Instructions For Completing Form Mo-941 - Employer'S Withholding Tax

ADVERTISEMENT

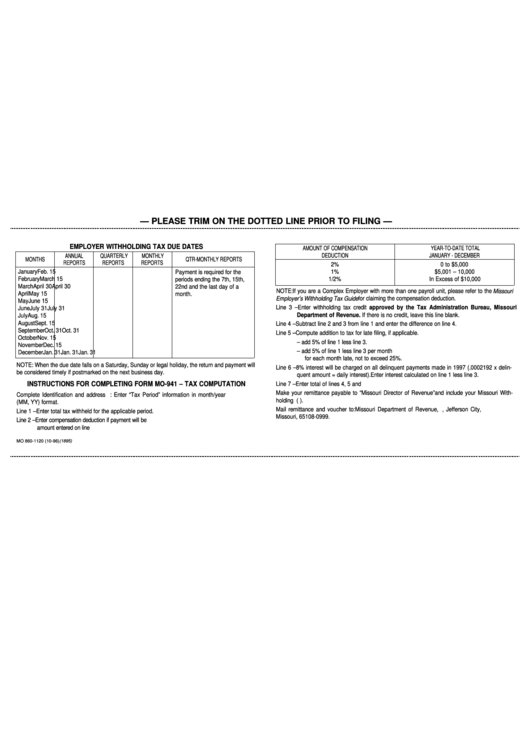

— PLEASE TRIM ON THE DOTTED LINE PRIOR TO FILING —

EMPLOYER WITHHOLDING TAX DUE DATES

AMOUNT OF COMPENSATION

YEAR-TO-DATE TOTAL

ANNUAL

QUARTERLY

MONTHLY

DEDUCTION

JANUARY - DECEMBER

MONTHS

QTR-MONTHLY REPORTS

REPORTS

REPORTS

REPORTS

2%

0 to $5,000

January

Feb. 15

1%

$5,001 – 10,000

Payment is required for the

February

March 15

periods ending the 7th, 15th,

1/2%

In Excess of $10,000

March

April 30

April 30

22nd and the last day of a

NOTE: If you are a Complex Employer with more than one payroll unit, please refer to the Missouri

April

May 15

month.

Employer’s Withholding Tax Guide for claiming the compensation deduction.

May

June 15

Line 3 – Enter withholding tax credit approved by the Tax Administration Bureau, Missouri

June

July 31

July 31

Department of Revenue. If there is no credit, leave this line blank.

July

Aug. 15

August

Sept. 15

Line 4 – Subtract line 2 and 3 from line 1 and enter the difference on line 4.

September

Oct. 31

Oct. 31

Line 5 – Compute addition to tax for late filing, if applicable.

October

Nov. 15

A. For failure to pay withholding by the due date – add 5% of line 1 less line 3.

November

Dec. 15

B. For failure to file your MO-941 by the due date – add 5% of line 1 less line 3 per month

December

Jan. 31

Jan. 31

Jan. 31

for each month late, not to exceed 25%.

NOTE: When the due date falls on a Saturday, Sunday or legal holiday, the return and payment will

Line 6 – 8% interest will be charged on all delinquent payments made in 1997 (.0002192 x delin-

be considered timely if postmarked on the next business day.

quent amount = daily interest). Enter interest calculated on line 1 less line 3.

INSTRUCTIONS FOR COMPLETING FORM MO-941 – TAX COMPUTATION

Line 7 – Enter total of lines 4, 5 and 6. This is the total amount to be remitted.

Make your remittance payable to “Missouri Director of Revenue” and include your Missouri With-

Complete Identification and address block. NOTE: Enter “Tax Period” information in month/year

holding I.D. number in the lower left area of your check (U.S. Funds Only).

(MM, YY) format.

Mail remittance and voucher to: Missouri Department of Revenue, P.O. Box 999, Jefferson City,

Line 1 – Enter total tax withheld for the applicable period.

Missouri, 65108-0999.

Line 2 – Enter compensation deduction if payment will be timely. Compensation should be taken on the

amount entered on line 1. Government agencies may not take the compensation deduction.

MO 860-1120 (10-96) (1895)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1