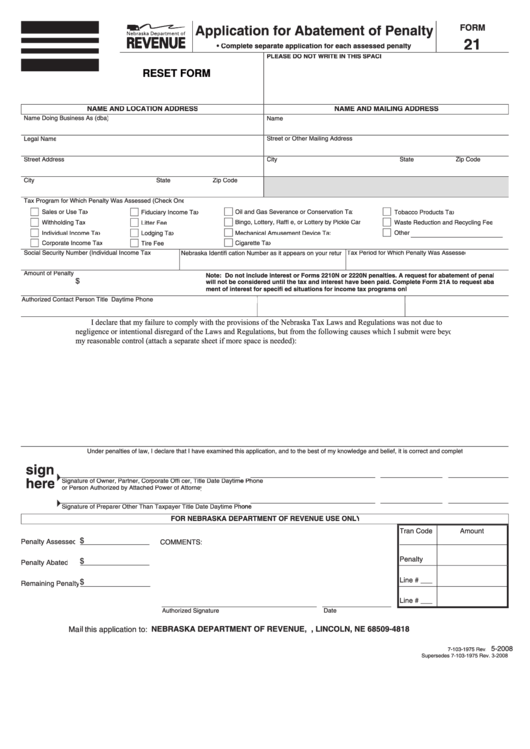

Application for Abatement of Penalty

FORM

21

• Complete separate application for each assessed penalty

PLEASE DO NOT WRITE IN THIS SPACE

RESET FORM

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Name Doing Business As (dba)

Name

Legal Name

Street or Other Mailing Address

City

Street Address

State

Zip Code

City

State

Zip Code

Tax Program for Which Penalty Was Assessed (Check One)

Sales or Use Tax

Fiduciary Income Tax

Oil and Gas Severance or Conservation Tax

Tobacco Products Tax

Withholding Tax

Litter Fee

Bingo, Lottery, Raffle, or Lottery by Pickle Card

Waste Reduction and Recycling Fee

Individual Income Tax

Lodging Tax

Mechanical Amusement Device Tax

Other

Corporate Income Tax

Cigarette Tax

Tire Fee

Social Security Number (Individual Income Tax)

Nebraska Identification Number as it appears on your return Tax Period for Which Penalty Was Assessed

Amount of Penalty

Note: Do not include interest or Forms 2210N or 2220N penalties. A request for abatement of penalty

$

will not be considered until the tax and interest have been paid. Complete Form 21A to request abate-

ment of interest for specified situations for income tax programs only.

Authorized Contact Person

Authorized Contact Person

Authorized Contact Person

Title

Title

Title

Daytime Phone

Daytime Phone

Daytime Phone

I declare that my failure to comply with the provisions of the Nebraska Tax Laws and Regulations was not due to

negligence or intentional disregard of the Laws and Regulations, but from the following causes which I submit were beyond

my reasonable control (attach a separate sheet if more space is needed):

Under penalties of law, I declare that I have examined this application, and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Owner, Partner, Corporate Officer,

Signature of Owner, Partner, Corporate Officer,

Signature of Owner, Partner, Corporate Officer,

Signature of Owner, Partner, Corporate Officer,

Title

Title

Title

Title

Date

Date

Date

Date

Daytime Phone

Daytime Phone

Daytime Phone

Daytime Phone

or Person Authorized by Attached Power of Attorney

Signature of Preparer Other Than Taxpayer

Signature of Preparer Other Than Taxpayer

Signature of Preparer Other Than Taxpayer

Signature of Preparer Other Than Taxpayer

Title

Title

Title

Title

Date

Date

Date

Date

Daytime Phone

Daytime Phone

Daytime Phone

Daytime Phone

FOR NEBRASKA DEPARTMENT OF REVENUE USE ONLY

Tran Code

Amount

$

Penalty Assessed

COMMENTS:

Penalty

$

Penalty Abated

Line # ___

$

Remaining Penalty

Line # ___

Authorized Signature

Date

Mail this application to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

5-2008

7-103-1975 Rev.

Supersedes 7-103-1975 Rev. 3-2008

1

1