Instructions For Maryland Form 500cr - Business Tax Credits - 1999

ADVERTISEMENT

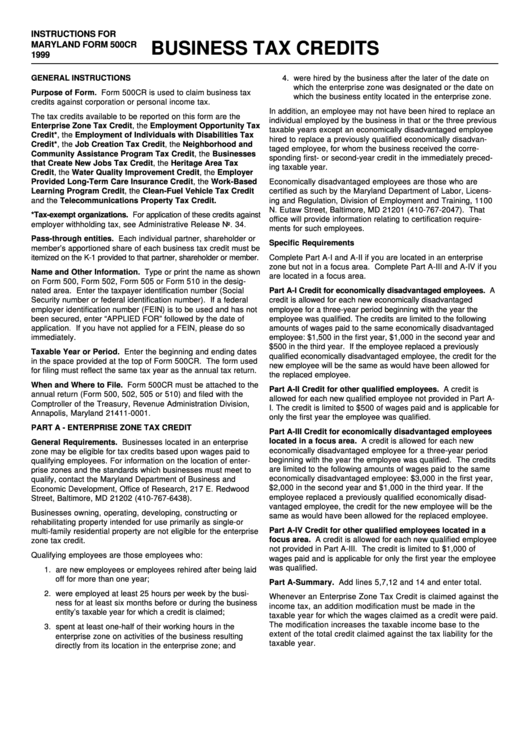

INSTRUCTIONS FOR

MARYLAND FORM 500CR

BUSINESS TAX CREDITS

1999

GENERAL INSTRUCTIONS

4. were hired by the business after the later of the date on

which the enterprise zone was designated or the date on

Purpose of Form. Form 500CR is used to claim business tax

which the business entity located in the enterprise zone.

credits against corporation or personal income tax.

In addition, an employee may not have been hired to replace an

The tax credits available to be reported on this form are the

individual employed by the business in that or the three previous

Enterprise Zone Tax Credit, the Employment Opportunity Tax

taxable years except an economically disadvantaged employee

Credit*, the Employment of Individuals with Disabilities Tax

hired to replace a previously qualified economically disadvan-

Credit*, the Job Creation Tax Credit, the Neighborhood and

taged employee, for whom the business received the corre-

Community Assistance Program Tax Credit, the Businesses

sponding first- or second-year credit in the immediately preced-

that Create New Jobs Tax Credit, the Heritage Area Tax

ing taxable year.

Credit, the Water Quality Improvement Credit, the Employer

Provided Long-Term Care Insurance Credit, the Work-Based

Economically disadvantaged employees are those who are

Learning Program Credit, the Clean-Fuel Vehicle Tax Credit

certified as such by the Maryland Department of Labor, Licens-

and the Telecommunications Property Tax Credit.

ing and Regulation, Division of Employment and Training, 1100

N. Eutaw Street, Baltimore, MD 21201 (410-767-2047). That

*Tax-exempt organizations. For application of these credits against

office will provide information relating to certification require-

employer withholding tax, see Administrative Release No. 34.

ments for such employees.

Pass-through entities. Each individual partner, shareholder or

Specific Requirements

member’s apportioned share of each business tax credit must be

itemized on the K-1 provided to that partner, shareholder or member.

Complete Part A-I and A-II if you are located in an enterprise

zone but not in a focus area. Complete Part A-III and A-IV if you

Name and Other Information. Type or print the name as shown

are located in a focus area.

on Form 500, Form 502, Form 505 or Form 510 in the desig-

nated area. Enter the taxpayer identification number (Social

Part A-I Credit for economically disadvantaged employees. A

Security number or federal identification number). If a federal

credit is allowed for each new economically disadvantaged

employer identification number (FEIN) is to be used and has not

employee for a three-year period beginning with the year the

been secured, enter “APPLIED FOR” followed by the date of

employee was qualified. The credits are limited to the following

application. If you have not applied for a FEIN, please do so

amounts of wages paid to the same economically disadvantaged

immediately.

employee: $1,500 in the first year, $1,000 in the second year and

$500 in the third year. If the employee replaced a previously

Taxable Year or Period. Enter the beginning and ending dates

qualified economically disadvantaged employee, the credit for the

in the space provided at the top of Form 500CR. The form used

new employee will be the same as would have been allowed for

for filing must reflect the same tax year as the annual tax return.

the replaced employee.

When and Where to File. Form 500CR must be attached to the

Part A-II Credit for other qualified employees. A credit is

annual return (Form 500, 502, 505 or 510) and filed with the

allowed for each new qualified employee not provided in Part A-

Comptroller of the Treasury, Revenue Administration Division,

I. The credit is limited to $500 of wages paid and is applicable for

Annapolis, Maryland 21411-0001.

only the first year the employee was qualified.

PART A - ENTERPRISE ZONE TAX CREDIT

Part A-III Credit for economically disadvantaged employees

located in a focus area. A credit is allowed for each new

General Requirements. Businesses located in an enterprise

economically disadvantaged employee for a three-year period

zone may be eligible for tax credits based upon wages paid to

beginning with the year the employee was qualified. The credits

qualifying employees. For information on the location of enter-

are limited to the following amounts of wages paid to the same

prise zones and the standards which businesses must meet to

economically disadvantaged employee: $3,000 in the first year,

qualify, contact the Maryland Department of Business and

$2,000 in the second year and $1,000 in the third year. If the

Economic Development, Office of Research, 217 E. Redwood

employee replaced a previously qualified economically disad-

Street, Baltimore, MD 21202 (410-767-6438).

vantaged employee, the credit for the new employee will be the

Businesses owning, operating, developing, constructing or

same as would have been allowed for the replaced employee.

rehabilitating property intended for use primarily as single-or

Part A-IV Credit for other qualified employees located in a

multi-family residential property are not eligible for the enterprise

focus area. A credit is allowed for each new qualified employee

zone tax credit.

not provided in Part A-III. The credit is limited to $1,000 of

Qualifying employees are those employees who:

wages paid and is applicable for only the first year the employee

was qualified.

1. are new employees or employees rehired after being laid

off for more than one year;

Part A-Summary. Add lines 5,7,12 and 14 and enter total.

2. were employed at least 25 hours per week by the busi-

Whenever an Enterprise Zone Tax Credit is claimed against the

ness for at least six months before or during the business

income tax, an addition modification must be made in the

entity’s taxable year for which a credit is claimed;

taxable year for which the wages claimed as a credit were paid.

The modification increases the taxable income base to the

3. spent at least one-half of their working hours in the

extent of the total credit claimed against the tax liability for the

enterprise zone on activities of the business resulting

taxable year.

directly from its location in the enterprise zone; and

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4