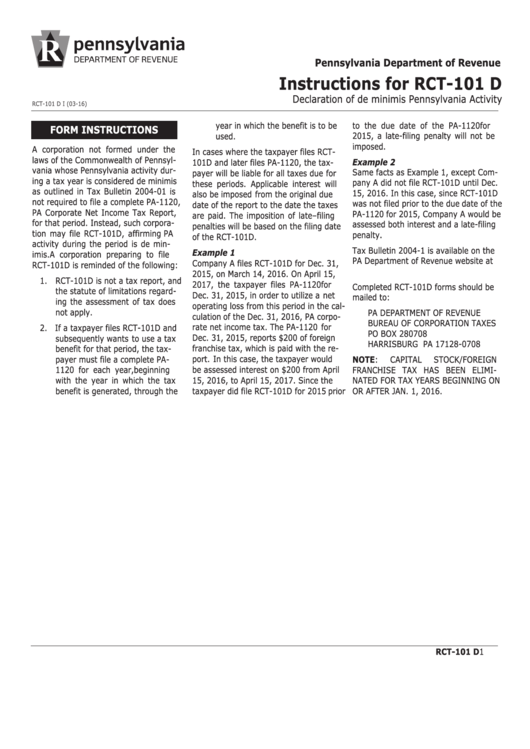

Instructions For Rct-101 D - Declaration Of De Minimis Pennsylvania Activity

ADVERTISEMENT

Pennsylvania Department of Revenue

Instructions for RCT-101 D

Declaration of de minimis Pennsylvania Activity

RCT-101 D I (03-16)

year in which the benefit is to be

to the due date of the PA-1120 for

FORM INSTRUCTIONS

2015, a late-filing penalty will not be

used.

imposed.

A corporation not formed under the

In cases where the taxpayer files RCT-

laws of the Commonwealth of Pennsyl-

Example 2

101D and later files PA-1120, the tax-

vania whose Pennsylvania activity dur-

Same facts as Example 1, except Com-

payer will be liable for all taxes due for

ing a tax year is considered de minimis

pany A did not file RCT-101D until Dec.

these periods. Applicable interest will

as outlined in Tax Bulletin 2004-01 is

15, 2016. In this case, since RCT-101D

also be imposed from the original due

not required to file a complete PA-1120,

was not filed prior to the due date of the

date of the report to the date the taxes

PA Corporate Net Income Tax Report,

PA-1120 for 2015, Company A would be

are paid. The imposition of late–filing

for that period. Instead, such corpora-

assessed both interest and a late-filing

penalties will be based on the filing date

tion may file RCT-101D, affirming PA

penalty.

of the RCT-101D.

activity during the period is de min-

Tax Bulletin 2004-1 is available on the

Example 1

imis. A corporation preparing to file

PA Department of Revenue website at

Company A files RCT-101D for Dec. 31,

RCT-101D is reminded of the following:

2015, on March 14, 2016. On April 15,

1. RCT-101D is not a tax report, and

2017, the taxpayer files PA-1120 for

Completed RCT-101D forms should be

the statute of limitations regard-

Dec. 31, 2015, in order to utilize a net

mailed to:

ing the assessment of tax does

operating loss from this period in the cal-

not apply.

PA DEPARTMENT OF REVENUE

culation of the Dec. 31, 2016, PA corpo-

BUREAU OF CORPORATION TAxES

rate net income tax. The PA-1120 for

2. If a taxpayer files RCT-101D and

PO BOx 280708

Dec. 31, 2015, reports $200 of foreign

subsequently wants to use a tax

HARRISBURg PA 17128-0708

franchise tax, which is paid with the re-

benefit for that period, the tax-

payer must file a complete PA-

port. In this case, the taxpayer would

NOTE:

CAPITAl

STOCk/FOREIgN

be assessed interest on $200 from April

1120 for each year, beginning

FRANCHISE TAx HAS BEEN ElIMI-

with the year in which the tax

15, 2016, to April 15, 2017. Since the

NATED FOR TAx yEARS BEgINNINg ON

benefit is generated, through the

taxpayer did file RCT-101D for 2015 prior

OR AFTER JAN. 1, 2016.

RCT-101 D

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1