Form Ftb 3520 Instructions - Power Of Attorney Declaration For Administration Of Tax Matters - 1999

ADVERTISEMENT

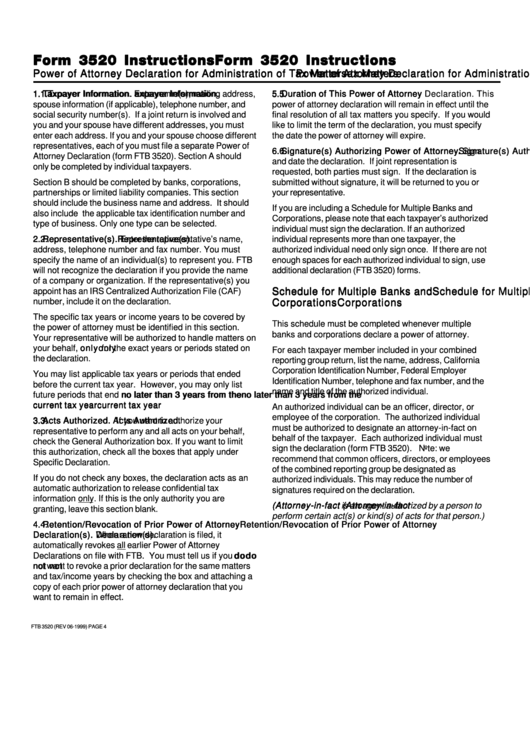

Form 3520 Instructions

Form 3520 Instructions

Form 3520 Instructions

Form 3520 Instructions

Form 3520 Instructions

Power of Attorney Declaration for Administration of T

Power of Attorney Declaration for Administration of T

Power of Attorney Declaration for Administration of Tax Matters

ax Matters

ax Matters

ax Matters

Power of Attorney Declaration for Administration of T

Power of Attorney Declaration for Administration of T

ax Matters

1. 1. 1. 1. 1. T T T T T axpayer Information.

axpayer Information.

axpayer Information.

5. 5. 5. 5. 5. Duration of This Power of Attorney Declaration.

Duration of This Power of Attorney Declaration.

Duration of This Power of Attorney Declaration.

axpayer Information.

axpayer Information. Enter name(s), mailing address,

Duration of This Power of Attorney Declaration.

Duration of This Power of Attorney Declaration. This

spouse information (if applicable), telephone number, and

power of attorney declaration will remain in effect until the

social security number(s). If a joint return is involved and

final resolution of all tax matters you specify. If you would

you and your spouse have different addresses, you must

like to limit the term of the declaration, you must specify

enter each address. If you and your spouse choose different

the date the power of attorney will expire.

representatives, each of you must file a separate Power of

6. 6. 6. 6. 6. Signature(s) Authorizing Power of Attorney

Signature(s) Authorizing Power of Attorney

Signature(s) Authorizing Power of Attorney

Signature(s) Authorizing Power of Attorney. . . . . Sign

Signature(s) Authorizing Power of Attorney

Attorney Declaration (form FTB 3520). Section A should

and date the declaration. If joint representation is

only be completed by individual taxpayers.

requested, both parties must sign. If the declaration is

Section B should be completed by banks, corporations,

submitted without signature, it will be returned to you or

partnerships or limited liability companies. This section

your representative.

should include the business name and address. It should

If you are including a Schedule for Multiple Banks and

also include the applicable tax identification number and

Corporations, please note that each taxpayer’s authorized

type of business. Only one type can be selected.

individual must sign the declaration. If an authorized

2. 2. 2. 2. 2. Representative(s).

Representative(s).

Representative(s).

Representative(s). Enter the representative’s name,

individual represents more than one taxpayer, the

Representative(s).

address, telephone number and fax number. You must

authorized individual need only sign once. If there are not

specify the name of an individual(s) to represent you. FTB

enough spaces for each authorized individual to sign, use

will not recognize the declaration if you provide the name

additional declaration (FTB 3520) forms.

of a company or organization. If the representative(s) you

Schedule for Multiple Banks and

Schedule for Multiple Banks and

Schedule for Multiple Banks and

Schedule for Multiple Banks and

Schedule for Multiple Banks and

appoint has an IRS Centralized Authorization File (CAF)

number, include it on the declaration.

Corporations

Corporations

Corporations

Corporations

Corporations

The specific tax years or income years to be covered by

This schedule must be completed whenever multiple

the power of attorney must be identified in this section.

banks and corporations declare a power of attorney.

Your representative will be authorized to handle matters on

only

only

your behalf, only

only

only for the exact years or periods stated on

For each taxpayer member included in your combined

the declaration.

reporting group return, list the name, address, California

Corporation Identification Number, Federal Employer

You may list applicable tax years or periods that ended

Identification Number, telephone and fax number, and the

before the current tax year. However, you may only list

name and title of the authorized individual.

future periods that end no later than 3 years from the

no later than 3 years from the

no later than 3 years from the

no later than 3 years from the

no later than 3 years from the

current tax year

current tax year

current tax year

current tax year

current tax year.

An authorized individual can be an officer, director, or

employee of the corporation. The authorized individual

3. 3. 3. 3. 3. Acts Authorized.

Acts Authorized.

Acts Authorized.

Acts Authorized.

Acts Authorized. If you want to authorize your

must be authorized to designate an attorney-in-fact on

representative to perform any and all acts on your behalf,

behalf of the taxpayer. Each authorized individual must

check the General Authorization box. If you want to limit

sign the declaration (form FTB 3520). Note: we

this authorization, check all the boxes that apply under

recommend that common officers, directors, or employees

Specific Declaration.

of the combined reporting group be designated as

If you do not check any boxes, the declaration acts as an

authorized individuals. This may reduce the number of

automatic authorization to release confidential tax

signatures required on the declaration.

information only. If this is the only authority you are

(Attorney-in-fact

(Attorney-in-fact

(Attorney-in-fact

(Attorney-in-fact

(Attorney-in-fact is an agent authorized by a person to

granting, leave this section blank.

perform certain act(s) or kind(s) of acts for that person.)

4. 4. 4. 4. 4. Retention/Revocation of Prior Power of Attorney

Retention/Revocation of Prior Power of Attorney

Retention/Revocation of Prior Power of Attorney

Retention/Revocation of Prior Power of Attorney

Retention/Revocation of Prior Power of Attorney

Declaration(s).

Declaration(s).

Declaration(s). When a new declaration is filed, it

Declaration(s).

Declaration(s).

automatically revokes all earlier Power of Attorney

d o

d o

Declarations on file with FTB. You must tell us if you d o

d o

d o

not

not

not want to revoke a prior declaration for the same matters

not

not

and tax/income years by checking the box and attaching a

copy of each prior power of attorney declaration that you

want to remain in effect.

FTB 3520 (REV 06-1999) PAGE 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1