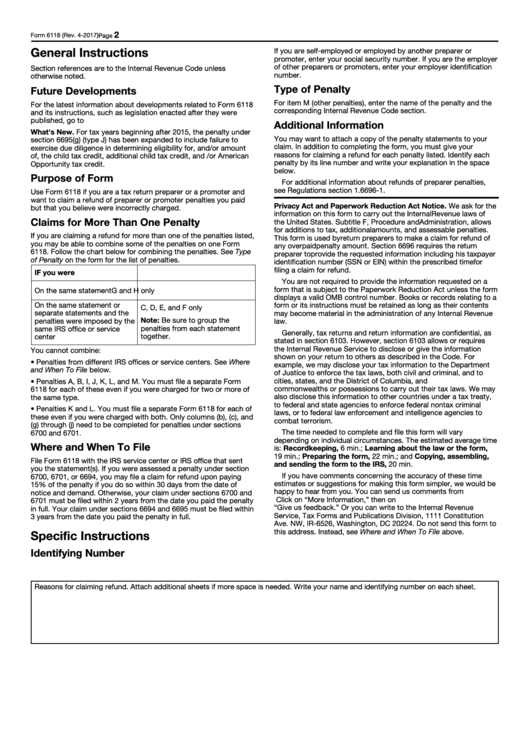

Claims for More Than One Penalty

the United States. Subtitle F, Procedure and Administration, allows

for additions to tax, additional amounts, and assessable penalties.

If you are claiming a refund for more than one of the penalties listed,

This form is used by return preparers to make a claim for refund of

you may be able to combine some of the penalties on one Form

any overpaid penalty amount. Section 6696 requires the return

6118. Follow the chart below for combining the penalties. See Type

preparer to provide the requested information including his taxpayer

of Penalty on the form for the list of penalties.

identification number (SSN or EIN) within the prescribed time for

filing a claim for refund.

IF you were billed...

THEN combine penalties...

You are not required to provide the information requested on a

form that is subject to the Paperwork Reduction Act unless the form

On the same statement

G and H only

displays a valid OMB control number. Books or records relating to a

On the same statement or

form or its instructions must be retained as long as their contents

C, D, E, and F only

separate statements and the

may become material in the administration of any Internal Revenue

Note: Be sure to group the

penalties were imposed by the

law.

penalties from each statement

same IRS office or service

Generally, tax returns and return information are confidential, as

together.

center

stated in section 6103. However, section 6103 allows or requires

the Internal Revenue Service to disclose or give the information

You cannot combine:

shown on your return to others as described in the Code. For

• Penalties from different IRS offices or service centers. See Where

example, we may disclose your tax information to the Department

and When To File below.

of Justice to enforce the tax laws, both civil and criminal, and to

cities, states, and the District of Columbia, and U.S.

• Penalties A, B, I, J, K, L, and M. You must file a separate Form

commonwealths or possessions to carry out their tax laws. We may

6118 for each of these even if you were charged for two or more of

also disclose this information to other countries under a tax treaty,

the same type.

to federal and state agencies to enforce federal nontax criminal

• Penalties K and L. You must file a separate Form 6118 for each of

laws, or to federal law enforcement and intelligence agencies to

these even if you were charged with both. Only columns (b), (c), and

combat terrorism.

(g) through (j) need to be completed for penalties under sections

The time needed to complete and file this form will vary

6700 and 6701.

depending on individual circumstances. The estimated average time

Where and When To File

is: Recordkeeping, 6 min.; Learning about the law or the form,

19 min.; Preparing the form, 22 min.; and Copying, assembling,

File Form 6118 with the IRS service center or IRS office that sent

and sending the form to the IRS, 20 min.

you the statement(s). If you were assessed a penalty under section

If you have comments concerning the accuracy of these time

6700, 6701, or 6694, you may file a claim for refund upon paying

estimates or suggestions for making this form simpler, we would be

15% of the penalty if you do so within 30 days from the date of

happy to hear from you. You can send us comments from

notice and demand. Otherwise, your claim under sections 6700 and

Click on “More Information,” then on

6701 must be filed within 2 years from the date you paid the penalty

“Give us feedback.” Or you can write to the Internal Revenue

in full. Your claim under sections 6694 and 6695 must be filed within

Service, Tax Forms and Publications Division, 1111 Constitution

3 years from the date you paid the penalty in full.

Ave. NW, IR-6526, Washington, DC 20224. Do not send this form to

this address. Instead, see Where and When To File above.

Specific Instructions

Identifying Number

Reasons for claiming refund. Attach additional sheets if more space is needed. Write your name and identifying number on each sheet.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1