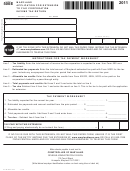

2000 Application for Extension

CD-419

4

Web-Fill

Franchise and Corporate Income Tax

12 - 00

PRINT

CLEAR

North Carolina Department of Revenue

CD-419 is the only acceptable form to be used by corporations requesting an extension of time to file a franchise and

corporate income tax return in this State. A copy of your federal extension is not a valid North Carolina extension.

North Carolina does not recognize or accept the federal extension. An automatic seven (7) month extension will be

granted if you properly complete this form and timely file it by the due date of the return to which the extension applies.

Returns are due on or before the 15

day of the third month following the close of the taxable year except for certain nonprofit

th

entities and cooperatives. Failure to pay the full amount of tax by the original due date of the return will result in the

assessment of interest and late payment penalties as provided by statute. Pay in U.S. currency.

Do not cut applications from this form.

Application for Extension

Franchise Tax

North Carolina Department of Revenue

Beginning Tax Year (MM-DD-YY)

Ending Tax Year (MM-DD-YY)

Federal Employer ID Number

N.C. Secretary of State ID Number

$

1. Total Franchise Tax Due

Legal Name (First 24 Characters) USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS

with this Application

Minimum Tax $35.00

Address

Send full amount of tax due with this application. Application only extends

City

State

Zip Code (5 Digit)

the time allowed to file the return and does not extend the time allowed to

pay the tax. Application for extension of franchise tax not applicable to

nonprofit entities and cooperatives or mutual associations.

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

CD-419

Title:

Web-Fill

MAIL TO: P.O. Box 25000, Raleigh, N.C. 27640-0520

12 - 00

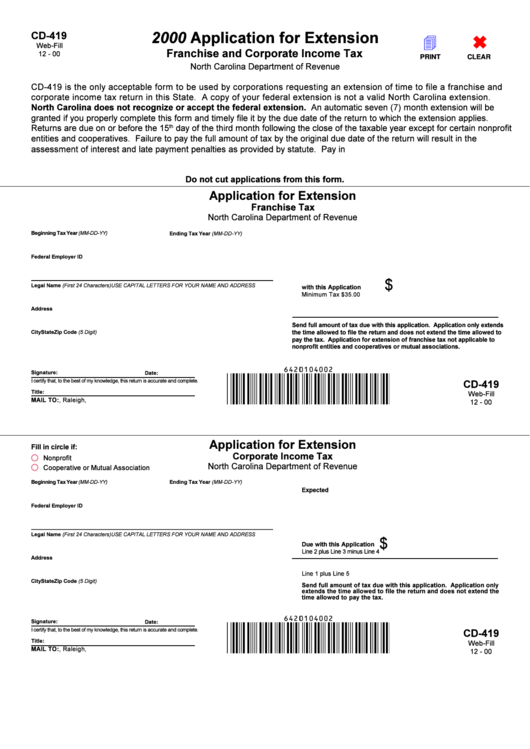

Application for Extension

Fill in circle if:

Corporate Income Tax

Nonprofit

North Carolina Department of Revenue

Cooperative or Mutual Association

Beginning Tax Year (MM-DD-YY)

Ending Tax Year (MM-DD-YY)

2. Total Corporate Income Tax

Expected

3. Annual Report Fee

Federal Employer ID Number

N.C. Secretary of State ID Number

4. Estimated Income Tax Payments

Legal Name (First 24 Characters) USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS

5. Total Corporate Income Tax

$

Due with this Application

Line 2 plus Line 3 minus Line 4

Address

6. Amount of Enclosed Check

Line 1 plus Line 5

City

State

Zip Code (5 Digit)

Send full amount of tax due with this application. Application only

extends the time allowed to file the return and does not extend the

time allowed to pay the tax.

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

CD-419

Title:

Web-Fill

MAIL TO: P.O. Box 25000, Raleigh, N.C. 27640-0520

12 - 00

1

1