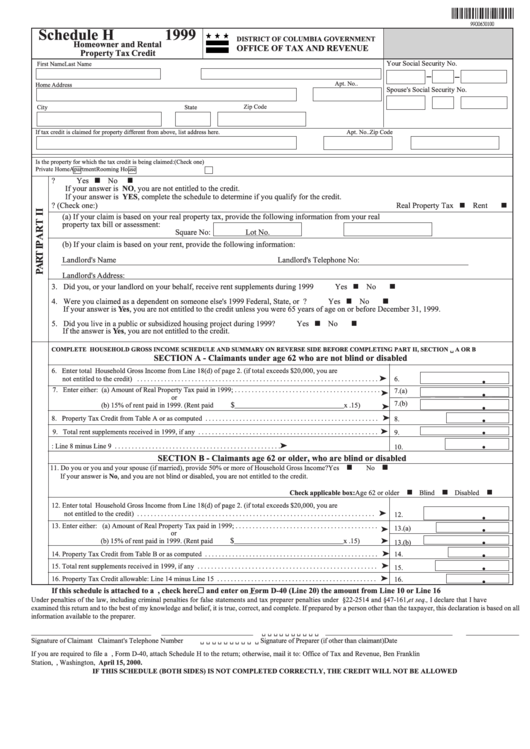

Schedule H - Homeowner And Rental Property Tax Credit - District Of Columbia Government, 1999

ADVERTISEMENT

Schedule H

1999

DISTRICT OF COLUMBIA GOVERNMENT

Homeowner and Rental

OFFICE OF TAX AND REVENUE

Property Tax Credit

Your Social Security No.

First Name

Last Name

Apt. No..

Home Address

Spouse's Social Security No.

Zip Code

City

State

If tax credit is claimed for property different from above, list address here.

Apt. No..

Zip Code

Is the property for which the tax credit is being claimed: (Check one)

Private Home

Apartment

Rooming House

1. Did you rent or own your home in the District for the entire calendar year 1999?

Yes

No

If your answer is NO, you are not entitled to the credit.

If your answer is YES, complete the schedule to determine if you qualify for the credit.

2. Is your credit claim based on real property tax or rent? (Check one:)

Real Property Tax

Rent

(a) If your claim is based on your real property tax, provide the following information from your real

property tax bill or assessment:

Square No:

Lot No.

(b) If your claim is based on your rent, provide the following information:

Landlord's Name

Landlord's Telephone No:

Landlord's Address:

3. Did you, or your landlord on your behalf, receive rent supplements during 1999

Yes

No

4. Were you claimed as a dependent on someone else's 1999 Federal, State, or D.C. Income Tax Return?

Yes

No

If your answer is Yes, you are not entitled to the credit unless you were 65 years of age on or before December 31, 1999.

5. Did you live in a public or subsidized housing project during 1999?

Yes

No

If the answer is Yes, you are not entitled to the credit.

COMPLETE HOUSEHOLD GROSS INCOME SCHEDULE AND SUMMARY ON REVERSE SIDE BEFORE COMPLETING PART II, SECTION A OR B

SECTION A - Claimants under age 62 who are not blind or disabled

6. Enter total Household Gross Income from Line 18(d) of page 2. (if total exceeds $20,000, you are

.

not entitled to the credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

.

7. Enter either: (a) Amount of Real Property Tax paid in 1999; . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.(a)

or

.

7.(b)

$

(b) 15% of rent paid in 1999. (Rent paid

_______________________________x .15)

.

8. Property Tax Credit from Table A or as computed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

.

9. Total rent supplements received in 1999, if any . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

.

10. Property Tax Credit allowable: Line 8 minus Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

SECTION B - Claimants age 62 or older, who are blind or disabled

11. Do you or you and your spouse (if married), provide 50% or more of Household Gross Income? Yes

No

If your answer is No, and you are not blind or disabled, you are not entitled to the credit.

Check applicable box: Age 62 or older

Blind

Disabled

12. Enter total Household Gross Income from Line 18(d) of page 2. (if total exceeds $20,000, you are

.

not entitled to the credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

.

13. Enter either: (a) Amount of Real Property Tax paid in 1999; . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.(a)

or

.

$

(b) 15% of rent paid in 1999. (Rent paid

_______________________________x .15)

13.(b)

.

14. Property Tax Credit from Table B or as computed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

.

15. Total rent supplements received in 1999, if any . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

.

16. Property Tax Credit allowable: Line 14 minus Line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

If this schedule is attached to a D.C. Form D-40, check here

and enter on Form D-40 (Line 20) the amount from Line 10 or Line 16

Under penalties of the law, including criminal penalties for false statements and tax preparer penalties under D.C. Code §22-2514 and §47-161, et seq., I declare that I have

examined this return and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by a person other than the taxpayer, this declaration is based on all

information available to the preparer.

__________________________________

__________________________

____________________________________

_______________

Signature of Claimant

Claimant's Telephone Number

Signature of Preparer (if other than claimant)

Date

If you are required to file a D.C. Individual Income Tax Return, Form D-40, attach Schedule H to the return; otherwise, mail it to: Office of Tax and Revenue, Ben Franklin

Station, P.O. Box 7861, Washington, D.C. 20044-7861. on or before April 15, 2000.

IF THIS SCHEDULE (BOTH SIDES) IS NOT COMPLETED CORRECTLY, THE CREDIT WILL NOT BE ALLOWED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2