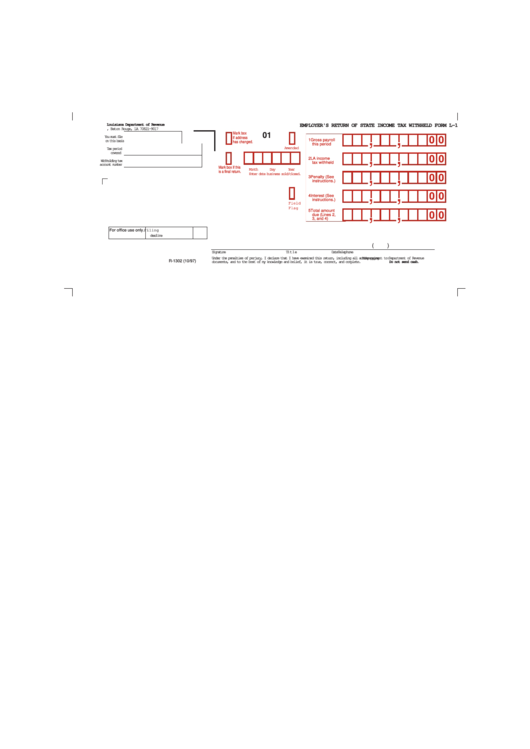

Form L-1 - Employer'S Return Of State Income Tax Withheld - Louisiana Department Of Revenue

ADVERTISEMENT

Louisiana Department of Revenue

EMPLOYER'S RETURN OF STATE INCOME TAX WITHHELD FORM L-1

P.O. Box 91017, Baton Rouge, LA 70821-9017

,

,

Mark box

01

You must file

if address

0 0

1 Gross payroll

on this basis

has changed.

this period

Amended

Tax period

,

,

covered

0 0

2 LA income

Withholding tax

tax withheld

account number

Mark box if this

Month

Day

Y e a r

,

,

is a final return.

E n t e r d a t e b u s i n e s s s o l d / c l o s e d .

0 0

3 Penalty (See

instructions.)

,

,

0 0

4 Interest (See

instructions.)

F i e l d

,

,

F l a g

5 Total amount

0 0

due (Lines 2,

3, and 4)

For office use only.

F i l i n g

d e a d l i n e

(

)

S i g n a t u r e

T i t l e

D a t e

Telephone

U n d e r t h e p e n a l t i e s o f p e r j u r y , I d e c l a r e t h a t I h a v e e x a m i n e d t h i s r e t u r n , i n c l u d i n g a l l a c c o m p a n y i n g

Make payment to: Department of Revenue

R-1302 (10/97)

documents, and to the best of my knowledge and belief, it is true, correct, and complete.

Do not send cash.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1