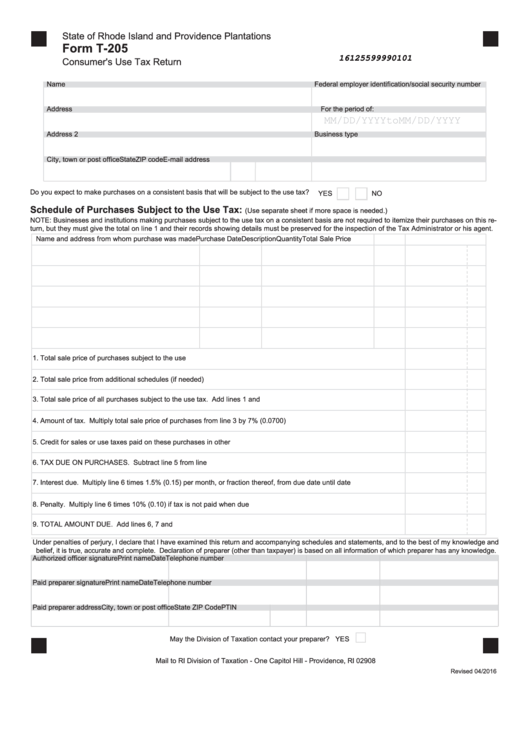

State of Rhode Island and Providence Plantations

Form T-205

16125599990101

Consumer's Use Tax Return

Name

Federal employer identification/social security number

Address

For the period of:

MM/DD/YYYY to MM/DD/YYYY

Address 2

Business type

City, town or post office

State

ZIP code

E-mail address

Do you expect to make purchases on a consistent basis that will be subject to the use tax?

YES

NO

Schedule of Purchases Subject to the Use Tax:

(Use separate sheet if more space is needed.)

NOTE: Businesses and institutions making purchases subject to the use tax on a consistent basis are not required to itemize their purchases on this re-

turn, but they must give the total on line 1 and their records showing details must be preserved for the inspection of the Tax Administrator or his agent.

Name and address from whom purchase was made

Purchase Date

Description

Quantity

Total Sale Price

1. Total sale price of purchases subject to the use tax............................................................................................................

2. Total sale price from additional schedules (if needed) .........................................................................................................

3. Total sale price of all purchases subject to the use tax. Add lines 1 and 2 .........................................................................

4. Amount of tax. Multiply total sale price of purchases from line 3 by 7% (0.0700)...............................................................

5. Credit for sales or use taxes paid on these purchases in other states ................................................................................

6. TAX DUE ON PURCHASES. Subtract line 5 from line 4 ....................................................................................................

7. Interest due. Multiply line 6 times 1.5% (0.15) per month, or fraction thereof, from due date until date paid.....................

8. Penalty. Multiply line 6 times 10% (0.10) if tax is not paid when due .................................................................................

9. TOTAL AMOUNT DUE. Add lines 6, 7 and 8......................................................................................................................

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature

Print name

Date

Telephone number

Paid preparer signature

Print name

Date

Telephone number

Paid preparer address

City, town or post office

State

ZIP Code

PTIN

May the Division of Taxation contact your preparer? YES

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908

Revised 04/2016

1

1 2

2