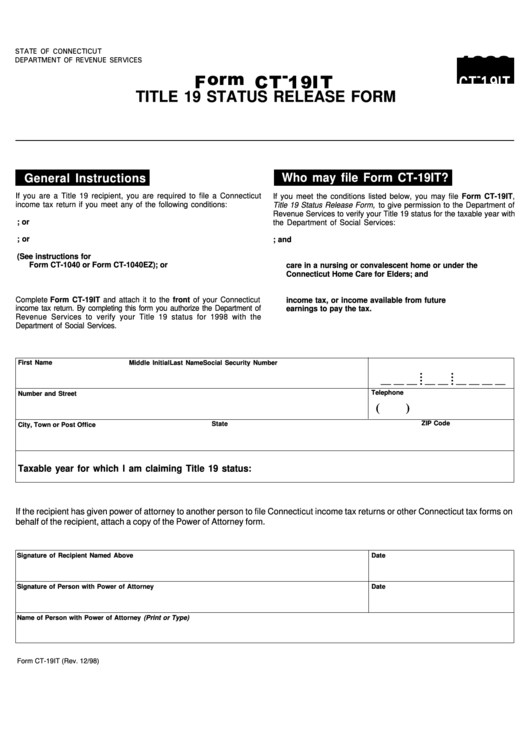

TITLE 19 STATUS RELEASE FORM

Who may file Form CT-19IT?

General Instructions

If you are a Title 19 recipient, you are required to file a Connecticut

If you meet the conditions listed below, you may file Form CT-19IT,

income tax return if you meet any of the following conditions:

Title 19 Status Release Form, to give permission to the Department of

Revenue Services to verify your Title 19 status for the taxable year with

1. You had Connecticut income taxes withheld; or

the Department of Social Services:

2. You made estimated tax payments to Connecticut; or

1. You were a Title 19 recipient during the taxable year; and

3. You meet the Gross Income Test (See instructions for

2. Medicaid assisted in the payment of your long-term

Form CT-1040 or Form CT-1040EZ); or

care in a nursing or convalescent home or under the

Connecticut Home Care for Elders; and

4. You had a federal alternative minimum tax liability.

3. You do not have the funds to pay your Connecticut

Complete Form CT-19IT and attach it to the front of your Connecticut

income tax, or income available from future

income tax return. By completing this form you authorize the Department of

earnings to pay the tax.

Revenue Services to verify your Title 19 status for 1998 with the

Department of Social Services.

First Name

Last Name

Social Security Number

Middle Initial

•

•

•

•

__ __ __ __ __ __ __ __ __

•

•

•

•

Telephone

Number and Street

(

)

ZIP Code

State

City, Town or Post Office

Taxable year for which I am claiming Title 19 status:

If the recipient has given power of attorney to another person to file Connecticut income tax returns or other Connecticut tax forms on

behalf of the recipient, attach a copy of the Power of Attorney form.

Signature of Recipient Named Above

Date

Signature of Person with Power of Attorney

Date

Name of Person with Power of Attorney (Print or Type)

Form CT-19IT (Rev. 12/98)

1

1