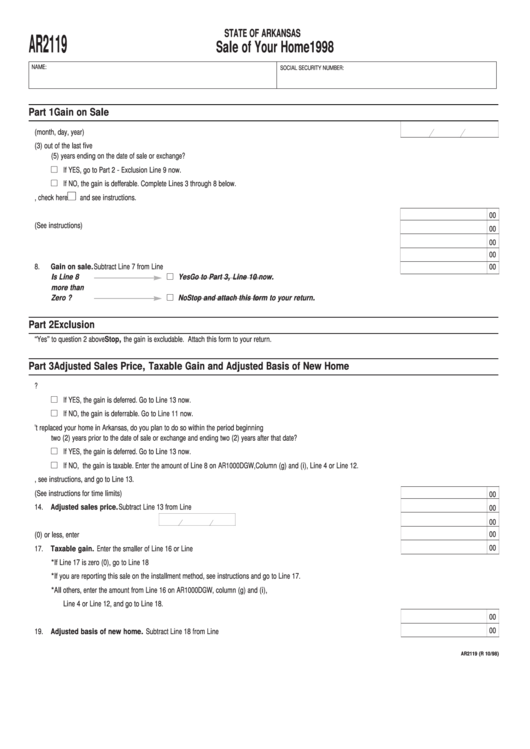

STATE OF ARKANSAS

AR2119

Sale of Your Home

1998

NAME:

SOCIAL SECURITY NUMBER:

Part 1

Gain on Sale

1.

Date that your former main home was sold (month, day, year) .........................................................................................

1.

2.

Did you own and use this property as your principle residence for three (3) out of the last five

(5) years ending on the date of sale or exchange?

If YES, go to Part 2 - Exclusion Line 9 now.

If NO, the gain is defferable. Complete Lines 3 through 8 below.

3.

If any part of your main home was ever rented or used for business, check here

and see instructions.

4.

Selling price of home. Do not include personal property items you sold with your home. ................................................

4.

00

5.

Expense of sale. (See instructions). ...................................................................................................................................

5.

00

6.

Subtract Line 5 from Line 4. ..............................................................................................................................................

6.

00

7.

Adjusted basis of home sold..............................................................................................................................................

7.

00

8.

Gain on sale. Subtract Line 7 from Line 6......................................................................................................................

8.

00

Is Line 8

Yes

Go to Part 3, Line 10 now.

more than

Zero ?

No

Stop and attach this form to your return.

Part 2

Exclusion

9.

If you answered “Yes” to question 2 above Stop, the gain is excludable. Attach this form to your return.

Part 3

Adjusted Sales Price, Taxable Gain and Adjusted Basis of New Home

10. Have you bought or built a new main home in Arkansas?

If YES, the gain is deferred. Go to Line 13 now.

If NO, the gain is deferrable. Go to Line 11 now.

11. If you haven’t replaced your home in Arkansas, do you plan to do so within the period beginning

two (2) years prior to the date of sale or exchange and ending two (2) years after that date?

If YES, the gain is deferred. Go to Line 13 now.

If NO, the gain is taxable. Enter the amount of Line 8 on AR1000DGW,Column (g) and (i), Line 4 or Line 12.

12. If you are reporting this sale on the installment method, see instructions, and go to Line 13.

13. Fixing-up expenses. (See instructions for time limits).......................................................................................................

13.

00

14. Adjusted sales price. Subtract Line 13 from Line 6. ....................................................................................................

14.

00

15a. Date you moved into your new home.

15b. Cost of new home.....................................

15b.

00

00

16. Subtract Line 15b from Line 14. If zero (0) or less, enter -0-.............................................................................................

16.

00

17. Taxable gain. Enter the smaller of Line 16 or Line 8. ....................................................................................................

17.

*

If Line 17 is zero (0), go to Line 18

*

If you are reporting this sale on the installment method, see instructions and go to Line 17.

*

All others, enter the amount from Line 16 on AR1000DGW, column (g) and (i),

Line 4 or Line 12, and go to Line 18.

00

18. Deferred gain. Subtract Line 17 from Line 8. .....................................................................................................................

18.

00

19. Adjusted basis of new home. Subtract Line 18 from Line 15b...................................................................................

19.

AR2119 (R 10/98)

1

1