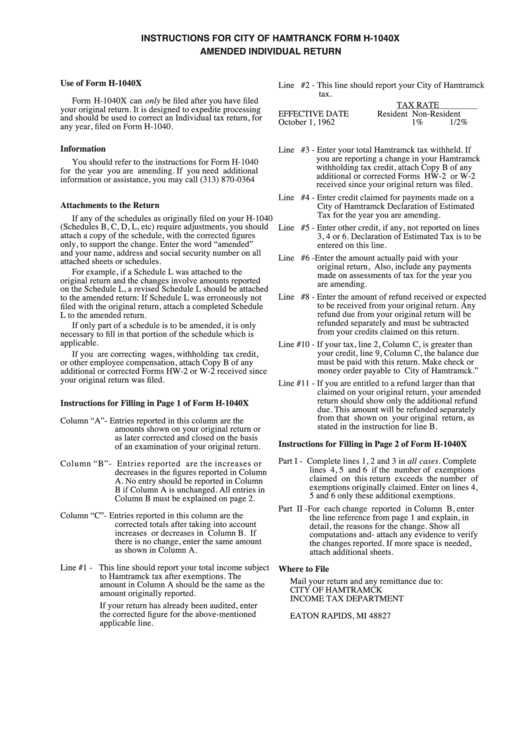

Instructions For City Of Hamtranck Form H-1040x Amended Individual Return

ADVERTISEMENT

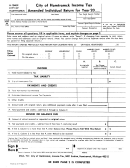

INSTRUCTIONS FOR CITY OF HAMTRANCK FORM H-1040X

AMENDED INDIVIDUAL RETURN

Use of Form H-1040X

Line #2 - This line should report your City of Hamtramck

tax.

Form H-1040X can only be filed after you have filed

TAX RATE

your original return. It is designed to expedite processing

EFFECTIVE DATE

Resident Non-Resident

and should be used to correct an Individual tax return, for

October 1, 1962

1%

1/2%

any year, filed on Form H-1040.

Information

Line #3 - Enter your total Hamtramck tax withheld. If

you are reporting a change in your Hamtramck

You should refer to the instructions for Form H-1040

withholding tax credit, attach Copy B of any

for the year you are amending. If you need additional

additional or corrected Forms HW-2 or W-2

information or assistance, you may call (313) 870-0364

received since your original return was filed.

Line #4 - Enter credit claimed for payments made on a

Attachments to the Return

City of Hamtramck Declaration of Estimated

Tax for the year you are amending.

If any of the schedules as originally filed on your H-1040

(Schedules B, C, D, L, etc) require adjustments, you should

Line #5 - Enter other credit, if any, not reported on lines

attach a copy of the schedule, with the corrected figures

3, 4 or 6. Declaration of Estimated Tax is to be

only, to support the change. Enter the word “amended”

entered on this line.

and your name, address and social security number on all

Line #6 -Enter the amount actually paid with your

attached sheets or schedules.

original return, Also, include any payments

For example, if a Schedule L was attached to the

made on assessments of tax for the year you

original return and the changes involve amounts reported

are amending.

on the Schedule L, a revised Schedule L should be attached

Line #8 - Enter the amount of refund received or expected

to the amended return: If Schedule L was erroneously not

to be received from your original return. Any

filed with the original return, attach a completed Schedule

refund due from your original return will be

L to the amended return.

refunded separately and must be subtracted

If only part of a schedule is to be amended, it is only

from your credits claimed on this return.

necessary to fill in that portion of the schedule which is

applicable.

Line #10 - If your tax, line 2, Column C, is greater than

your credit, line 9, Column C, the balance due

If you are correcting wages, withholding tax credit,

must be paid with this return. Make check or

or other employee compensation, attach Copy B of any

money order payable to City of Hamtramck.”

additional or corrected Forms HW-2 or W-2 received since

your original return was filed.

Line #11 - If you are entitled to a refund larger than that

claimed on your original return, your amended

return should show only the additional refund

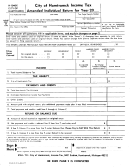

Instructions for Filling in Page 1 of Form H-1040X

due. This amount will be refunded separately

from that shown on your original return, as

Column “A”- Entries reported in this column are the

stated in the instruction for line B.

amounts shown on your original return or

as later corrected and closed on the basis

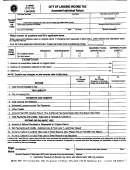

Instructions for Filling in Page 2 of Form H-1040X

of an examination of your original return.

Part I - Complete lines 1, 2 and 3 in all cases. Complete

Column “B”- Entries reported are the increases or

lines 4, 5 and 6 if the number of exemptions

decreases in the figures reported in Column

claimed on this return exceeds the number of

A. No entry should be reported in Column

exemptions originally claimed. Enter on lines 4,

B if Column A is unchanged. All entries in

5 and 6 only these additional exemptions.

Column B must be explained on page 2.

Part II -For each change reported in Column B, enter

Column “C”- Entries reported in this column are the

the line reference from page 1 and explain, in

corrected totals after taking into account

detail, the reasons for the change. Show all

increases or decreases in Column B. If

computations and- attach any evidence to verify

there is no change, enter the same amount

the changes reported. If more space is needed,

as shown in Column A.

attach additional sheets.

Line #1 - This line should report your total income subject

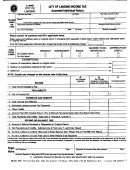

Where to File

to Hamtramck tax after exemptions. The

Mail your return and any remittance due to:

amount in Column A should be the same as the

CITY OF HAMTRAMCK

amount originally reported.

INCOME TAX DEPARTMENT

If your return has already been audited, enter

P.O. BOX 209

the corrected figure for the above-mentioned

EATON RAPIDS, MI 48827

applicable line.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1