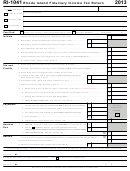

Form Ri-1041 - Rhode Island Fiduciary Income Tax Return - 2004 Page 4

ADVERTISEMENT

RI-1041

2004

FIDUCIARY ALTERNATIVE MINIMUM TAX

Name of Estate or Trust

Federal Identification Number

PART 1

ALTERNATIVE MINIMUM TAX

1.

1.

Federal Alternative Minimum Taxable Income from Federal Form 1041, Schedule I, line 29............................................................

2.

2.

Exemption - if line 1 is LESS than $75,000; enter $22,500. Otherwise, complete the exemption worksheet on page I-4 ...............

3.

3.

Subtract line 2 from line 1...................................................................................................................................................................

4.

If you figured the tax on RI-1041, Schedule D, complete part 2 and enter the amount from line 32 here. If you figured the tax

using the fiduciary tax rate schedule and line 3 is less than $175,000 then multiply line 3 by 6.5% (.065). Otherwise, multiply

line 3 by 7% (.07) and subtract $875 from the result.........................................................................................................................

4.

5.

5.

Alternative minimum tax foreign tax credit - Federal Form 1041, Schedule I, line 53...........................

25%

6.

RI Rate...................................................................................................................................................

6.

7.

Alternative minimum foreign tax credit - multiply line 5 by line 6.......................................................................................................

7.

8.

Tentative minimum tax - subtract line 7 from line 4............................................................................................................................

8.

9.

RI tax from RI-1041, page 1, line 8A......................................................................................................

9.

10.

Foreign tax credit from Federal Form 1041, Schedule G, line 2a.............

10.

25%

11.

RI Rate......................................................................................................

11.

12.

Multiply line 10 by line 11.......................................................................................................................

12.

13.

RI income tax less foreign tax credit - subtract line 12 from line 9.....................................................................................................

13.

14.

RI Alternative minimum tax - subtract line 13 from line 8

(If zero or less, enter

zero). Enter here and on RI-1041, page 1, line 9.

14.

PART 2

ALTERNATIVE MINIMUM TAX USING MAXIMUM CAPITAL GAINS RATES

15.

15.

Enter the amount from line 3 above....................................................................................................................................................

16.

Enter the amount from RI-1041, Schedule D, line 9

(As refigured for AMT, if

necessary).....................

16.

17.

Enter the amount from RI-1041, Schedule D, line 7

(As refigured for AMT, if

necessary).....................

17.

18.

A.

Add lines 16 and 17.......................................................................................................................

18A.

B.

Enter the amount from RI-1041, Schedule D, line 4

(As refigured for AMT, if

necessary)............ 18B.

C.

Enter the SMALLER of line 18A or line 18B.................................................................................. 18C.

19.

Enter the SMALLER of line 15 or line 18C......................................................................................................................................... 19.

20.

Subtract line 19 from line 15................................................................................................................................................................ 20.

21.

If line 20 is less than $175,000 then multiply line 20 by 6.5% (.065). Otherwise, multiply line 20 by 7% (.07) and subtract $875

21.

from the result.....................................................................................................................................................................................

22.

Enter the amount from RI-1041, Schedule D, line 16............................................................................

22.

23.

Enter the SMALLER of line 15 or line 16...............................................................................................

23.

24.

Enter the SMALLER of line 22 or line 23

(If zero, go to line

26)...........................................................

24.

25.

Multiply line 24 by 2.50% (.025)..........................................................................................................................................................

25.

26.

Subtract line 24 from line 23...................................................................................................................

26.

27.

27.

Multiply line 26 by 5.00% (.05)............................................................................................................................................................

IF LINE 17 IS ZERO OR BLANK, SKIP LINES 28 AND 29 AND GO TO LINE 30. OTHERWISE, GO TO LINE 28.

28.

28.

Subtract line 23 from line 19...................................................................................................................

29.

Multiply line 28 by 6.25% (.0625)........................................................................................................................................................

29.

30.

30.

Add lines 21, 25, 27 and 29................................................................................................................................................................

31.

If line 15 is less than $175,000 then multiply line 15 by 6.5% (.065). Otherwise, multiply line 15 by 7% (.07) and subtract $875

31.

from the result.....................................................................................................................................................................................

32.

Enter the SMALLER of lines 30 or 31 here and on line 4 above.......................................................................................................

32.

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4