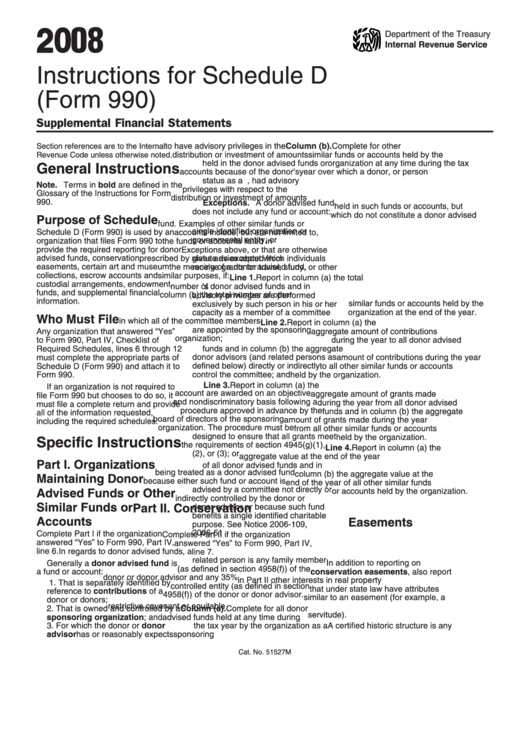

2008 Instructions For Schedule D (Form 990)

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Schedule D

(Form 990)

Supplemental Financial Statements

to have advisory privileges in the

Column (b). Complete for other

Section references are to the Internal

distribution or investment of amounts

similar funds or accounts held by the

Revenue Code unless otherwise noted.

held in the donor advised funds or

organization at any time during the tax

General Instructions

accounts because of the donor’s

year over which a donor, or person

status as a donor.

appointed by the donor, had advisory

Note. Terms in bold are defined in the

privileges with respect to the

Glossary of the Instructions for Form

distribution or investment of amounts

990.

Exceptions. A donor advised fund

held in such funds or accounts, but

does not include any fund or account:

which do not constitute a donor advised

Purpose of Schedule

1. That makes distributions only to a

fund. Examples of other similar funds or

single identified organization or

Schedule D (Form 990) is used by an

accounts include, but are not limited to,

governmental entity, or

organization that files Form 990 to

the funds or accounts listed in

provide the required reporting for donor

2. In which a donor or donor advisor

Exceptions above, or that are otherwise

advised funds, conservation

gives advice about which individuals

prescribed by statute as excepted from

easements, certain art and museum

the meaning of a donor advised fund.

receive grants for travel, study, or other

collections, escrow accounts and

similar purposes, if:

Line 1. Report in column (a) the total

custodial arrangements, endowment

number of donor advised funds and in

a. The donor or donor advisor’s

funds, and supplemental financial

column (b) the total number of other

advisory privileges are performed

information.

exclusively by such person in his or her

similar funds or accounts held by the

capacity as a member of a committee

organization at the end of the year.

Who Must File

in which all of the committee members

Line 2. Report in column (a) the

are appointed by the sponsoring

Any organization that answered “Yes”

aggregate amount of contributions

organization;

to Form 990, Part IV, Checklist of

during the year to all donor advised

Required Schedules, lines 6 through 12

b. No combination of donors or

funds and in column (b) the aggregate

donor advisors (and related persons as

must complete the appropriate parts of

amount of contributions during the year

defined below) directly or indirectly

Schedule D (Form 990) and attach it to

to all other similar funds or accounts

control the committee; and

Form 990.

held by the organization.

c. All grants from the fund or

Line 3. Report in column (a) the

If an organization is not required to

account are awarded on an objective

aggregate amount of grants made

file Form 990 but chooses to do so, it

and nondiscriminatory basis following a

during the year from all donor advised

must file a complete return and provide

procedure approved in advance by the

funds and in column (b) the aggregate

all of the information requested,

board of directors of the sponsoring

amount of grants made during the year

including the required schedules.

organization. The procedure must be

from all other similar funds or accounts

designed to ensure that all grants meet

held by the organization.

Specific Instructions

the requirements of section 4945(g)(1),

Line 4. Report in column (a) the

(2), or (3); or

aggregate value at the end of the year

Part I. Organizations

3. That the Secretary exempts from

of all donor advised funds and in

being treated as a donor advised fund

column (b) the aggregate value at the

Maintaining Donor

because either such fund or account is

end of the year of all other similar funds

advised by a committee not directly or

or accounts held by the organization.

Advised Funds or Other

indirectly controlled by the donor or

Similar Funds or

Part II. Conservation

donor advisor or because such fund

benefits a single identified charitable

Accounts

Easements

purpose. See Notice 2006-109,

2006-51 I.R.B. 1121.

Complete Part I if the organization

Complete Part II if the organization

answered “Yes” to Form 990, Part IV,

answered “Yes” to Form 990, Part IV,

line 6.

In regards to donor advised funds, a

line 7.

related person is any family member

Generally a donor advised fund is

In addition to reporting on

(as defined in section 4958(f)) of the

a fund or account:

conservation easements, also report

donor or donor advisor and any 35%

in Part II other interests in real property

1. That is separately identified by

controlled entity (as defined in section

that under state law have attributes

reference to contributions of a

4958(f)) of the donor or donor advisor.

similar to an easement (for example, a

donor or donors;

restrictive covenant or equitable

2. That is owned and controlled by a

Column (a). Complete for all donor

servitude).

sponsoring organization; and

advised funds held at any time during

3. For which the donor or donor

the tax year by the organization as a

A certified historic structure is any

advisor has or reasonably expects

sponsoring organization.

building or structure listed in the

Cat. No. 51527M

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5