Form It-65 - Schedule In K-1 - Partner'S Share Of Indiana Adjusted Gross Income, Deductions, Modifications And Credits - 2004

ADVERTISEMENT

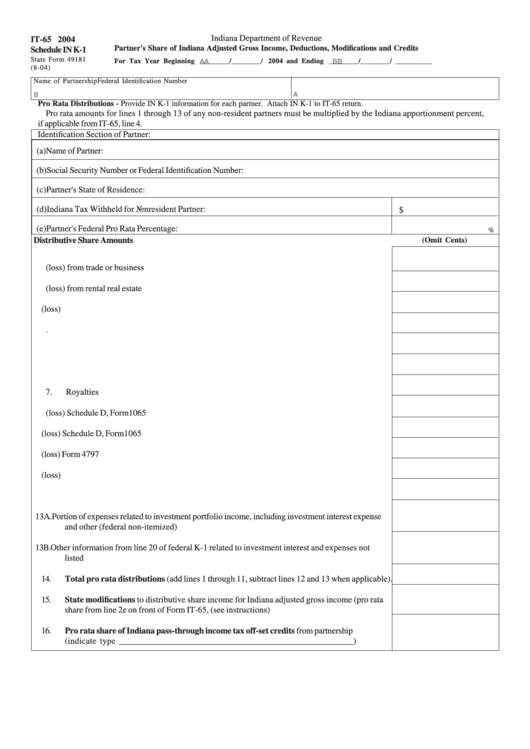

Indiana Department of Revenue

IT-65 2004

Partner's Share of Indiana Adjusted Gross Income, Deductions, Modifications and Credits

Schedule IN K-1

State Form 49181

For Tax Year Beginning

________/________/

2004 and Ending

________/________/ __________

AA

BB

(8-04)

Name of Partnership

Federal Identification Number

B

A

Pro Rata Distributions - Provide IN K-1 information for each partner. Attach IN K-1 to IT-65 return.

Pro rata amounts for lines 1 through 13 of any non-resident partners must be multiplied by the Indiana apportionment percent,

if applicable from IT-65, line 4.

Identification Section of Partner:

(a) Name of Partner:

(b) Social Security Number or Federal Identification Number:

(c) Partner's State of Residence:

(d) Indiana Tax Withheld for Nonresident Partner:

$

(e) Partner's Federal Pro Rata Percentage:

%

Distributive Share Amounts

(Omit Cents)

1.

Ordinary income (loss) from trade or business activities ...........................................................

2.

Income (loss) from rental real estate activities ............................................................................

3c.

Other net rental income (loss) .....................................................................................................

4.

Guaranteed payments to partner ................................................................................................

5.

Interest income ...........................................................................................................................

6a.

Ordinary dividends .....................................................................................................................

7.

Royalties .....................................................................................................................................

8.

Net short-term capital gain (loss) Schedule D, Form 1065 ..........................................................

9a.

Net long-term capital gain (loss) Schedule D, Form 1065 ...........................................................

10.

Net IRC Section 1231 gain (loss) Form 4797 ...............................................................................

11.

Other income (loss) ....................................................................................................................

12.

IRC Section 179 expense deduction ............................................................................................

13A.

Portion of expenses related to investment portfolio income, including investment interest expense

and other (federal non-itemized) deducations ............................................................................

13B.

Other information from line 20 of federal K-1 related to investment interest and expenses not

listed elsewhere ..........................................................................................................................

14.

Total pro rata distributions (add lines 1 through 11, subtract lines 12 and 13 when applicable).

15.

State modifications to distributive share income for Indiana adjusted gross income (pro rata

share from line 2e on front of Form IT-65, (see instructions) ......................................................

16.

Pro rata share of Indiana pass-through income tax off-set credits from partnership

(indicate type ____________________________________________________) ..............

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1