Schedule Tc-56 - Angel Investor Credit - South Carolina Department Of Revenue

ADVERTISEMENT

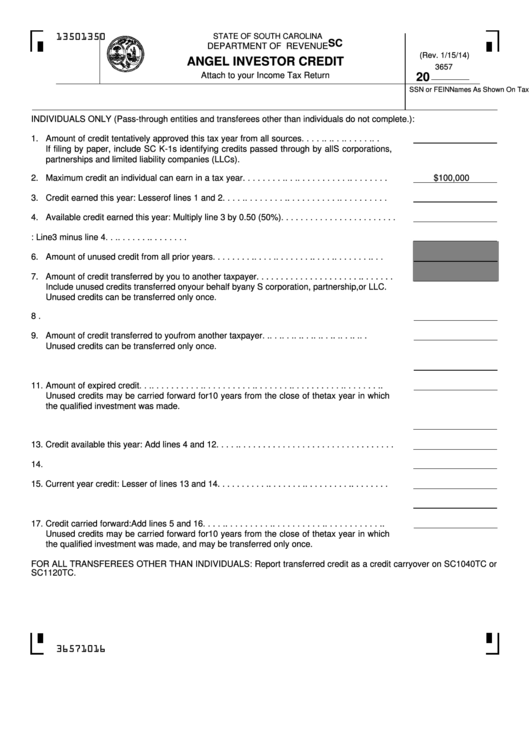

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-56

DEPARTMENT OF REVENUE

(Rev. 1/15/14)

ANGEL INVESTOR CREDIT

3657

Attach to your Income Tax Return

20

Names As Shown On Tax Return

SSN or FEIN

INDIVIDUALS ONLY (Pass-through entities and transferees other than individuals do not complete.):

1.

Amount of credit tentatively approved this tax year from all sources. . . . . . . . . . . . . . . . . .

If filing by paper, include SC K-1s identifying credits passed through by all S corporations,

partnerships and limited liability companies (LLCs).

2.

Maximum credit an individual can earn in a tax year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$100,000

3.

Credit earned this year: Lesser of lines 1 and 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Available credit earned this year: Multiply line 3 by 0.50 (50%). . . . . . . . . . . . . . . . . . . . . . . .

5. Credit earned this year but not available this year: Line 3 minus line 4. . . . . . . . . . . . . . . . . .

6.

Amount of unused credit from all prior years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Amount of credit transferred by you to another taxpayer. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Include unused credits transferred on your behalf by any S corporation, partnership, or LLC.

Unused credits can be transferred only once.

8. Line 6 minus line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Amount of credit transferred to you from another taxpayer. . . . . . . . . . . . . . . . . . . . . . . . . . .

Unused credits can be transferred only once.

10. Add lines 8 and 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

Amount of expired credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unused credits may be carried forward for 10 years from the close of the tax year in which

the qualified investment was made.

12. Line 10 minus line 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Credit available this year: Add lines 4 and 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

Current year tax liability. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Current year credit: Lesser of lines 13 and 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Line 13 minus line 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Credit carried forward: Add lines 5 and 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unused credits may be carried forward for 10 years from the close of the tax year in which

the qualified investment was made, and may be transferred only once.

FOR ALL TRANSFEREES OTHER THAN INDIVIDUALS: Report transferred credit as a credit carryover on SC1040TC or

SC1120TC.

36571016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1