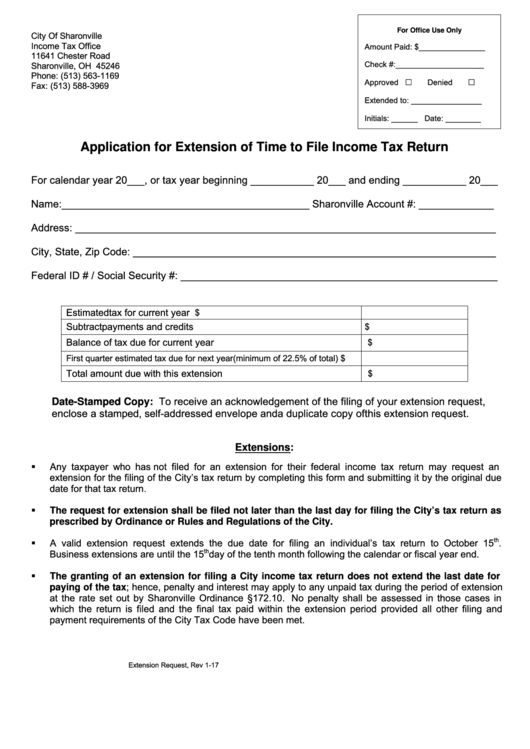

For Office Use Only

City Of Sharonville

Income Tax Office

Amount Paid: $_______________

11641 Chester Road

Check #:____________________

Sharonville, OH 45246

Phone: (513) 563-1169

Approved

Denied

Fax: (513) 588-3969

Extended to: ________________

Initials: ______ Date: ________

Application for Extension of Time to File Income Tax Return

For calendar year 20___, or tax year beginning ___________ 20___ and ending ___________ 20___

Name: ___________________________________________ Sharonville Account #: _____________

Address: _________________________________________________________________________

City, State, Zip Code: _______________________________________________________________

Federal ID # / Social Security #: _______________________________________________________

Estimated tax for current year

$

Subtract payments and credits

$

Balance of tax due for current year

$

First quarter estimated tax due for next year (minimum of 22.5% of total)

$

Total amount due with this extension

$

Date-Stamped Copy: To receive an acknowledgement of the filing of your extension request,

enclose a stamped, self-addressed envelope and a duplicate copy of this extension request.

Extensions:

Any taxpayer who has not filed for an extension for their federal income tax return may request an

extension for the filing of the City’s tax return by completing this form and submitting it by the original due

date for that tax return.

The request for extension shall be filed not later than the last day for filing the City’s tax return as

prescribed by Ordinance or Rules and Regulations of the City.

th

A valid extension request extends the due date for filing an individual’s tax return to October 15

.

th

Business extensions are until the 15

day of the tenth month following the calendar or fiscal year end.

The granting of an extension for filing a City income tax return does not extend the last date for

paying of the tax; hence, penalty and interest may apply to any unpaid tax during the period of extension

at the rate set out by Sharonville Ordinance §172.10. No penalty shall be assessed in those cases in

which the return is filed and the final tax paid within the extension period provided all other filing and

payment requirements of the City Tax Code have been met.

Extension Request, Rev 1-17

1

1