Form Wv/sev-401c - Annual Coal Severance Tax Return - 1999

ADVERTISEMENT

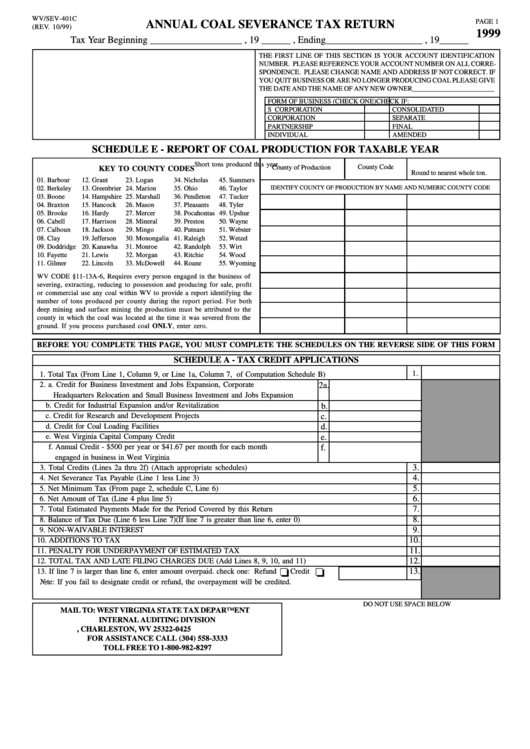

WV/SEV-401C

PAGE 1

ANNUAL COAL SEVERANCE TAX RETURN

(REV. 10/99)

1999

Tax Year Beginning ___________________ , 19 ______ , Ending____________________ , 19______

THE FIRST LINE OF THIS SECTION IS YOUR ACCOUNT IDENTIFICATION

NUMBER. PLEASE REFERENCE YOUR ACCOUNT NUMBER ON ALL CORRE-

SPONDENCE. PLEASE CHANGE NAME AND ADDRESS IF NOT CORRECT. IF

YOU QUIT BUSINESS OR ARE NO LONGER PRODUCING COAL PLEASE GIVE

THE DATE AND THE NAME OF ANY NEW OWNER________________________

FORM OF BUSINESS (CHECK ONE)

CHECK IF:

S CORPORATION

CONSOLIDATED

CORPORATION

SEPARATE

PARTNERSHIP

FINAL

INDIVIDUAL

AMENDED

SCHEDULE E - REPORT OF COAL PRODUCTION FOR TAXABLE YEAR

Short tons produced this year.

County Code

County of Production

KEY TO COUNTY CODES

Round to nearest whole ton.

01. Barbour

12. Grant

23. Logan

34. Nicholas

45. Summers

IDENTIFY COUNTY OF PRODUCTION BY NAME AND NUMERIC COUNTY CODE

02. Berkeley

13. Greenbrier

24. Marion

35. Ohio

46. Taylor

03. Boone

14. Hampshire

25. Marshall

36. Pendleton

47. Tucker

04. Braxton

15. Hancock

26. Mason

37. Pleasants

48. Tyler

05. Brooke

16. Hardy

27. Mercer

38. Pocahontas

49. Upshur

06. Cabell

17. Harrison

28. Mineral

39. Preston

50. Wayne

07. Calhoun

18. Jackson

29. Mingo

40. Putnam

51. Webster

08. Clay

19. Jefferson

30. Monongalia

41. Raleigh

52. Wetzel

09. Doddridge

20. Kanawha

31. Monroe

42. Randolph

53. Wirt

10. Fayette

21. Lewis

32. Morgan

43. Ritchie

54. Wood

11. Gilmer

22. Lincoln

33. McDowell

44. Roane

55. Wyoming

WV CODE §11-13A-6, Requires every person engaged in the business of

severing, extracting, reducing to possession and producing for sale, profit

or commercial use any coal within WV to provide a report identifying the

number of tons produced per county during the report period. For both

deep mining and surface mining the production must be attributed to the

county in which the coal was located at the time it was severed from the

ground. If you process purchased coal ONLY, enter zero.

BEFORE YOU COMPLETE THIS PAGE, YOU MUST COMPLETE THE SCHEDULES ON THE REVERSE SIDE OF THIS FORM

SCHEDULE A - TAX CREDIT APPLICATIONS

1.

1. Total Tax (From Line 1, Column 9, or Line 1a, Column 7, of Computation Schedule B)

2. a. Credit for Business Investment and Jobs Expansion, Corporate

2a.

Headquarters Relocation and Small Business Investment and Jobs Expansion

b. Credit for Industrial Expansion and/or Revitalization

b.

c. Credit for Research and Development Projects

c.

d. Credit for Coal Loading Facilities

d.

e. West Virginia Capital Company Credit

e.

f. Annual Credit - $500 per year or $41.67 per month for each month

f.

engaged in business in West Virginia

3.

3. Total Credits (Lines 2a thru 2f) (Attach appropriate schedules)

4.

4. Net Severance Tax Payable (Line 1 less Line 3)

5.

5. Net Minimum Tax (From page 2, schedule C, Line 6)

6.

6. Net Amount of Tax (Line 4 plus line 5)

7.

7. Total Estimated Payments Made for the Period Covered by this Return

8.

8. Balance of Tax Due (Line 6 less Line 7)(If line 7 is greater than line 6, enter 0)

9.

9. NON-WAIVABLE INTEREST

10.

10. ADDITIONS TO TAX

11.

11. PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX

12.

12. TOTAL TAX AND LATE FILING CHARGES DUE (Add Lines 8, 9, 10, and 11)

13.

13. If line 7 is larger than line 6, enter amount overpaid. check one: Refund

Credit

Note: If you fail to designate credit or refund, the overpayment will be credited.

DO NOT USE SPACE BELOW

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

INTERNAL AUDITING DIVISION

P.O. BOX 425, CHARLESTON, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333

TOLL FREE TO 1-800-982-8297

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2