2013 Credit For Educational Opportunity Worksheet - Maine Revenue Services

ADVERTISEMENT

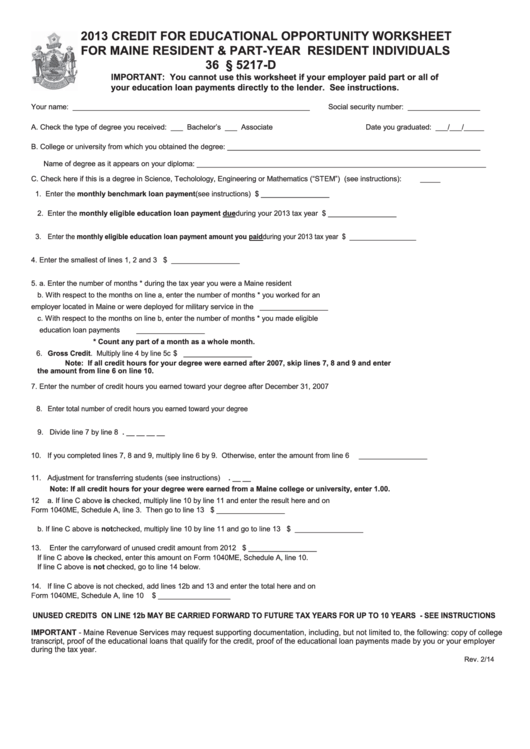

2013 CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET

FOR MAINE RESIDENT & PART-YEAR RESIDENT INDIVIDUALS

36 M.R.S.A. § 5217-D

IMPORTANT: You cannot use this worksheet if your employer paid part or all of

your education loan payments directly to the lender. See instructions.

Your name: ___________________________________________________________

Social security number: __________________

A. Check the type of degree you received: ___ Bachelor’s ___ Associate

Date you graduated: ___/___/_____

B. College or university from which you obtained the degree: _______________________________________________________________

Name of degree as it appears on your diploma: ________________________________________________________________________

C. Check here if this is a degree in Science, Techolology, Engineering or Mathematics (“STEM”) (see instructions):

_____

1. Enter the monthly benchmark loan payment (see instructions) ..................................................................... 1. $ _________________

2. Enter the monthly eligible education loan payment due during your 2013 tax year .................................... 2. $ _________________

3. Enter the monthly eligible education loan payment amount you paid during your 2013 tax year ............................. 3. $ __________________

4. Enter the smallest of lines 1, 2 and 3 .................................................................................................................4. $ _________________

5. a. Enter the number of months * during the tax year you were a Maine resident ............................................. 5a.

_________________

b. With respect to the months on line a, enter the number of months * you worked for an

employer located in Maine or were deployed for military service in the U.S. Armed Forces ..................... 5b.

_________________

c. With respect to the months on line b, enter the number of months * you made eligible

education loan payments ...........................................................................................................................

5c.

_________________

* Count any part of a month as a whole month.

6. Gross Credit. Multiply line 4 by line 5c ...............................................................................................................6. $ _________________

Note: If all credit hours for your degree were earned after 2007, skip lines 7, 8 and 9 and enter

the amount from line 6 on line 10.

7. Enter the number of credit hours you earned toward your degree after December 31, 2007 ............................ 7.

_________________

8. Enter total number of credit hours you earned toward your degree ........................................................................ 8.

_________________

9. Divide line 7 by line 8 .....................................................................................................................................

9.

__ . __ __ __ __

10. If you completed lines 7, 8 and 9, multiply line 6 by 9. Otherwise, enter the amount from line 6 .................

10.

_________________

11. Adjustment for transferring students (see instructions) .................................................................................

11.

__ . __ __

Note: If all credit hours for your degree were earned from a Maine college or university, enter 1.00.

12

a. If line C above is checked, multiply line 10 by line 11 and enter the result here and on

Form 1040ME, Schedule A, line 3. Then go to line 13 .............................................................................. 12a. $ _________________

b. If line C above is not checked, multiply line 10 by line 11 and go to line 13 ............................................. 12b. $ _________________

13. Enter the carryforward of unused credit amount from 2012 ..........................................................................

13. $ _________________

If line C above is checked, enter this amount on Form 1040ME, Schedule A, line 10.

If line C above is not checked, go to line 14 below.

14. If line C above is not checked, add lines 12b and 13 and enter the total here and on

Form 1040ME, Schedule A, line 10 ...............................................................................................................

14. $ __________________

UNUSED CREDITS ON LINE 12b MAY BE CARRIED FORWARD TO FUTURE TAX YEARS FOR UP TO 10 YEARS - SEE INSTRUCTIONS

IMPORTANT - Maine Revenue Services may request supporting documentation, including, but not limited to, the following: copy of college

transcript, proof of the educational loans that qualify for the credit, proof of the educational loan payments made by you or your employer

during the tax year.

Rev. 2/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1